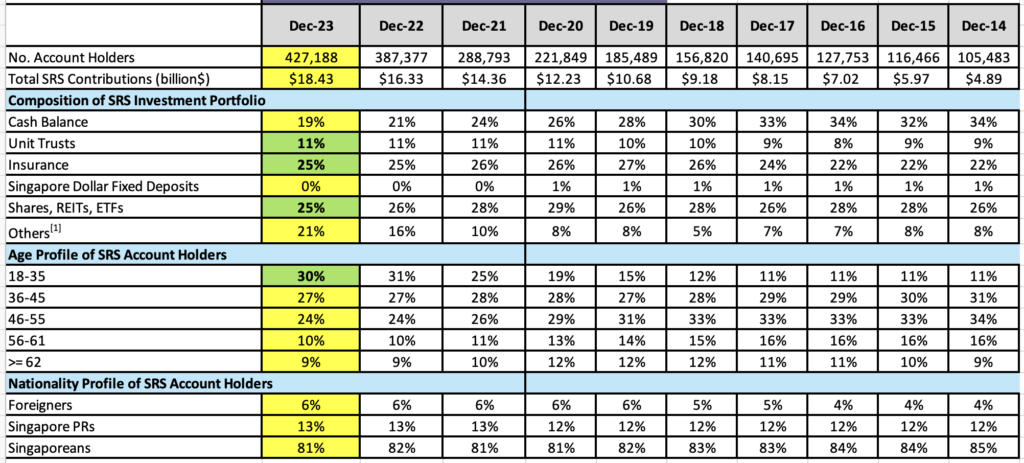

For years, I’ve been trying to understand why 1 in 3 people choose to settle for a ridiculously low return of 50 cents for every $1,000 in cash that they leave idle in their Supplementary Retirement Scheme (SRS) account.

The number has since dropped to 1 in 5, but that is still a significant portion of SRS account holders who are willingly letting their funds lose purchasing value over the years to inflation.

Many people are quick to top up their SRS account in a bid to avoid paying a higher tax bill, so I’ve always wondered, why do they not put that level of urgency towards investing it?

Despite me repeatedly saying for years that leaving money in your SRS account is silly because it earns you only a meagre 0.05% p.a. of interest each year (a level that has not changed for the last decade and will likely not change in the near foreseeable future either), it befuddled me as to people were content to leave their funds idle anyway.

Until now.

I finally figured out that the problem might not be due to a lack of awareness (by now, at least), but the fact that while it takes only a few seconds to transfer funds into your SRS account, it takes a lot more time and effort to go and invest it.

What’s more, for many people, it may not even be worth their time to do so, especially if their SRS funds are barely a substantial portion of their entire portfolio. In my case, my SRS funds constitute less than 5% of my overall investment portfolio, which makes the time and effort required to manage individual stock picks not as worth it.

So…what if you don’t want to settle for a paltry 0.05% p.a. each year, and want to invest that in the most fuss-free way while paying as little fees as possible?

Well, in that case, robo-advisor Syfe’s SRS portfolios might just be your answer.

Syfe SRS Portfolios

Not many platforms allow investors to seamlessly manage all their investments in a single place. Syfe’s customers, however, can invest their cash in money market funds, stocks bought through Syfe brokerage, and now your SRS investments too.

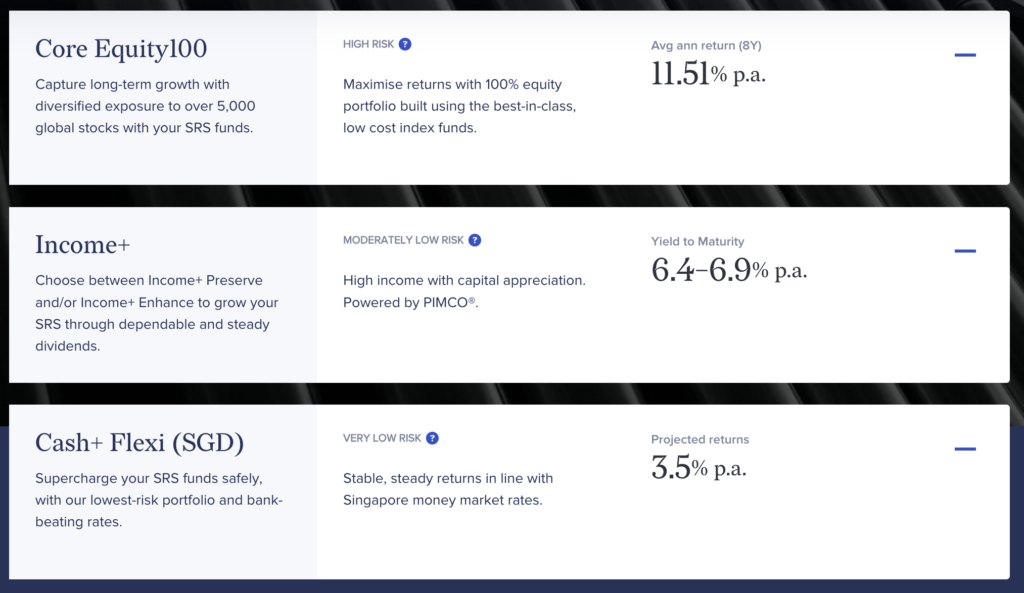

With 3 different SRS portfolios that you can choose from to invest your SRS monies in, you can decide which fits your risk appetite and personal investment objectives best. Whether you are a conservative investor who prefers an income-generating approach focused on dividends, or a growth investor who seeks diversified exposure to over 5,000 stocks globally, there is a portfolio for you.

Robo-advisors like Syfe make it easier for everyday folks to start investing, offering various diversified portfolios that are managed for you at a low cost.

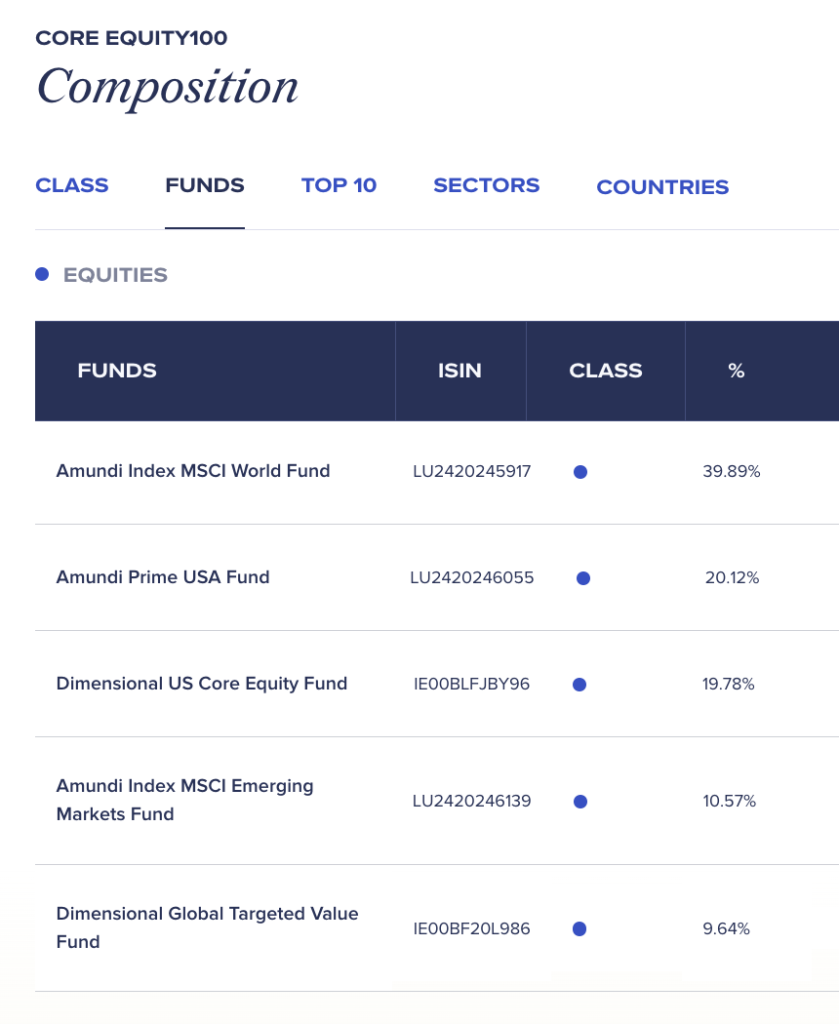

If you’re young with a longer time horizon ahead of you, you may prefer Syfe’s Core Equity100 portfolio, which is designed using low-cost index funds and optimised with proven factors like value, size, and quality for superior long-term returns. This is being powered by Amundi and Dimensional, and you can see the breakdown of the funds in this portfolio below:

On the other hand, if you are a fan of income investing, then you can explore the Syfe Income+ portfolio, which aims to generate dependable and steady dividends together with overall capital appreciation. These are offered in partnership with PIMCO, and what’s more, Syfe’s exclusive access unlocks up to 60% savings on fund level fees for retail investors vs. if you were to invest directly yourself.

The constituent funds are comprised of the following:

| SYFE INCOME+ PRESERVE | SYFE INCOME+ ENHANCE |

| PIMCO GIS GLOBAL INVESTMENT GRADE CREDIT FUND | PIMCO GIS GLOBAL INVESTMENT GRADE CREDIT FUND |

| PIMCO GIS GLOBAL BOND FUND | PIMCO GIS ASIA STRATEGIC BOND FUND |

| PIMCO GIS ASIA STRATEGIC BOND FUND | PIMCO GIS INCOME FUND |

| PIMCO GIS INCOME FUND | PIMCO GIS ASIA HIGH YIELD BOND FUND |

| PIMCO GIS ASIA HIGH YIELD BOND FUND | PIMCO GIS DIVERSIFIED INCOME FUND |

| – | PIMCO GIS CAPITAL SECURITIES |

If you would rather not take too much risk with your SRS funds meant for retirement, then Syfe also has the Cash+ Flexi (SGD) portfolio, which invests in money market funds, yielding 3.5% p.a. projected returns for now. This comprises 2 funds, both managed by LionGlobal.

How to manage your SRS portfolio vs. cash investments

While topping up one’s SRS account is a great way to reduce your income tax bill (especially if you’re in the higher tax bracket), you should remember that 50% of the amount you withdraw from your SRS account will be taxable. In contrast, any capital gains or dividends you make on your cash investments are not taxed.

Thus, some investors choose to adopt the below strategy instead:

- Cash investments for higher-risk, high-return equities

- SRS investments for lower-risk, more stable investments

If you don’t wish to stress over how to withdraw to pay minimal taxes after you hit the statutory age of 62, then the above strategy can allow you to take advantage of the higher, non-taxable returns on your cash investments, while reserving your SRS portfolio for steady and stable investments instead.

After all, since 50% of your SRS withdrawals are taxable, you’d probably want to make sure that you do not end up negating the initial tax savings you enjoyed in your younger years.

If you’re guilty of not having invested your SRS monies because you worried that you wouldn’t be able to manage the portfolio, then robo-advisors like Syfe offer a convenient way to manage your investments for you.

By putting together portfolios offered by world-class fund managers such as Amundi, Dimensional and PIMCO, Syfe has simplified SRS investing and reduced the time and effort needed for SRS account holders to start investing.

Now, there’s no more excuse for you to settle for just 0.05% p.a. on your SRS funds.

Disclosure: This article is written in collaboration with Syfe. All opinions are that of my own.

Sponsored Message by Syfe:

Syfe has now launched SRS portfolios! We know that waiting over 30 years for your SRS to mature can feel like eternity, so from now till 31 December, Syfe is running a promotion of $50 cash back on every $25,000 invested in Core Equity100 or Income+ SRS portfolios.

Promo code: SRSBB.

This promotion is available to both new and existing Syfe clients. Terms and conditions apply.

Disclaimer: Not financial advice. Any form of investment carries risks, and none of the stocks mentioned in this article serves as a recommendation to buy (or sell). Your individual returns may vary depending on your own skill as an investor. Always do your own research before investing.This advertisement has not been reviewed by the Monetary Authority of Singapore.