You start out creating a budget with the best intentions, then life happens. You get carried away swiping your card and before you know it your budget is blown…..again! Or maybe you unintentionally overspend at the grocery store? Then you throw your budget away because the unexpected expense or overspending causes you to blow your budget.

You may have even uttered the words, “Oh, I’ll start over next month.” I know I can’t be the only one that does this! You think your budget will only work if it’s perfect, so you scrap it every single time you overspend.

To be perfectly honest, our family got into this bad habit when we first started budgeting. As soon as something went wrong (because something always comes up), we would throw in the towel and vow to do better next month.

The problem?

Then we’d overspend and revert back to our old habits. This was keeping us from reaching our financial goals sooner. The expectation to have everything perfect with our money and our budget 24/7 was causing us to fail with budgeting.

It only took a few months of repeatedly “starting over” to realize we were setting ourselves up for failure. We were literally throwing in the towel and giving up month after month.

Know that you are not alone. In fact, Americans on average spend $7,400 more than they make each year. That statistic isn’t to encourage you to spend more than you make, but to let you know that you are not alone in your struggle. And guess what! Your budget will never be perfect, and that’s okay!

Budgeting is less about the math and more about your flexibility and willingness to stick with it even when you overspend.

So instead of starting over the next month, we found a way to just keep going when we felt like throwing in the towel. We started writing mini-budgets!

Mini budgets have saved our family’s finances month after month. They gave me peace of mind and have forced me to truly know what’s going on with my finances.

What Is A Mini-Budget?

A regular budget is a budget that you make from one payday to the next. So if you get paid on Friday, you’ll make a budget from Friday until your next check comes in.

But what if your budget doesn’t go as planned? What if there is an unexpected doctor’s visit? Or you overspend on a Target shopping trip? That’s where mini-budgets come in!

A mini-budget is a smaller budget where you budget from today until your next payday, no matter how long the timeframe is.

For instance, my husband and I used to get paid once a month (on the same day). That’s a long time to stick to a budget. A LOT can happen in a month! The chances of our budget perfectly matching what we anticipated was not great.

In the past, I’d throw out the budget as soon as we went over in a certain category. I felt like a failure, so I’d toss it out. However, I learned that instead of throwing away the entire budget, I would just rewrite a completely new mini-budget.

Why You Need A Mini-Budget

A mini-budget helps you take back control of your budget when you’ve gotten off track. Instead of throwing the budget out the window, you create a mini-budget to help you get back on track with your financial goals.

It’s similar to getting off track with your meal plan at Thanksgiving. You don’t just say “Oh well. I’ll start over next month”. You get back to meal planning and keep going. If you miss a day at the gym, you don’t just stop going. You make your way to the gym and keep working out. If you’re late to work, you don’t stop going to work. You figure out why you were late and fix it.

That’s what a mini-budget does for your finances. It helps you fix any problems that came up during the month. Creating a mini-budget and getting back on track when you just want to wallow and beat yourself up takes discipline. It makes you uncomfortable because you’re not used to it, but guess what?

“Discomfort is the currency to your dreams.” – Brooke Castillo

“If you want something you’ve never had, you must be willing to do something you’ve never done.” – Thomas Jefferson

Don’t expect it to feel good right now. Expect it to feel good when you look at your budget at the end of the month and you only went off track for 4 days instead of 15 like you did last month. That’s when it’ll feel good.

A mini-budget is also a great way to dip your toes into the world of budgeting. You don’t have to wait until payday. You don’t have to wait until Monday. Start now. Start today.

How To Write A Mini-Budget

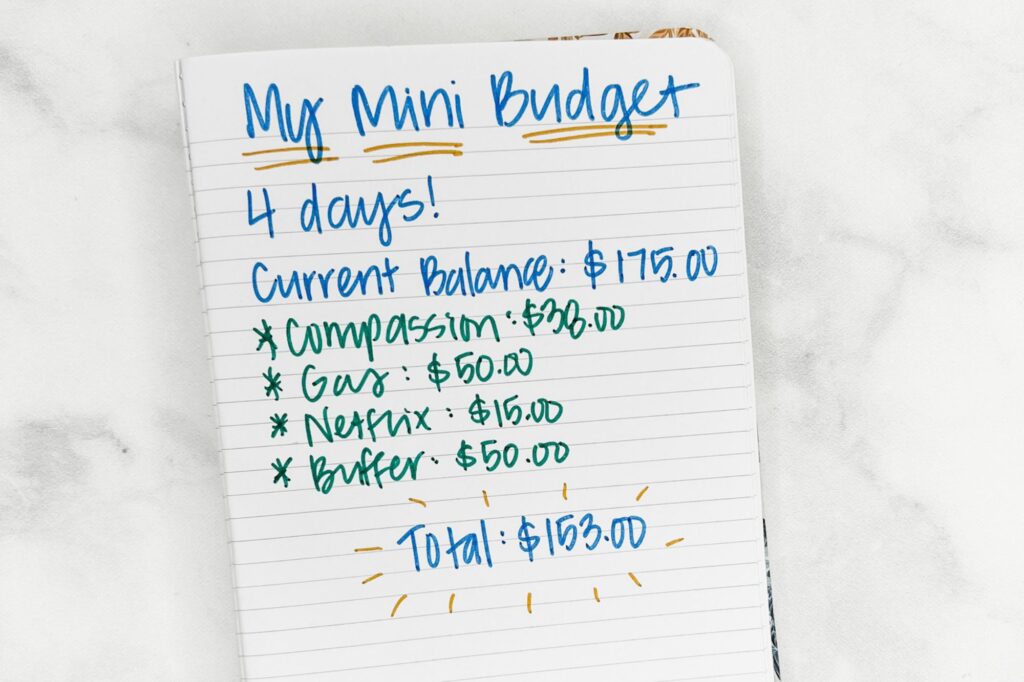

Step 1: Write down the current balance in your checking account.

This can be the hardest step, but it is the most essential. When you overspend, you might be tempted to ignore your problem. If you ignore the problem, it doesn’t exist, right? Wrong. That’s what we like to think to ease the frustration of dealing with the problem, but it can’t be farther from the truth.

Sit down, pull out your phone, and open your online banking app. Write down your balance. If you have any checks or transactions that need to clear, be sure to deduct those from the balance.

A quick tip to see if any checks are still outstanding: Get your checkbook and figure out what the check number is for the last check you wrote. Search that check number in your app. You may have to expand the days in the filter. Work backward about 10 checks and see if they cleared.

You should now have your real up to date balance for your checking account.

Step 2: Determine how many days you have until your next payday.

Look at your calendar and figure out when your next payday is. How many days from today until that date?

This step will help you figure out how many days your mini-budget will need to last.

Step 3: List out your expenses.

Make a list of expenses you expect to have from now until payday. Don’t forget to include bills on auto-draft too. If you aren’t sure which bills you have coming up, check out your last month’s bank statement or your budget binder for guidance.

Don’t forget to check your calendar and make sure you don’t have any events coming up that you’ll need to budget for (like birthdays, Christmas parties, etc).

Step 4: Create your budget

Create your budget using the money you have left in your account and the expenses you have leftover to pay through your next payday.

If you don’t have enough money to cover your expenses, here are some options for you:

Step 5: Post your budget where you can see it daily.

Post your budget where you can see it daily. Go back and reference it often to make sure you’re not on track. If you find yourself off track again, write another mini-budget.

A quick way to see if you’re off track is to put your budget into a budgeting app. I personally use and love Quicken for this. It will help tell you in real-time if you’re on track or not.

PS: if you hate balancing your checkbook, Quicken will help you keep track of your actual balance in your checking account so you can ditch your check register.

3 Benefits Of A Mini-Budget

1). Mini-budgets allow you to keep going and salvage the budget.

Mini-budgets help you to just keep going. Instead of giving up, you’re getting back on track! You realize there is a problem (a blown budget) and you set out to fix it instead of just saying you’ll start over next month.

This step creates so much mental growth!! Giving up is easy. To just keep going is where the real work and growth is.

2). Mini-budgets hold you accountable.

Mini-budgets are amazing because not only do they hold you accountable for your finances, but they allow you to be flexible with your finances. No one is perfect and no budget is perfect. Every budget will need to be tweaked some and that’s okay!

You can see what happened and take steps to prevent it from happening in the future. Kinda like when I kept overspending on my credit card again.

Keep in mind this is NOT to beat yourself up. No one has ever talked so bad to themselves that they just magically changed all of their bad habits. You have to be nice and compassionate to yourself. Say to yourself, “I’m learning to manage my money better”.

3). They set you up for success.

Writing a mini-budget helps you set yourself up for success. You will be more aware of where you stand financially and how to continue growing closer to your money goals!

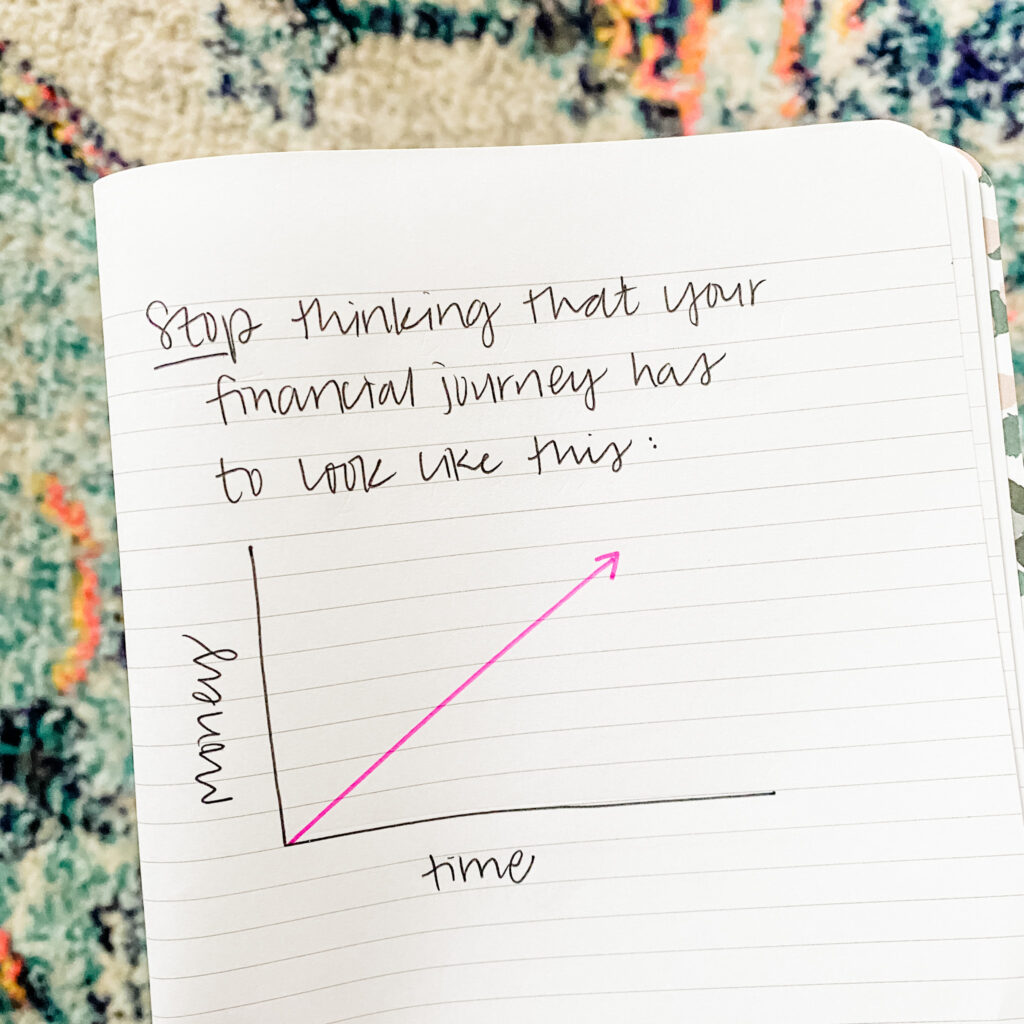

We all know ignoring your finances won’t make them get any better. When you dig down deep and get your hands dirty is where the magic happens. You start slowly becoming better and better with money.

The goal is NOT to be perfect. The goal is to keep improving. Keep putting one foot in front of the other.

What To Do If You Don’t Have Enough Money Until Payday

There may come a time when you don’t have enough money to make it until payday. If that happens, then follow these thee steps below.

1. Pay for your four walls first.

Pay for your house, power, water, groceries, gas, car payment, and phone first. Don’t worry about everything else.

2. Cut expenses.

Drastically cut your expenses. Create a bare-bones budget if you have to.

Other ways to cut expenses:

- Cut down your phone plan.

- Try to make do with the food you have at home or only get limited groceries.

- Cut out cable if you still have it.

- Sell stuff on Facebook Marketplace.

- Do some odd jobs. (Cleaning, baking, cutting grass, etc.) for extra money.

- Adjust some of your budget categories and spend less.

Ideas to help you get started:

- Decrease your gas category by not driving as much to save on gas.

- Move your hair appointment out a few weeks.

- Cancel the family restaurant trip.

- Return some items you don’t need to the store.

3. Give yourself grace.

Give yourself grace. It took guts and courage to rip off that band-aid and create a mini-budget. Give yourself props for getting started! You deserve it. Do whatever you need to do to make your budget equal out. Don’t be afraid to get creative.

What NOT To Do When You Create A Mini-Budget

1. Don’t beat yourself up.

Everyone has blown their budget. Most people have dealt with overdraft fees. Everyone has spent more than they wanted to. Everyone has been in your shoes before. Don’t talk down to yourself. Be willing to give yourself grace.

2. Resist the urge to transfer money from your emergency fund.

Make this the last-ditch effort. You don’t want to get into the habit of continually transferring money from savings due to overspedning. You want to build discipline. You don’t want to keep relying on your savings account to bail you out of minor emergencies.

3. Don’t get a cash advance.

Don’t take money off of your credit card. This prevents you from building that discipline muscle of sticking to your budget. You don’t need to start relying on your credit cards to pay your bills. You need to learn how to budget with the money you’re paid. You don’t want to get into the habit of living off more than you make.

4. Don’t get a 401k Loan.

Again, this is NOT an emergency. You just overspent money. You do not need to take money from your 401k. There are a ton of early withdrawal and tax penalties for withdrawing from your 401k. It’s not worth it. It costs you WAY TOO MUCH money.

5. Don’t ignore your problems.

This might sound so simple, but don’t ignore your problems. Ignoring your problems is never a good plan. When you ignore your problems, they compound on top of each other and you end up with a bigger mess than when you first started.

Creating a mini-budget will help you in more ways than you can imagine. It will help you just as much mentally as it will with your money. It will help you learn to grow and face your problems instead of ignoring them and brushing them under the rug. Be willing to learn from your mistakes and get better. Know better. Do better. That’s all you need to do.

The Bottom Line

Look, budgeting isn’t a walk in the park, and we all mess up sometimes. That’s okay! If you find you’ve blown through your monthly budget, don’t just give up and wait for a new month to start. Try making a “mini-budget” to get yourself back on track. Trust me, it’s a game-changer. This way, you’re not just ignoring the problem, but tackling it head-on, so you’re less likely to make the same mistakes next time.

The point is not to be perfect, but to keep improving. Forget about feeling guilty or stressed; a mini-budget helps you get control back and sets you up for a more financially secure future. So, stop waiting for the perfect moment to start budgeting, and give mini-budgets a try. You’ve got this!