13th Nov 2024

Reading Time: 6 minutes

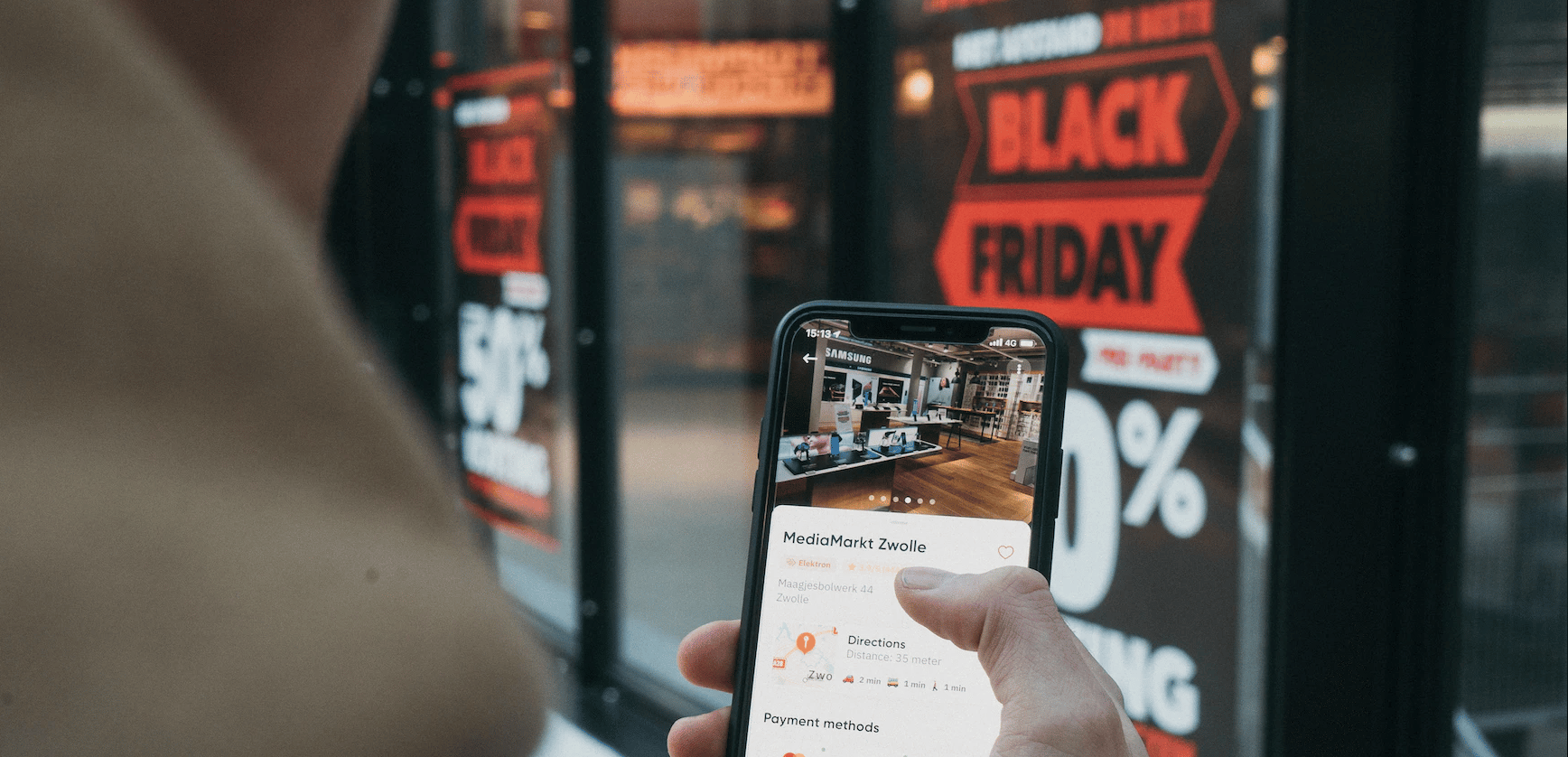

It is that time of year again that our email inbox, our television screens and social media feeds are being bombarded with two words: BLACK FRIDAY. As ever, businesses are promising incredible sales and bargains you can’t possibly afford to overlook. This year, due to the rising cost of living, these promises could feel more important than ever. However, MoneyMagpie’s founder and consumer expert Jasmine Birtles is telling us to stay financially safe.

Black Friday is a phenomenon that hit our shores back in 2010 and has grown bigger every year. In fact, 30% of all annual retail sales happen between Black Friday and Christmas: it occurs on the last Friday of November.

This year, with so many of us worrying about our finances, retailers are pushing Black Friday ‘deals’ very hard, both in store and online. But how do you know if you’re going to get a real bargain, rather than wasting your cash?

Jasmine says, “It’s so easy to be taken in by clever marketing tactics. They make us think that we’ve nabbed ourselves a bargain and stop us checking to see if it really is the cheapest – I know I’ve done it! The problem with Black Friday is that there’s a weight of advertising and hype around the whole event that makes us think that anything we get in a Black Friday sale is definitely going to be a bargain. It isn’t. In fact, some studies (like ones from Which?) have found that in most cases you’re likely to be able to buy that item cheaper somewhere else than in a Black Friday sale!”

Although we love a good bargain, we also want to make sure you’re getting the best deal possible. So, before you head out shopping, read our 4 reasons to beware of Black Friday below.

1.Beware of Brands You Don’t Know

The best offers aren’t always provided by the big brands. Small retailers often jump in on the act too and provide some really good deals. If you do, however, get tempted by an offer on a site you don’t recognise, you should check their authenticity before you buy.

Impartial reviews are available to read on sites such as Reevoo where you can run a background company check online, which includes their credit score. If you are buying online, always pay with credit card or Paypal to make sure that your transaction is protected.

Also remember that Black Friday products do not guarantee extended return policies either, so if you’re buying for Christmas, do check in advance. This is especially important right now when many shops might offer a full Black Friday closing down sale – so you won’t be able to return the goods when the shop is closed permanently.

One thing to keep in mind, though, is that major card providers such as MasterCard and Visa will reimburse you the cost difference if an advertised Black Friday price is lower than the price you recently paid for the same item.

You need to send your receipt, the ad and a claim form within 60 days of the ad’s publication.

2. Beware of Losing Money

If you’re a small (or big) business taking part in the Black Friday frenzy, you could actually end up losing money.

In the last few years, customers have gone into serious spending mode online with bargain buying, and as a result, many businesses failed to cope as their websites struggled to handle the demand of traffic.

An example of this is Argos which saw its website go down for two hours in the 2014 Black Friday sales because it simply wasn’t prepared for the high quantities of traffic. Research by Six Degrees Group estimate that this website fault could have cost them around £5m.

Research by Deichmann in 2020 revealed that most people haven’t a clue when it comes to bagging a bargain, either. Of almost 6,000 adults surveyed, only 9% worked out that a ‘buy one get one free’ offer isn’t as good value as a “buy one, get a discount on second item” offer. Make sure you’re up-to-scratch on your maths before you make any big purchases!

So it’s important if you’re a small business to prepare properly in order to avoid losing out on revenue on this day. Take a look at this useful guide on how to prepare your website for the Black Friday frenzy…or just decide to ignore the day and do your own flash sale in December to pull in the crowds!

3.Beware of Scams and Fraudsters

Black Friday is a great day for fraudsters and scammers to take advantage of shoppers, so make sure you’re extra cautious when looking for deals.

Just because someone uses the words ‘cheap’ or ‘discount’ doesn’t mean that it’s always a good deal. Usually, where the prices seem too good to be true, it means the goods may also be fake or faulty. If a deal seems too good to be true, it probably is!

This also means you MUST make sure you know the returns policy on what you are buying, especially electrical and other expensive items. Reputable sites and retailers will have no problem being upfront about the ins and outs of their policies so check before you buy.

Faced with the right pressures, we’re all vulnerable. Fraudsters put people into what psychologists call a ‘hot state’. This is when we think less clearly if we are eager to spend during the frenzy of deals and sales. We tend to lose the ability to do due diligence and the hope of getting a bargain can be a compelling lure.

As we shop online more than ever, it’s easy to fall victim to a scam.

Make sure to beware of scam emails, too. Fraudsters will send emails under the guise of being a popular high street retailer offering amazing discounts. Clicking on the links may leave you vulnerable to fraud. Always check the email address from which a message is sent, to make sure it is legit.

4.Beware of Impulse Buying

Do you actually NEED the thing that’s on an amazing Black Friday deal? Or do you just WANT it?

Black Friday can offer significant savings on really good products, so make a list of what you know you need or want to buy as gifts, and scope out the costs and where the goods are available beforehand.

It’s easy to get lost in the excitement of the sales on Black Friday, so carefully consider if you are making a sensible purchase that you’re going to get use from. This is important even if you don’t go into the shops but just go online. It’s still too easy to be sucked into buying something you don’t need or want. Research your items in advance too – so you can spot a fake discount!

A previous survey by TopCashBack has found that nearly half of UK consumers are waiting for Black Friday sales to buy big ticket items they’ve been wanting for a while and more than a quarter have been holding-off since August. On average, consumers are planning to spend around £421 in the sales but hope to save £228, i.e. they’re hoping to get a 35% discount on their purchases.

Of course, they might get some good discounts if they have researched the items beforehand and know how much they should be. But it’s all too easy to be made to think you’re getting a bargain when you’re not.

Jasmine reminds us all that her “biggest piece of advice when it comes to Black Friday is to ignore it…unless there is something specific that you know you need (and I mean ’need’) which you have already researched and you know how much it is normally. If you then look around at the ‘offers’ on this item and find a genuine price drop in the sale then go for it, but otherwise I would just ignore the Black Friday so-called deals.

The vast majority of them are not good offers and, worse than that, the hype and hypnotism around this supposed sale time could potentially mesmerise you into spending money on things that you don’t need or even want using money that you can’t actually afford to spend. This happens to loads of people every year at this time and I suggest that you protect yourself by simply keeping away from the websites and shops around this time. Really, if you don’t go in (physically or online) you won’t be tempted. That’s the way I operate and I recommend it to everyone else!”

Much of the same applies to Prime Day – read more about that here.