I bought Bitcoin for the first time in 2017.

I tried my darnedest to understand it but my traditional finance brain couldn’t get there.1

Instead of repeatedly banging my head against the wall and fighting the growing crypto religion, I bought some. It was a hedge against being left behind.

My timing was never great but I averaged in a number of times over the years.

That first ramp-up to $20k or so around Thanksgiving 2017 was fun. The daily swings were wild. Then came the crash and a crypto winter. During the pandemic in March 2020, Bitcoin lost half of its value in just two days.

Then we had another boom that more or less ended right when Coinbase went public in the spring of 2021.

There were some dark days during that crypto winter following the Sam Bankman Fried fiasco. There was another ~80% crash.

When I first bought Bitcoin, I told myself it was a buy-and-hold forever asset. There’s no good way to value it. There are no cash flows. I’ve come to buy the digital gold story, but it still feels like a bunch of techies have more or less created trillions of dollars out of thin air.

I don’t say that as a slight either. It’s impressive.

I came close to selling some during the last boom times in 2021. I was waiting for Bitcoin to hit $75,000 and I was going to lighten up. It never quite got there. The ensuing crash was brutal but I stayed invested just like I had in the previous massacre.

This time around I decided to enforce some sell discipline.

I’m not offering investment advice to anyone else here but thought it would be helpful to share my reasons for selling some of my Bitcoin position.

Here’s goes:

I’m rebalancing. This one position is now nearly 10% of my entire portfolio. Outside of my total stock market index funds, Bitcoin is my largest single holding.

It’s time to trim and bring that position back to a more reasonable 5% or so of my portfolio.

Selling is an inexact science. I know there is nothing special about a big round number like $100,000 but the time seemed right to rebalance and right-size this position.

Regular rebalancing is one of the best ways to take advantage of an ultra-volatile asset.

Look at it this way — crypto has graduated from a speculative asset to something I’m using in a more traditional portfolio management construct.

There’s more money at stake. I first started buying Bitcoin when it was around $4,000 but it was relatively small amounts of money. From my average cost basis, the position is up roughly 5-6x.

There’s way more money at stake now than during the previous booms.

A massive crash would be far more painful from a dollar perspective because the stakes are higher.

I guess I’m not a diamond hands person. Oh well.

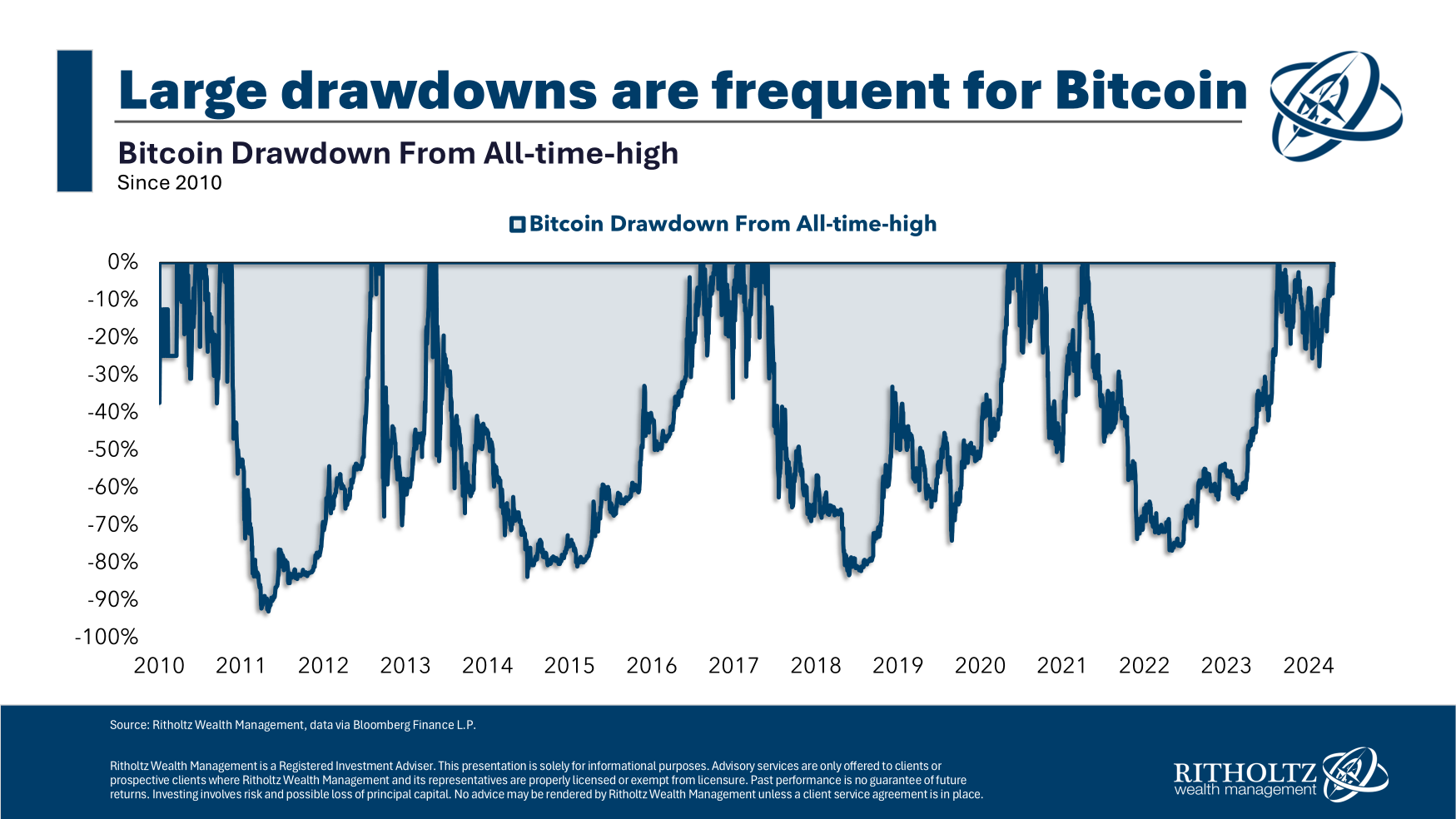

Bitcoin has painful drawdowns. Here’s a look at the historical drawdown profile of Bitcoin:

That’s four Great Depression-like crashes in the past 15 years!

It’s possible these gigantic crashes are a thing of the past because there is now more institutional money in the space what with ETFs, advisors and institutional capital at play. Maybe the 80% crashes every few years will go away but this asset was created to have extreme levels of volatility.

It trades 24/7. It’s global. There are no cash flows. There’s no CEO or board. We still don’t know who Satoshi is.

You can’t rule out the possibility of crypto winters, but even if that phase is done, I would expect 40-60% crashes are still on the table.

I don’t know when it will happen but it’s a good bet at some point it will get wrecked again.

I’m practicing regret minimization. I sold 25% of my position when it hit $99,000 and change.2 I’ve got another limit order to sell if and when it hits $110,000.

The plan is to cut my position in half.

Why do it this way?

Call it a Grand Rapids hedge or regret minimization. I would feel like an idiot if I sold everything and it went up to $150k or higher. I would also regret it if I held everything and saw it crash yet again.

So I split the difference. One way or another I’ll have some regret but I’m comfortable with this decision.

If Bitcoin does crash in the months or years ahead I’ll plan on buying more and rebalance into the pain.

I’m simply being more strategic about this position than I was in the past because it grew to such an outsized piece of my portfolio (for my tastes at least).

I’m sure some true believers will think I’m an idiot. It’s possible I’m selling way too early and will feel stupid if this boom reaches new heights.

That’s one of the reasons I’m still holding onto half of my position.

The most bullish aspect of crypto to me over the years is the fact that it just won’t die. If it didn’t die during the SBF disaster, it’s never going away. I recognize this fact which is why I didn’t want to sell everything.

Even if Bitcoin crashes again in the future it’s possible it will happen from much higher levels and I won’t get the chance to buy back at current prices.

I’m OK with my decision if that happens.

Investing itself is a form of regret minimization.

Further Reading:

Sam Bankman Fried vs. The Match King

1Digital gold is still the easiest explanation but that’s not what people were originally selling it as. The narrative about what crypto is has changed a lot over the years. Doesn’t really matter I guess.

2I just didn’t have enough patience to wait out the $100,000 mark.