If you’re a savvy consumer but dislike having to deal with insurance agents who try to hard sell or influence you towards getting certain products that you know aren’t great for you and your family, then check out Planner Bee. Aside from allowing you to manage your (and your family’s) insurance policies all in one place, it offers a new model of buying insurance – where you and your needs come first, and the agent servicing comes only at the end AFTER you’ve made your decision. Can technology remove the commissions bias that is inherent in the industry? I’m certainly hopeful, but you can read on to decide for yourself!

You know what you want to buy, and head online to compare quotes on various online aggregators. Then, you discover that you’ve run into several issues:

- Most online aggregators offer quotes from only a limited number of insurers, or product types (e.g. pet insurance is not common, only a few portals have it)

- While you know what you want, you wish to speak with someone to ask questions and clarify your concerns before you commit, especially to a long-term plan like life or health insurance

- You try to call up your insurance agent friend for it, only to realise that they are unable to get you quotes from insurers like AIA, Great Eastern or Prudential.

- Sometimes, your agent is unavailable and does not reply…which makes you wonder, what will happen when you need them during claims then? Who do you go to if they’re the only contact you have for that policy?

The state of the insurance market today

The insurance industry is fraught with conflicts of interest, which often means that consumers have little to no clue as to whether their insurance agent is recommending them the best policy that meets their needs, or one that is better for the agent’s earnings. From different commissions rates overseas trips for pushing certain products, these incentive structures are often not made known to the consumer, making it even harder for them to judge what is truly driving their agent’s recommendations.

I’ve met dozens of insurance agents, and most fail to truly impress me enough to earn my trust. For the ones who do, I’ve kept them close over the years, using their recommendations as a second (sometimes third) opinion to help validate whether my decision is correct.

The tell-tale signs usually appear when your agent is quick to recommend you whole life insurance, investment-linked plans (ILPs) or endowment policies spanning over 20 or 30 years. It is a fact that term life insurance is a far more cost-effective way to protect against mortality for most consumers*, while investment-linked plans with their high fees will hardly help you to beat the market and most endowment plans have barely kept up with market returns.

*See a case study of when the other argument (whole life over term life) might hold true here, such as when someone does NOT want to buy term and invest the rest.

After my recent article about how insurance agents are compensated in Singapore, the team at Planner Bee reached out to me to share their solution to this problem. As an award-winning fintech app helmed by a team from insurance and wealth management backgrounds, Planner Bee was designed to help consumers make informed decisions based on their needs rather than an agent’s commissions.

And the truth is, unless your insurance needs are complex, you might be better off planning for yourself, so that you can eliminate all these potential conflicts of interest in the first place! This is what I’ve personally done for the last decade, and I recommend that you take ownership of managing your own insurance policies for yourself in this manner too.

But as a DIY insurance planner, where do you go to ensure that you’re on the right track?

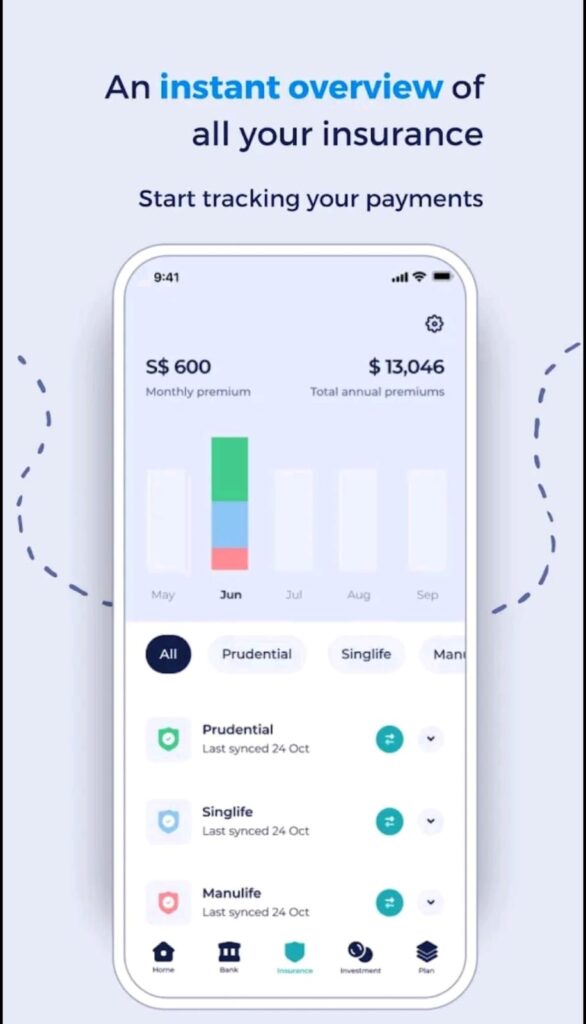

Find and manage your insurance policies in one place

Enter Planner Bee, a mobile personal financial tool designed by Singaporeans to cater specifically to the needs of insurance buyers here. Powered by their own proprietary engine, the app’s dashboard was also among the first in Singapore to offer users a one-stop overview of their various insurance policies across multiple insurers.

You can use it to manage not just your own policies, but also that of your family. In one glance, you’ll be able to track:

- What plans you (and your family) have

- The coverage offered by each, and in total

- The premiums and renewal (payment) dates for each policy

I previously recommended the Autumn app for this purpose to many of you, but after Standard Chartered Bank decided to put the brakes on that project earlier this year, I’ve been looking out for an alternative solution – and found it in Planner Bee.

Once I had manually keyed in the details of my policies (and my entire family’s), I could now see and manage all of them within the app.

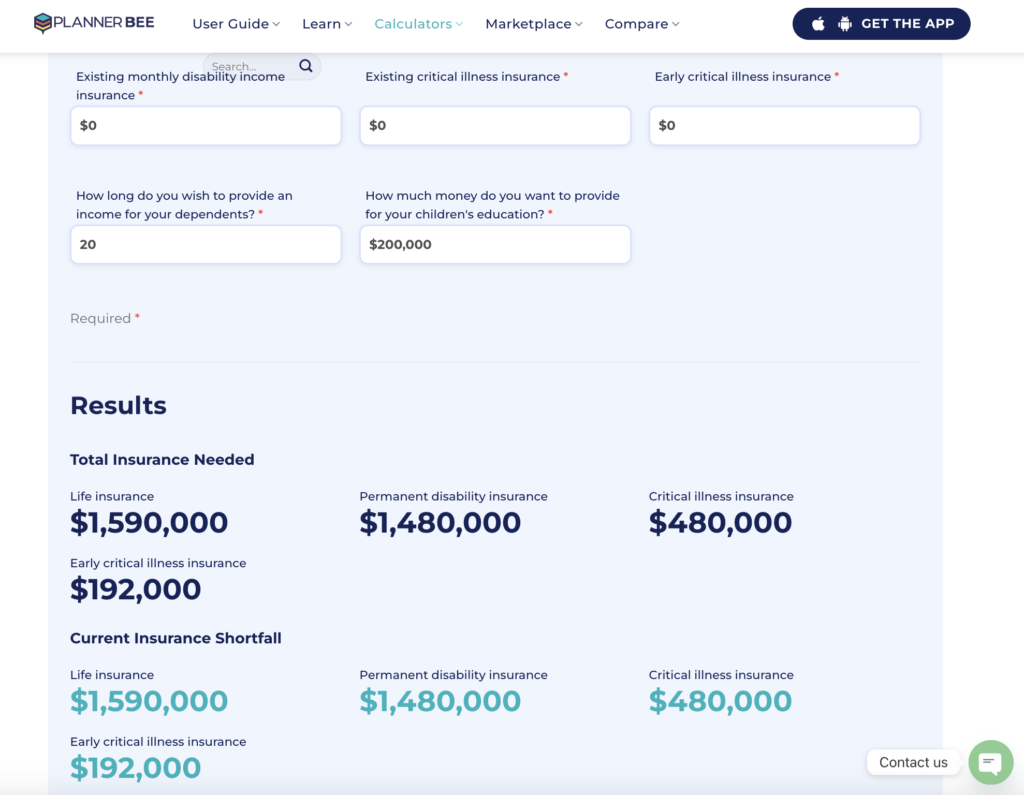

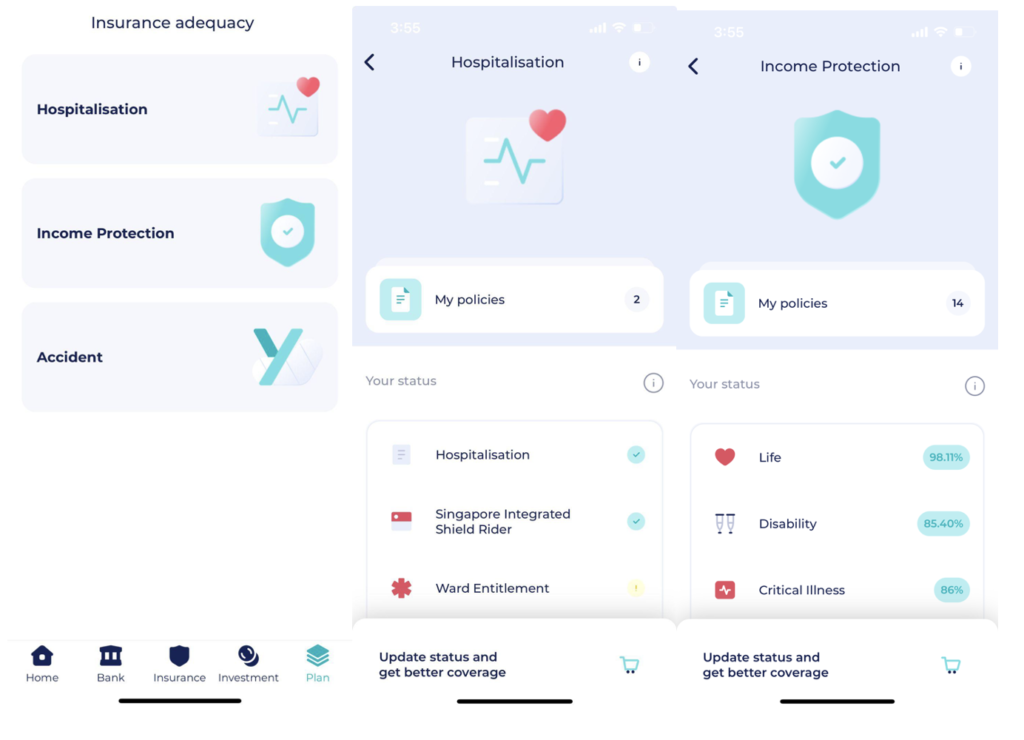

And with tools such as an insurance needs calculator, you’ll be guided on figuring out the total insurance coverage you need and whether your existing policies adequately protect you.

Once you know what gaps you need to fill, you can then navigate their marketplace to compare across insurers and policies. Planner Bee sources products and quotes from across 29 insurers in one place, which saves you time and effort since you no longer need to visit multiple providers individually. Whether you need a personal accident plan or a maternity cover, you will be able to compare the benefits across different plans and insurers in a single view.

As the costs of premiums for the same plan vary at different times based on the insurers’ discounts, your age and gender, it is generally difficult for consumers to compare easily. Even agents from FAs that distribute products from multiple insurers will have a tough time getting these quotes for you, since insurers such as Great Eastern and Prudential typically do not open up distribution channels with these agencies in order to protect their own tied agents.

You can get around this by requesting for a personalised quote from Planner Bee; simply submit your details, sum of coverage needed and your annual budget for premiums.

Powered by its proprietary recommendation engine, you can also input your insurance needs and let the Planner Bee platform make personalised and brand-agnostic insurance suggestions for you, making it easier for you to find the right policy without bias.

This means that whether you’re looking for health insurance to cover medical costs or life insurance for family protection, Planner Bee brings everything under one roof, making it an easy, one-stop shop for your insurance needs.

Can you trust Planner Bee?

Planner Bee was founded by Ms. Cherie Wang, who is a certified Chartered Financial Consultant (ChFC) and Chartered Life Underwriter (CLU) who has ranked in the top 5% of financial advisors globally for more than 10 years.

But despite her achievements, Cherie recognized a persistent flaw in the system: many financial advisors in Singapore typically operate based on commissions, which creates potential conflicts of interest. Another challenge she faced was that while working in an agency, she and her colleagues didn’t always have access to the best products within their distribution network to offer to clients.

Many clients also sought her help in managing their entire portfolios, including policies she didn’t have direct access to. With over 20 insurers in Singapore, manually comparing products across the board each time was impractical, and it became evident that her clients needed a more transparent and efficient way to manage their insurance portfolios.

This realisation drove her to work on Planner Bee, which was founded with 2 main goals:

- To help people manage their overall finances in one place.

- To provide an unbiased platform for needs-based financial product comparison.

As their team is not affiliated with any insurance company, their goal is to assist you in planning and purchasing policies from multiple insurers without any bias or preference towards a particular company.

Today, Planner Bee combines the convenience of a marketplace with financial calculators, an educational library, and personalised guidance from licensed advisors to help you get covered with confidence. The financial planning tool now connects to 42 financial institutions so you can consolidate your banking transactions, insurance policies, and investment portfolios all in one place.

Tip: Remember to always ask your advisor for their MAS Representative Number, so you can check that they are licensed to handle your case. Planner Bee provides these to the consumer, upon request.

Unlike aggregators that simply list insurance products, Planner Bee goes one step further to provide tools to help DIY users evaluate their own insurance needs and offers personalised quotations based on those needs.

Your premiums are the same when buying through Planner Bee or directly from the insurance providers.

And should you ever feel stuck or confused, you can also opt to consult a human advisor through their online consultation feature.

The app also categorises your insurance policies for you, so you remember what you’ve bought and already have covered. It also reminds you (via email and WhatsApp) when your renewal dates are nearing, so you don’t have to worry about any policies lapsing!

How Planner Bee solves for conflicts of interest

Instead of leaving the recommendations up to individual insurance agents, who may each push for different policies for different reasons, Planner Bee opts for a model where your quotations provided are driven by the customer’s requirements rather than which insurer is currently paying the highest commissions for closing or giving an incentive trip on.

How does technology remove the bias? Most quotation systems today require a human agent to key in details and select the policy that they wish to get quotes for. In contrast, the quotation systems at Planner Bee does not take into account commissions (since it does not have the information in the system in the first place for it to be biased), and provides quotations solely based on customer’s requirements, budget and benefits or needs.

To give you full visibility and control over your choices, Planner Bee’s quotation system sorts policies by its benefit features and premium rates. This essentially rules out any biases that might favour policies delivering higher commissions, helping to ensure that customers are getting the best value for their money.

Get your questions about any policy answered by scheduling a Zoom call, or send messages via WhatsApp to discuss the provided quotations. Once you’ve decided to purchase, a video call (via Zoom) will be arranged with a salaried licensed advisor, who will explain the terms and conditions and verify if the policies selected truly match your needs, so you can buy with a peace of mind.

Who should use Planner Bee?

If you already manage your own insurance policies and you’re simply looking for quotes and assistance without having to deal with an agent hard selling you, then you will love the Planner Bee experience.

You get full control over your own buying experience without the influence of any agent bias, yet still have access to ask the Planner Bee team if you need to clarify any terms or concerns on the policies you’re examining.

Aside from its modern digital insurance planning interface for consumers, a core benefit of Planner Bee is that it offers access to over 500 insurance products across 29 insurers.

This is hard – or close to impossible – for most agents or agencies to replicate. It is a well-known fact that you can only get Prudential policies from a Prudential agent, for instance, which is why most online comparison portals or aggregators are not able to pull quotes for you from a brand with only tied agents either.

No tied agent or independent financial advisory group has access to that many, nor can a single human go for sufficient product training on to become an expert in so many different products. That is why Planner Bee pulls from the strength of their team as one, with different people specialising in their own strengths, brand(s) or product portfolio. They combine the knowledge and experience to guide the technology interface and quotations, but the licensed advisor is only assigned at the end after the consumer has decided which product or insurer they wish to go with.

So if you’re comfortable with using online tools and want to save time and effort comparing policies from various insurers, the app offers a seamless way for you to manage your health and life insurance needs – not just for yourself, but for your entire family.

You can use their insurance needs calculator or the mobile app to analyse your existing coverage:

But while savvy insurance buyers will find the app and tools useful, Planner Bee will be less suitable for people who are clueless on their insurance needs, or if you’re unsure on even the type and function that each insurance policy plays in our life.

In such a scenario, you will probably be better off with an in-person consultation with an insurance agent, who can sit down to educate you and advise you based on their recommendations.

Sponsored Message from Planner Bee:

How to buy insurance via Planner Bee

The best way to use Planner Bee would be to gauge your own financial needs first and compare to see which policy’s benefits would serve you best.

Then, get a personalised quote via their online form which you’ll receive via email.

If you need, you may request for an obligation-free consultation online or via a phone call to run through the different options.

Once you’ve decided on your choice of plan, you can apply for a scheduled call to go through any questions you have and e-sign the digital forms to apply for the policies that you need.

Once your plan is approved, you will get a confirmation from the Planner Bee team via email and WhatsApp.

In the event that you need to make any claims, you can simply reach out to the same WhatsApp number or email for your convenience, and their dedicated customer service team will assist you with your claims or servicing matters.

Check out Planner Bee for yourself here.

To get a discount, quote DISCOUNTPLEASE to get the following offers:

- Integrated Shield plans: $50 cashback for your first year premium

- Term Life plans: 15% discount on your first year premium

- Whole Life plans: 10% discount on your first year premium

Discounts valid within the next 12 months.

Disclosure: This post was written in partnership with Planner Bee Pte Ltd.