The problem with investing heavily in GICs in retirement

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

By Julie Cazzin with Allan Norman

Q: My wife and I are both 62, semi-retired, working two to three days a week earning $15,000 to $20,000 combined. We’re curious about advice around Canada Pension Plan (CPP), Old Age Security (OAS) and the clawback, as well as registered retirement savings plans (RRSPs), registered retirement Income funds (RRIFs) and tax-free savings accounts (TFSAs). I have an indexed pension of $79,500 dropping to $69,500 at age 65 and I expect full CPP, while my wife expects 50 per cent. We are conservative investors and only invest in guaranteed investment certificates (GICs). I have a $90,000 TFSA and $13,000 RRSP, my wife has a $110,000 TFSA, $580,000 RRSP, and $580,000 non-registered account. We have no debts, three children, and our house is worth $1.2 million. We love travelling and we live on my pension and our earnings, which is about $73,000 per year after tax. Any advice you can give us on our investments going forward is appreciated. — Rudy

Advertisement 2

Article content

FP Answers: Rudy, U.S. author and researcher Wade Pfau, a professor at the American College of Financial Services, describes and researches two different approaches to retirement planning — safety-first and probability. You are leaning toward the safety-first approach and my guess is that most financial planners, along with what you may read in the paper, lean toward a probability approach to retirement planning.

Article content

The probability approach goes something like this: Invest in, and hold, a certain level of equities in your portfolio and if those equities perform at, or close to, historical levels, you should be okay.

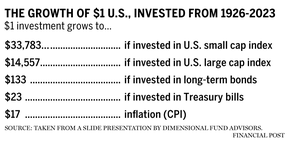

A quick glance at table 1 below confirms equities have outperformed safer investments like bonds and treasury bills so why even consider a safety-first approach?

The challenge with the probability approach is that historical returns are random, and you don’t know when the returns will appear, or even if they will appear within your investment time frame. Plus, there is no guarantee you will capture the historical returns due to your investment choices and decisions.

Article content

Advertisement 3

Article content

A safety-first approach adds guarantees to your financial plan, including annuities for income and life insurance to leave a legacy or estate.

Rudy, in your case you have a pension, CPP, and OAS, all of which are indexed and are considered annuities. You are also holding GICs guaranteeing your capital but not your purchasing power due to inflation. This is the opposite of equities, which don’t guarantee your capital but may provide inflation protection as seen historically in Table 1.

Inflation risk, in my view, is one of the biggest threats that retirees face, even more so than the jarring emotional impact of market volatility. Apart from the past few years, inflation sneaks up on you slowly and quietly, until one day you find you can no longer afford what you once were able to. For a retiree there is no real recovery once inflation takes hold.

In the table above, you can see that $1 invested at the rate of inflation in 1926 would be worth $17 today. This means that prices in 2023 are 17 times more on average than they were in 1926.

In your case, Rudy, your indexed pension, CPP and OAS will protect you from inflation risk because you don’t have spending plans that rely on your GIC savings. Once you reach age 65 your pension bridge benefit will drop off and your pension will be reduced by $10,000. However, your CPP and OAS at that time will total close to $23,000 per year, more than making up for the pension decrease.

Advertisement 4

Article content

Consider delaying your CPP and OAS to age 70 to maximize your lifetime CPP and OAS benefits. The two determining factors of when to start CPP and OAS, if you want to maximize the benefits, are based on your future expected investment returns and your life expectancy, both of which are unknown. The lower your expected returns, the more it makes sense to delay CPP and OAS; the shorter your life expectancy, the more it makes sense to start CPP and OAS early.

Rudy, after age 65, for each year you delay CPP to age 70, it increases by 8.4 per cent and OAS increases by 7.2 per cent. As a GIC investor, you are not going to beat that. Think about converting your RRSPs to a RRIF at age 65 and then drawing enough from your RRIFs each year to age 70, replacing what you would have received in CPP and OAS payments. If, for some reason, your part-time work leads to more income and you don’t need a RRIF income, you can always convert the RRIF back to an RRSP before the year you turn 72.

Converting to a RRIF has many benefits. It will allow you to split pension income with your wife and avoid OAS clawback, your wife will be able to claim the $2,000 pension tax credit, and you can control the amount of withholding tax taken on minimum RRIF withdrawals.

Advertisement 5

Article content

Rudy, it seems like you and your wife are in good shape and fortunate to be able to take a safety-first approach to retirement while maintaining your lifestyle. Many couples and individuals are reliant on the probability-based approach to fund their retirement. My question to you is, “What are you going to do with your GIC savings if you only plan to live on your pension, CPP and OAS?” The question to ask yourself is, “If I converted some of that GIC money to an annuity, would I be more likely to spend, and make better use of the money?” If the answer is yes, then converting some of your GIC money to an annuity could be a good option for you and your wife.

Allan Norman, M.Sc., CFP, CIM, provides fee-only certified financial planning services and insurance products through Atlantis Financial Inc. and provides investment advisory services through Aligned Capital Partners Inc., which is regulated by the Canadian Investment Regulatory Organization. He can be reached at alnorman@atlantisfinancial.ca.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content