On October 1, 2024, CrossingBridge Advisors launched CrossingBridge Nordic High Income Bond Fund (NRDCX). The fund will invest in high-income bonds issued, originated, or underwritten out of Denmark, Finland, Norway, and Sweden. Those might be fixed or floating rate bonds, zero-coupon bonds and convertible bonds, and bonds issued by corporations and governments. It will be solely managed by CrossingBridge Advisors.

The managers will seek high current income, and the prospect of some capital growth, within the Nordic bond universe. Within that space, they operate with few externally imposed constraints beyond a commitment to avoid real estate and financials. The firm’s internally imposed constraint is an intense dislike of losing their investors’ money. The fund will hedge its currency exposure with one- to three-month forward currency swaps.

David Sherman in his capacity as CIO and Spencer Rolfe as portfolio manager of the fund with assistant portfolio manager Chen Ling. Mr. Sherman founded CrossingBridge, its predecessor Cohanzick (1996), and is the firm’s Chief Investment Officer. Mr. Rolfe joined in 2017 as a distressed credit and special opportunities analyst, spent a stretch as Managing Director at Corvid Peak Credit Management, and returned to CrossingBridge in 2023. They are assisted by Chen Ling, who has been with the firm since 2021. As of 8/31/2024, the firm manages over $3.2 billion in assets.

Two-plus reasons why the fund is worth your consideration

Nordic Bonds as an asset class are intriguing.

The Nordic bond market is large and mature. Terje Monsen of DNB Asset Management, a Nordic investment manager with about 100 funds and $90 billion in AUM, describes the market this way:

The Nordic bond market has decades of history with the first credit funds established in Norway in the 1980s. Over the years the market has grown and developed into a well-diversified and quite liquid market, total size estimated at around EUR 1500 bn.

The prime driver for the market’s growth is a change in the willingness or ability of commercial lending by banks. Once upon a time, corporations looking to borrow large sums of money for relatively short periods could arrange a leveraged or floating rate loan from market markets such as Donaldson, Lufkin, Jenrette (DLJ), or Credit Suisse which no longer exist. European UCITS are not permitted to own floating-rate loans, which locked away another source of capital. A workaround was repackaging the loan as a sort of floating rate bond issued, primarily, in Norway. David Sherman reports that the market is growing by 30% per year. That is consistent with reports from Nordic Trustee, a provider of European bond market data and services.

“Nordic bonds” can refer to both bonds issued by Nordic entities and bonds issued in Nordic markets by non-Nordic entities. Because the Nordic markets are more amenable to smaller-sized issues – those in the $50 – 450 million range – than the US market which better accommodates huge issues, many smaller US and European borrowers work through the Nordics. About one-quarter of the €60 billion Nordic high-yield market, in particular, are non-Nordic issuers.

CrossingBridge, understandably, did considerable research before committing to a fund dedicated to this market. Key characteristics of the Nordic market uncovered in their research:

- Nordic bonds currently earn 200-400bps more than comparable US HY bonds / leveraged loans with better credit quality and less leverage.

- Total returns on Nordic HY bonds are higher than on US bonds, 6.1% versus 5.5% when measured over rolling 12-month periods

- Nordic HY bonds are modestly more volatile than their US peers but much less volatile than global floating rate high yield bonds; that latter comparison is meaningful because Nordic bonds function for some issuers as a substitute for a floating rate leveraged loan. Much of the argument for an actively managed fixed-income fund is that managers are cognizant of and capable of mitigating such volatility.

- More than 80% of Nordic bonds have strong covenants covering financial maintenance, debt issuances, and other creditor protections. In the US, only about 10% of loans have such covenants. That’s relevant because many of these bonds are stand-ins for leveraged loans.

- 49% of Nordic HY bonds feature floating rates, 64% have maturities within the next three years

The market is highly transparent and well-regulated. Because the market is dominated by smaller deals and newer issuers, yields tend to be higher than for comparable US issues. David Sherman, in conversation, believes that default rates (excluding energy, real estate, and financials) tend to be comparable with those in the US but recovery rates are higher in the Nordic market. That is, if an issuer defaults, bondholders get more of their investment back there as opposed to here.

Finally, the fund is likely to be lightly correlated with US fixed-income markets. Credit-oriented funds generally move independent of investment grade ones anyway, and the unique characteristics of a Nordic high-yield focus, including the distinctive nature of the issuers, is likely to heighten that independence.

David Sherman and CrossingBridge are exceptional stewards of your money.

CrossingBridge advises, or sub-advises, five open-ended mutual funds, and one exchange-traded fund. All are income-oriented, active, and capacity-constrained. In addition, all have top-tier risk-adjusted returns since inception.

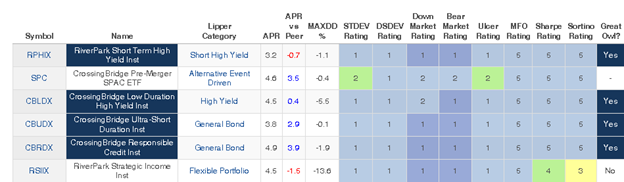

MFO Premium allows us to track funds, including ETFs, on an unusual array of measures of risk awareness, consistency, and risk-adjusted performance. For the sake of those not willing to obsess over whether an Ulcer Index of 1.3 is good, we almost present color-coded rankings. Blue, in various shades, is always the top tier, followed by green, yellow, orange, and red. Below are all of the risk and risk-return rankings for all of the funds advised or sub-advised by Cohanzick/CrossingBridge since inception.

Total and risk-adjusted performance since inception, all CrossingBridge funds (through 8/30/2024)

Source: MFO Premium fund screener and Lipper global dataset. The category assignments are Lipper’s; their validity is, of course, open to discussion.

Here’s the short version: every fund, by virtually every measure, has been a top-tier performer since launch. That reflects, in our judgment, the virtues of both an intense dislike of losing investors’ money and a willingness to go where larger firms cannot.

According to Mr. Sherman’s testimony, he has been investing in Nordic bonds since the early years of the century, and CrossingBridge funds currently hold $300 million in Nordic paper already, “some cash alternatives, some credit opportunities but about 80% in the Core Value or buy-and-hold category.” That Core Value portfolio has substantially less leverage than its US peers, an estimated yield-to-worst of 10.28% (again, much higher than in the US HY market), and an option-adjusted spread of 707 bps, which was calculated by applying August 31, 2024 prices to the firm’s publicly disclosed holdings of June 30, 2024. on the June 30th holdings publicly available applying August 31st pricing. They also have limited oil-and-gas exposure including service companies.

NCI Advisory is an interesting resource.

(That qualifies as point five of a reason.)

CrossingBridge has a business relationship with NCI and is a minority owner of the firm, but NCI has no role in managing the fund. As we noted above, Mr. Sherman has both an extensive history in, and extensive holdings of, Nordic bonds – some ultra-short cash alternatives and some credit opportunities, but the vast majority are core value or buy-and-hold issues – in its other portfolios.

While English is the lingua franca of European investing, and trading can be done from New York, CrossingBridge concluded that there was a compelling case for having “ears on the ground.” There’s a six-hour time difference between New York and Copenhagen so important developments might occur when markets first open in Europe but managers are still sleeping in New York. There are nuances in corporate communications that might be caught by native speakers but missed in translation. And there’s the potential for local developments and cultural differences that simply may not be apparent or understood by foreigners. In those and other instances, NCI’s insights are invaluable. CrossingBridge felt a strategic relationship would create an alignment of interest and source to channel insights it might otherwise not receive.

Administrative detail

The fund’s minimum initial investment is $5,000. The net expense ratio is 0.95%.