The Government of India rolled out the National Pension Scheme (NPS) for all the citizens of India way back on May 1, 2009 and for corporate sector from December, 2011. Since then, NPS has become one of the most popular investment and tax saving options in India.

The numbers speak for themselves – The Total assets under management (AUM) with NPS is now at Rs. 8.82 Lakh crore with Y-o-Y growth of 23.45%. The number of subscribers under various schemes under the National Pension System (NPS) rose to 624.81 lakh as at March 4th 2023 from 508.47 Lakh in March 2022 showing a year- on- year (Y-o-Y) increase of 22.88%.

Most of my blog readers have chosen NPS for two main reasons – i) for tax saving purpose & ii) No other choice but to invest, as contribution to NPS has been made mandatory for most of the Govt employees.

If you are investing in NPS Scheme or planning to invest in NPS, you need to be aware of all the latest NPS Income Tax benefits that are currently available under old Tax Regime and New Tax Regime (w.e.f FY 2020-21).

In this post, lets discuss – What are the NPS Income Tax benefits for FY 2023-24 or AY 2024-25? Can you claim Income Tax Deduction on NPS contribution under New Tax Regime? Are there any tax deductions under NPS Tier-2 account? Under what sections of the IT act NPS investments can be claimed as tax deductions? What is the investment proof to avail the tax benefit under NPS for FY 2023-24?

Latest NPS Income Tax Benefits FY 2023-24 / AY 2024-25 under Old & New Tax Regimes

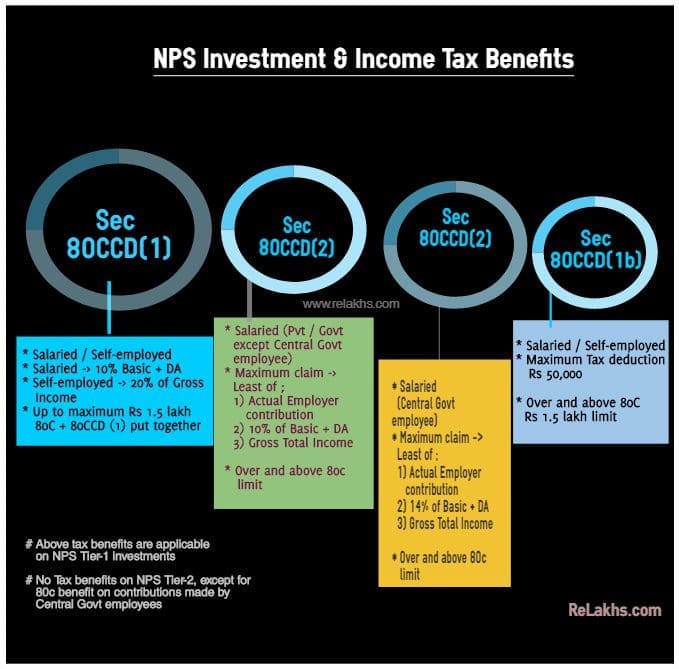

Below are the various Income Tax Sections under which an NPS investor can claim Income Tax Deductions for FY 2023-24 / AY 2024-25 .

- Section 80C

- Section 80CCD (1)

- U/S 80CCD (1b)

- Section 80CCD (2)

“Under the new tax regime, the first three deductions are not available, but the fourth one continues to be available”

Income Tax Benefits under NPS Tier-1 Account for AY 2024-25

Tax Deduction under 80CCD(1) on NPS investment by Salaried individual (except Central Govt employees) :

- An Employee can contribute to Government notified Pension Schemes (like National Pension Scheme – NPS). The contributions can be upto 10% of the salary (salaried individuals).

- The maximum amount that can be claimed as tax deduction is Rs 1.5 lakh u/s 80 CCD(1).

Old Tax Regime : If you are opting old tax regime then you can continue claiming income tax deduction as listed in the above two points.

New Tax Regime : If you are going ahead with New Tax Regime then you can not claim income tax benefits u/s 80 CCD(1).

Tax Deduction under 80CCD(1) on NPS investment by Self-employed individual :

- The self-employed (individual other than the salaried class) can contribute up to 20% of their gross income and the same can be deducted from the taxable income under Section 80CCD (1) of the Income Tax Act, 1961.

- The maximum amount that can be claimed as tax deduction is Rs 1.5 lakh u/s 80CCD(1).

Under Old Tax Regime : If you are opting old tax regime then you can continue claiming income tax deduction as listed in the above two points.

New Tax Regime : If you are going ahead with New Tax Regime then you cannot claim income tax benefits u/s 80CCD(1).

Income Tax Deduction under 80CCD(2) on NPS investment for Non-Central Govt Employees :

- An employer can also contributes to NPS scheme.

- The contribution amount made by the employer can be claimed as tax deduction u/s 80CCD(2), subject to the threshold limit of, least of the below; Amount contributed by an employer

- 10% of Basic salary + DA (or)

- Gross Total income

- This is an additional deduction which will not form part of Sec.80C limit.

- Self-employed individuals are not eligible to claim the NPS tax deduction u/s 80CCD(2).

Under old & New Tax Regime : If you are selecting New Tax Regime in your Income Tax Return then there is now a threshold limit u/s 80CCD(2), with effective from FY 2020-21. Your employer can contribute to your NPS account as mentioned in the above points. However, if your employer’s contributions under Sec 80CCD(2) are more than Rs 7,50,000 a year (along with EPF and Superannuation), then such exceeding contributions are taxable income in the hands of the employee. The interest earned on over and above Rs 7.5 lakh balance is also taxable.

Income Tax Deduction under 80CCD(2) on NPS investment for Central Govt Employees :

- The contribution amount made by the employer (Central Govt in this case) can be claimed as tax deduction u/s 80CCD(2), subject to the threshold limit of, least of the below;Amount contributed by an employer

- 14% of Basic salary + DA (or)

- Gross Total income

- The Centre will now contribute 14% of basic salary to Govt employees’ pension corpus, up from 10%. This is w.e.f April 2019.

- This is an additional deduction which will not form part of Sec.80C limit.

Under old & New Tax Regime : If you are selecting New Tax Regime in your Income Tax Return then there is now a threshold limit u/s 80CCD(2), with effective from FY 2020-21. Your employer can contribute to your NPS account as mentioned in the above points. However, if your employer’s contributions under Sec 80CCD(2) are more than Rs 7,50,000 a year (along with EPF and Superannuation), then such exceeding contributions are taxable income in the hands of the employee. The interest earned on over and above Rs 7.5 lakh balance is also taxable.

NPS Additional Tax Deduction u.s 80CCD(1b)

An additional tax benefit of Rs 50,000 can be claimed u/s 80CCD (1b) by the salaried or self-employed individuals.

Kindly note that the Total Deduction under section 80C, 80CCC and 80CCD(1) together cannot exceed Rs 1,50,000 for the financial year 2020-21. The additional tax deduction of Rs 50,000 u/s 80CCD (1b) is over and above this Rs 1.5 Lakh limit.

Under Old Tax Regime : If you are opting old tax regime then you can continue claiming income tax deduction of Rs 50,000 u/s 80CCD(1b).

New Tax Regime : If you are going ahead with New Tax Regime then you cannot claim additional income tax deduction of Rs 50,000 u/s 80CCD(1b).

Income Tax Benefits under NPS Tier-2 Account for FY 2023-24

The Tier II National Pension Scheme account is just like a savings account and subscribers are free to withdraw the money as and whenever they require.

Tax Deduction under 80c for NPS Tier-2 investment

The contributions by the government employees (only) under Tier-II of NPS will be covered under Section 80C for deduction up to Rs 1.5 lakh for the purpose of income tax, with a three-year lock-in period. This is w.e.f April, 2019.

For other NPS subscribers, there are no tax benefits available on NPS investments in Tier-2 accounts.

Under Old Tax Regime : If you are opting old tax regime then you can continue claiming income tax deduction u/s 80C.

New Tax Regime : If you are going ahead with New Tax Regime then you cannot claim these contributions u/s 80c.

NPS Maturity Proceeds & Withdrawal Rules FY 2023-24

Below are the common rules that are applicable under old and new tax regimes regarding NPS Maturity proceeds and withdrawals;

NPS Tier-1 Maturity proceeds on Retirement is Tax-exempt

- After attaining 60 years of age, you are allowed to withdraw 60% of the total Corpus amount and at least 40% of the accumulated wealth in the NPS account needs to be utilized for purchase of annuity/pension plan.

- With effective from 1st April, 2019, the 60% NPS withdrawal is fully tax-exempt.

- In case the total corpus in the account is less than Rs. 2 Lakhs as on the Date of Retirement (Government sector)/attaining the age of 60 (Non-Government sector), the subscriber (other than Swavalamban subscribers) can avail the option of complete withdrawal. However 60% of this withdrawal will be tax-exempt and 40% is taxable.

NPS Tier-1 Account & Partial withdrawals

The Tier 1 account is non-withdrawable till the person reaches the age of 60. However, partial withdrawal before that is allowed in specific cases.

- In the latest rule change (Budget 2017), PFRDA (Pension Fund Regulatory And Development Authority) has relaxed the withdrawal norms to the effect that now the subscribers can withdraw up to 25% of contributions starting from the third year of opening of NPS.

- Kindly note that such partial withdrawals are tax-exempt. (The NPS partial withdrawals made before 1.04.2017 are taxable.)

The withdrawals from NPS Tier 2 account do not come with any income tax benefit. The tax assessee is liable for taxation on any gains arising out of investments in NPS Tier-II account and such gains are taxable as per the applicable income tax slab rates.

Can NRIs claim Tax deductions on NPS AY 2024-25?

Whether you are eligible to claim tax benefits depends on the tax regime you opt for for FY 2023-24.

Non-resident Indians (NRIs) are eligible to invest in the NPS scheme just like resident Indians. The Rs 50,000 additional tax benefit on NPS is also available to NRIs. These tax deductions are available under old tax regime.

The transfer of funds should be routed through a non-resident external account (NRE) or non-resident ordinary account (NRO). The only difference is that the former is a repatriable resident account whereas the latter is non-repatriable one.

What is the investment proof to avail the tax benefit under NPS?

The Subscriber can submit the Transaction Statement as an investment proof. Alternatively, Subscriber from “All Citizens of India” can also download the receipt of voluntary contribution made in Tier I account for the required financial year from NPS account NSDL log-in. It can be downloaded from the sub menu “Statement of Voluntary Contribution under National Pension System (NPS)” available under main menu “View” in NPS account log-in.

Kindly note that this article is not a recommendation to invest in NPS Scheme. It is only meant to provide information on NPS Income tax benefits FY 2023-24.

Continue reading:

(Post first published on : 23-Sep-2023)