Source: The College Investor

There’s a staggering lack of financial literacy when it comes to how student loans work when paying for college.

Every college financial aid office says “just apply for student loans”, but nobody tells you how student loans work!

Increasingly, tuition continues to rise, saddling millions of students with large amounts of student loan debt. In fact, the average student is graduating with almost $30,000 in student loans. That’s slightly more than a Tesla Model 3 or even a wedding. Without students loans, many people would not even be able to attend college.

For most anyone heading to college, student loans will become a fact of life. But where do student loans come from, how much can you borrow, and what is the true cost? In this article, you’ll learn all about how student loans work.

The Ins and Outs of Student Loans

Student loans are available for undergraduate and graduate students alike. They are based on need, of which income is only one component. Students loans are issued by the government (hence the term Direct Loan – directly from the government). Although, private student loans are also available. The amount issued to a student will depend on the student’s financial situation. The final decision is up to the school.

Financial aid packages are the first step in receiving a student loan. The financial aid package is made up of gift aid (such as grants and scholarships), loans, and work-study programs.

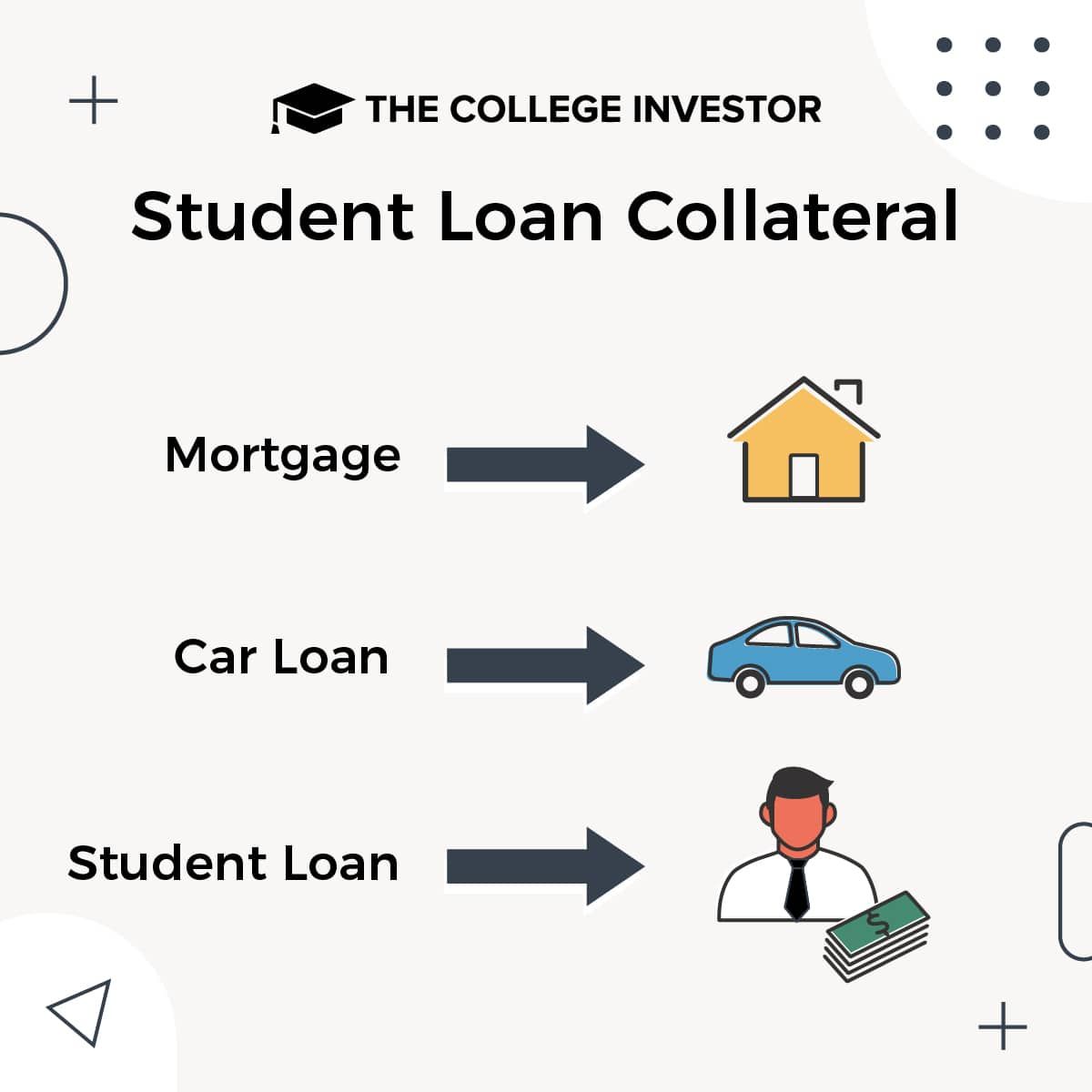

What is the collateral for a student loan? It’s important to remember that the collateral for a student loan is your future earnings. When you buy a car and get a car loan, the collateral for the car loan is the car. So if you don’t pay the car note, the bank can repossess your car. With student loans, it’s important to remember that the collateral is your future earnings. If you don’t repay a student loan, the government can garnish your wages, take your tax returns, and more. Always keep this in mind when borrowing.

Student Loan Collateral. Source: The College Investor

How To Apply For A Student Loan

The FAFSA, or Free Application for Federal Student Aid, must be filled out each year to receive financial aid. FAFSA deadlines change each year. You can check the deadlines here. Be sure your FAFSA is submitted on time. Otherwise, a late FAFSA will certainly complicate your financial situation and leave you scrambling to pay for school.

To get an idea of how much financial aid you might be awarded, check the Federal Aid Estimator website.

Upon being “awarded” financial aid, you’ll receive amounts for gift aid and loans. There should also be a breakdown of your school’s cost. Schools display cost information in different ways and the true cost can be off by a wide margin. Depending on what is shown, you may need to ask the school for cost on:

- Tuition

- Housing

- Food

- Travel

- Fees (labs, etc.)

- Books

Add in any other known cost. It’s better to overestimate rather than underestimate. Many students find that they are short on money, even after receiving their financial aid. This is due to many costs that are not accounted for.

Note: The first year is also usually the least expensive year of college. Your college costs will typically rise each year you attend a college.

Actually Applying For Student Loans

Now that you have your financial aid award, you’ll see several “awards” of loans (notice the parenthesis – it’s terrible they call this an award). These loans are subject to the annual student loan limits, which are very low – only $5,500 in year 1.

First, you’ll be offered a Direct Student Loan. This is your child’s loan. It could be subsidized or unsubsidized. With subsidized loans, the government pays your interest while in school. With unsubsidized loans, your interest grows your loan balance while you’re in school. That’s the only real difference. Read our full guide to subsidized vs. unsubsidized loans here.

Second, you may be offered Parent PLUS Loans. These loans are the parent’s loan. Your child has no legal responsibility for this loan. You can borrow, as a parent, for your child’s education. We hate seeing parent’s borrow for their children’s college, but we also know that some parents might not have planned or want to have tough conversations. As a result, a lot of over-borrowing can happen. See our full guide to Parent Student Loans here.

Finally, you can look at using private loans. Many families opt for private loans in-lieu of Parent PLUS Loans. Private loans are taken out in your child’s name, but the parent is the cosigner. This makes both of you responsible. For parents with great credit and income, private loans may offer lower interest rates. But they don’t come with any type of loan forgiveness options, and rarely are the rates actually much better. Borrow at your own risk. You can see our guide to the best private loans here.

How Much Should You Borrow?

Once you have an annual cost for school, subtract out gift aid and any money your parents may have saved up for college. If you have saved up money for college, subtract it out as well. The number you’re left with is not only direct school cost (tuition & housing) but cost needed to live while you’re in school. If you have a job, factor in how much of the above cost it will cover. You should have a final number on cost at this point.

That final number is the amount needed for school loans. The less money in school loans you have to take, the better. As you can see, the amount of loans isn’t just about tuition and books. It should factor in all costs that are associated with being a student.

One caveat about student loans: students will often take the full awarded amount, even if it isn’t needed. If you don’t need the full amount, you can take only what is needed. Taking more loan money than what is needed will cost more in interest and increase your monthly loan payments.

Key Rule Of Thumb: Our key rule of thumb for how much you should borrow is simply to NEVER borrow more than you expect to earn in your first year after graduation. This will help ensure that you never borrow too much and can’t afford to repay it.

Related: How To Calculate The ROI Of College

Paying Back Your Student Loans

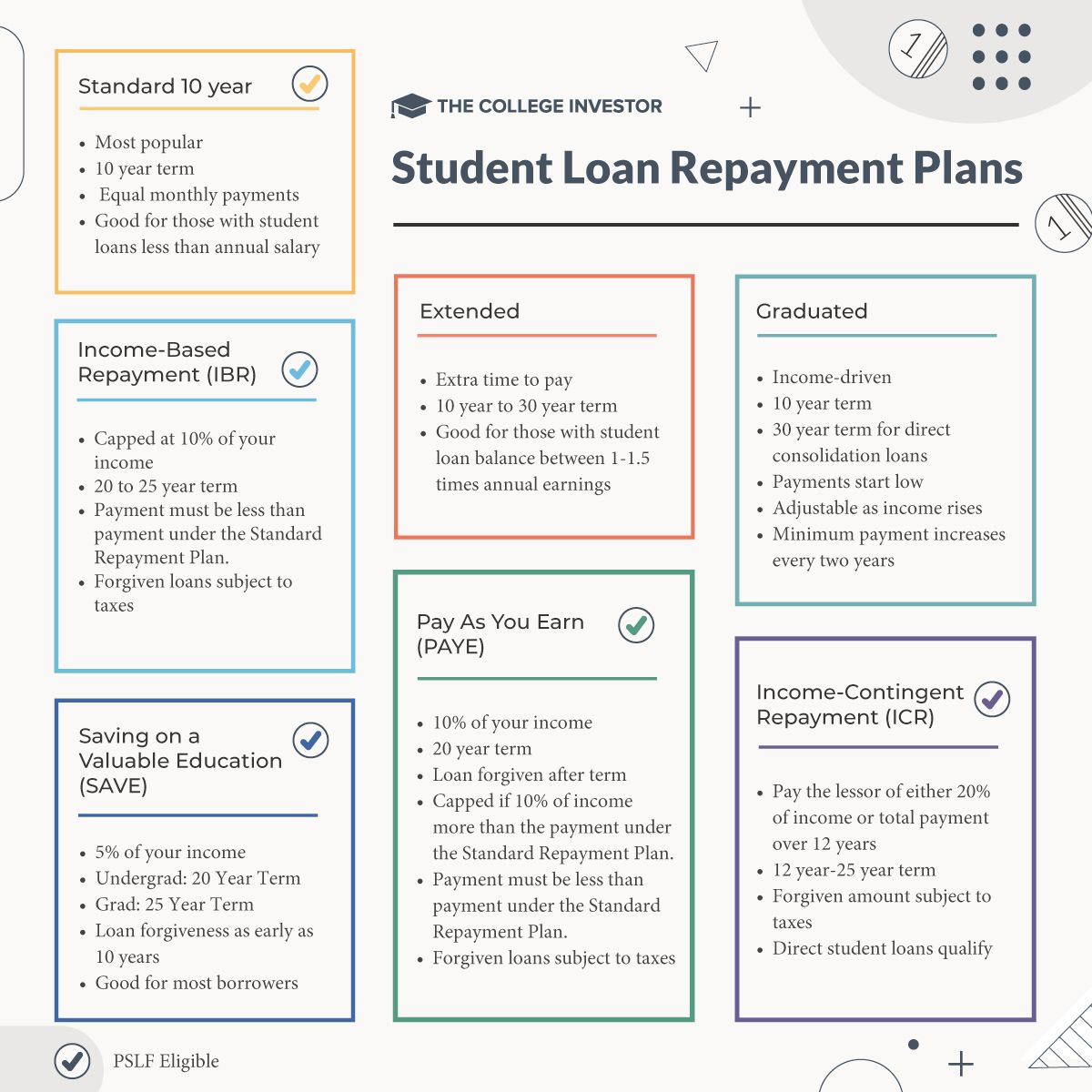

If you have Federal student loans, there are a variety of repayment plans, such as income-driven repayment plans, that can help you pay back your student loans in an affordable way.

You should pick the repayment plan that you can afford to make the payment on every month. If you don’t know where to start, look at using a tool like Student Loan Planner to help you.

The government offers a number of loan features that are not available with non-government loans. These include:

- Forbearance: You don’t have to start paying on student loans until after you graduate.

- Hardship: While in repayment, you can push back payments until your finances improve.

- Low interest: Most loans will have interest rates in the single digits.

- Low origination fees: Fees for disbursed loans are ~1% of the loan value.

- Loan Forgiveness Programs: There are a variety of loan forgiveness programs that federal loans are eligible for.

If you are enrolled at least half-time, you don’t have to begin making payments on government loans until six months after graduating. Additionally, interest will not accrue until after graduation for subsidized loans, but starts accruing immediately for unsubsidized loans.

According to the Federal Reserve, the average monthly payment is $393, with a median monthly payment of $222. How much you pay will depend on the repayment plan and interest rate. Note that graduate loans will usually have higher interest rates than undergraduate loans.

Private loans don’t have any options for loan forgiveness, and the deferment rules are strict. You essentially have to make these payments no matter what, just like a mortgage or car loan.

Source: The College Investor

A Necessity for Most Students

With tuition continuing to skyrocket, student loans have become a necessity for virtually any student wanting to attend college. While student loans can be a large source of financing for college, planning for cost and taking only the amount needed will help to avoid being overly saddled with unneeded debt.