The stock market is at all time high. The BSE Sensex has hit an all-time intra-day high of 67,000 (on 19-Jul-2023). The speed at which the equity markets recovered, after the Covid related crash, would have surprised many of the investors.

On 28th February 2020, the Indian share market saw a massive crash and more than Rs. 5 lakh crores in investor’s wealth were wiped out, attributable to the Coronavirus scare. The Indian indices registered a 3.5% fall which was the second biggest fall in the history of the Sensex.

However, we have already seen that most crashes are followed by faster growth and recovery. The Indian stock market began to recover in April 2020 after an adverse impact during the initial phase of the pandemic. Now, we are staring at record closing high!

The phase between 2020 and 2021 has been a real test for so-called long-term direct equity and mutual fund investors. Understandably, some of you might have got jittery after watching your overall equity portfolio returns deteriorating and some of us might have considered it as an opportunity to top up their existing investment portfolios.

In my previous ‘My Mutual Fund Portfolio‘ article, I have mentioned about my ‘CRASH Fund‘ investment strategy. I have been implementing this strategy judiciously for the last few years and worked well for me.

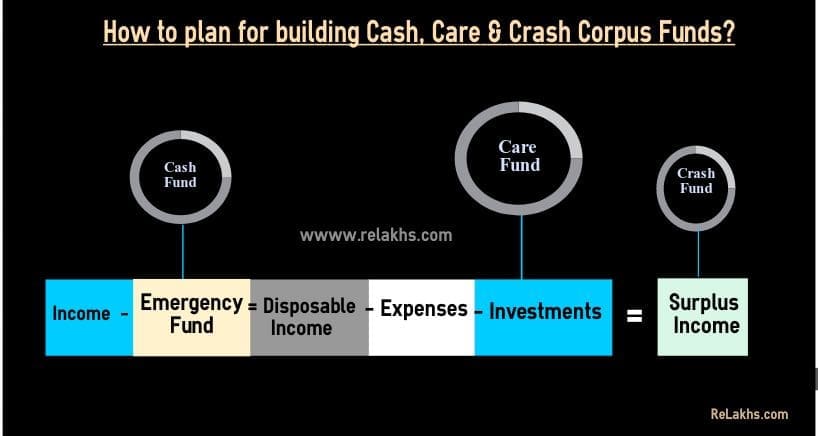

Besides Emergency Fund (Cash Fund), we also maintain a ‘Crash Fund‘ to invest lump sum amount (additional investments) in MF portfolio & Equities whenever there is a market crash/downturn. We had an opportunity to deploy this fund in to our existing mutual fund schemes during the 2020 stock market crash.

So, where did I invest the crash fund? Let me share my latest mutual fund portfolio.

My Latest Mutual Fund Portfolio 2023

My previous article on ‘my MF picks‘ (published in June, 2020), I had listed below mutual fund schemes as part of my MF portfolio;

- Medium Term Goal – Kid’s Higher Education

- HDFC Hybrid Equity Fund (erstwhile HDFC Balanced Fund)

- SBI Hybrid Equity Fund

- Long Term Goal – Wealth Creation

- UTI Nifty Next 50 Index Fund

- HDFC Hybrid Equity Fund

- SBI Hybrid Equity Fund

- Axis Long Term Equity Fund (accumulated)

- Franklin Smaller Companies Fund (accumulated)

Below are the changes made to my Equity Mutual Fund Portfolio during the last three years;

- I have redeemed the units of SBI Hybrid Equity Fund and re-invested in HDFC Hybrid Equity Fund of respective goals.

- I have sold the accumulated units of Axis LTE Fund, Franklin Smaller Companies Fund, re-invested the proceeds in UTI Nifty Next 50 Index Fund.

- During the year 2020, we have deployed the Crash fund in UTI Nifty Next 50 Index Fund and HDFC Hybrid Equity Fund in installments.

- So, we now have only two mutual funds in our Portfolio;

- HDFC Hybrid Equity fund &

- UTI Nifty Next 50 Index Fund

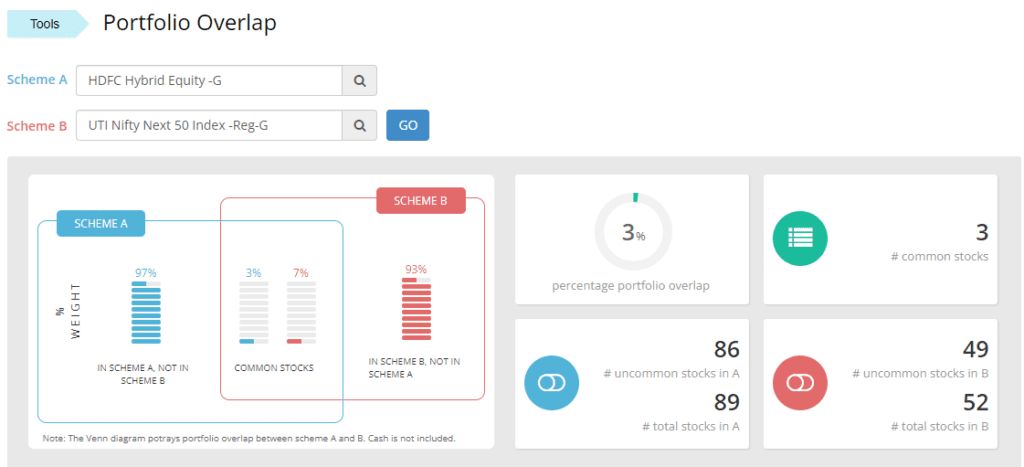

Note that the Portfolio overlap (as of now) between HDFC Hybrid Equity Fund and UTI Nifty Next 50 Index Fund is around 3%.

So, are these the only best Mutual Fund Schemes to invest for your financial goals? – The answer is definitely NO. These are just my Picks.

In case, you would like to get your Mutual Fund portfolio reviewed by us, kindly post your query in our all new Forum platform. Join now!

(Please note that the above-mentioned Mutual fund investments are done based on my financial risk profile and goals. This article is for information & knowledge sharing purposes only. If required, kindly take help of a Registered Investment Advisor in designing a Portfolio that is based on your requirements.)

Suggested Reads :

- Mutual Funds Taxation Rules FY 2023-24 (AY 2024-25) | Capital Gains Tax Rates Chart

- Long Term Investment Horizon : Importance & Benefits | My father’s risky investments! (Real-life examples)

- Five Personal Financial Mistakes that I have committed…!

- My First job interview experience | A life-long memorable one!

(Post first published on : 19-Jul-2023)