Dal Tadka, Dal Fry, Dal Makhani. I am sure you have noticed these menu items some time you went to eat in a restaurant.

But have you ever come across – LEAN FIRE, COAST FIRE, FAT FIRE, BARISTA FIRE.

Not in a restaurant of course, but when planning for your money future.

Ok. Ok. Why are you setting us on FIRE and what is this FIRE?

What is FIRE?

FIRE stands for Financial Independence and Retire Early. It is a commitment to reach a life stage where money can stop being a motivator for work. It is a point where you have a better control of your life and your time.

It is usually accompanied with an aggressive savings program and cutting down a lot of wasteful expense.

FIRE is quite a movement with several communities with millions of followers around the world.

Interestingly, as most things acquire flavours, so did FIRE.

Let me throw some light on the FIRE flavours.

#LEAN FIRE

You are looking to live a very frugal life post retirement and hence need a much smaller fund to maintain a lifestyle that comes with it. Bare necessities – go back to the caves if you can. You know what I mean.

# FAT FIRE

This is a lifestyle which is as good as it comes. Expenses to the hilt, luxury vacations, high end watches, parties (may be on a yacht), no holds barred spending continues post retirement.

Literally the other side to LEAN. I cannot imagine the savings plan it calls for.

# COAST FIRE

Financial Independence is the focus here; early retirement – not so much. With financial independence, you are worry free.

Work not for money but because you are having fun doing it. Put it another way, you can afford to carry a resignation letter in your pocket – to be served at will. Or, take the impromptu vacation tomorrow.

#BARISTA FIRE

This is similar to COAST with the difference that you plan to delay withdrawals from the retirement portfolio.

You do this by quitting a high paying, stressful job at a defined point and replace it with a gig which you enjoy (being an artist, teach children, work with a charity, part time consultancy, etc.) even at a lower pay. It pays the bill (no savings) for a few or several years so that the portfolio powers and prepares itself at the backend.

—

So, these are the current retirement / FIRE flavours in the market.

Aren’t you tempted?

One question still remains though – what kind of preparation would it need to reach any. Well, I say you should do an assessment.

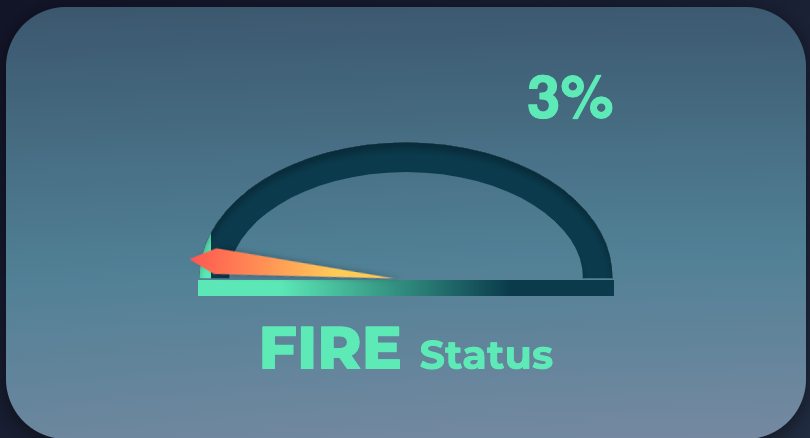

That’s where you can use one more – RapidFIRE.

This is our latest tool that allows you to make a quick and dirty clean assessment of what do you need for your Financial Independence and Retire Early dream and by when can it be possible.

Not just that, you can make instant changes to various assumptions and find out how soon can you be ready to meet your FIRE goal – and tune it to the flavour of your choice.

Use RapdiFIRE now. There is no fee or charges to use it.

I am sure you will find it very useful.

—

By the way, which FIRE flavour are you working towards.

I look forward to your response.

![[Retirement] What is your FIRE flavour? [Retirement] What is your FIRE flavour?](https://i1.wp.com/unovest.co/wp-content/uploads/2024/06/RAPIDFIRE-CLUB.png?w=696&resize=696,0&ssl=1)