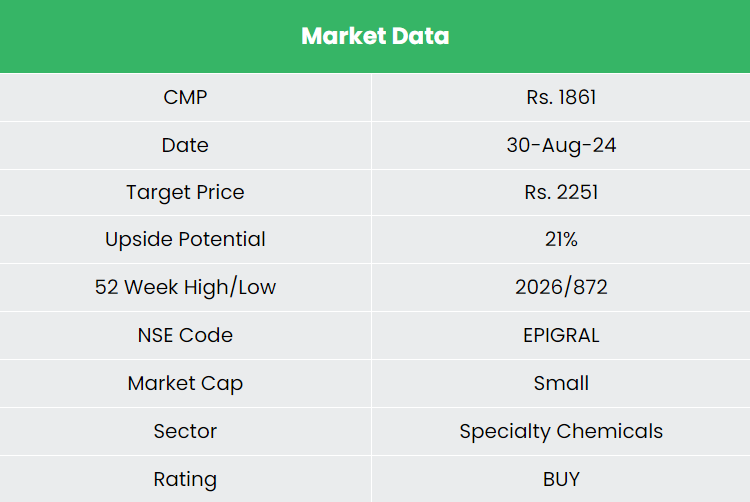

Epigral Ltd – India’s Leading Integrated Chemical Manufacturer

Founded in 2007 and headquartered in Ahmedabad, Epigral Ltd. (formerly Meghmani Finechem Ltd.) is a leader in India’s chemical industry. Starting with Chlor-Alkali production in Dahej, the company has expanded to include Chloromethanes, Hydrogen Peroxide, Epichlorohydrin, and CPVC. It has India’s first Epichlorohydrin plant based on renewable resources and the largest CPVC plant, driving nation’s infrastructure growth. Their cutting-edge manufacturing facility spans 60 hectares in Dahej, Gujarat.

Products and Services

Epigral offers a wide range of essential derivatives and specialty chemicals across 15+ industries:

- Chlor-Alkali: Products like caustic soda, caustic potash, liquid chlorine, and hydrogen gas, used in alumina, textiles, chemicals, soaps, detergents, agrochemicals, and pharmaceuticals.

- Derivative Products: Includes chloromethanes and hydrogen peroxide, serving the pharmaceutical, PTFE pipes, refrigerant gas, paper and pulp, textile, chemical, and effluent treatment industries.

- Specialty Chemicals: CPVC resin, CPVC compound, epichlorohydrin (ECH), and chlorotoluene value chain, used in pipes and fittings, windmills, automobiles, adhesives, agrichemicals, and APIs.

Subsidiaries: As of FY24, the company has one associate company.

Growth Strategies

- Capacity Expansion: During Q1FY25, Epigral increased CPVC resin capacity by 45,000 TPA, reaching 75,000 TPA. It also added 35,000 TPA in CPVC compounds during the quarter.

- New Ventures: Expanding into chlorotoluene and its value chain for pharmaceutical and agrochemical intermediates, with commissioning expected by Q2FY25.

- R&D Enhancement: Launched a Research and Development Centre in Ahmedabad in FY24 to boost specialty product innovation.

- Capacity Utilization: Optimal utilization of new facilities is projected from FY26.

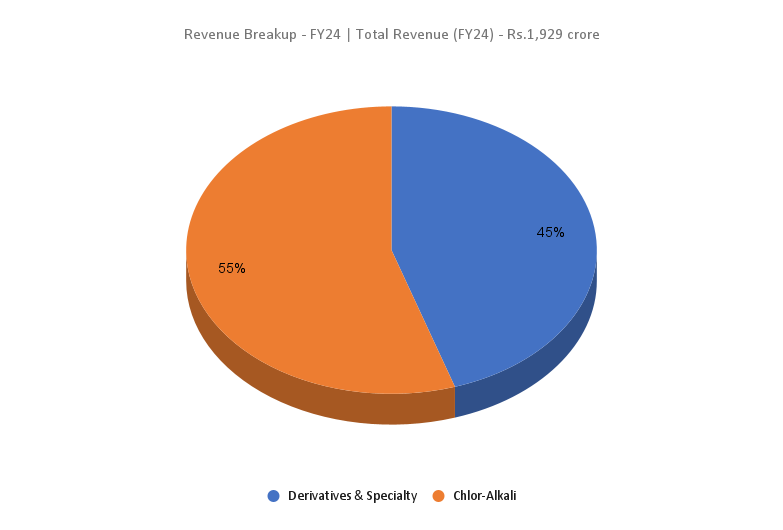

- Product Mix Shift: Aiming to shift the product mix from 45:55 to 70:30, favoring derivatives and specialty chemicals over chlor-alkali.

- Market Leadership: Holds top national capacities in caustic soda, caustic potash, chloromethanes, hydrogen peroxide, CPVC resin, and India’s first ECH plant.

Financial Performance

Q1FY25

- Revenue reached ₹654 crore, up 43% YoY.

- Volume grew 29%, led by Derivatives and Specialty business.

- EBITDA increased 85% to ₹176 crore.

- Net profit jumped 169% to ₹86 crore.

- Margins improved: gross margin to 40%, EBITDA margin to 27%, and net profit margin to 13%.

- Product realization declined despite strong growth.

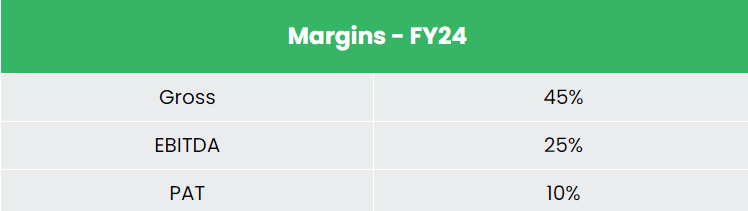

FY24

- Volume grew 15%, boosted by diversification and new projects.

- Revenue declined 12% to ₹1,929 crore due to lower realizations.

- Operating profit fell 30% to ₹481 crore, and net profit dropped 44% to ₹196 crore.

- Industry faced subdued demand, oversupply, and low realizations.

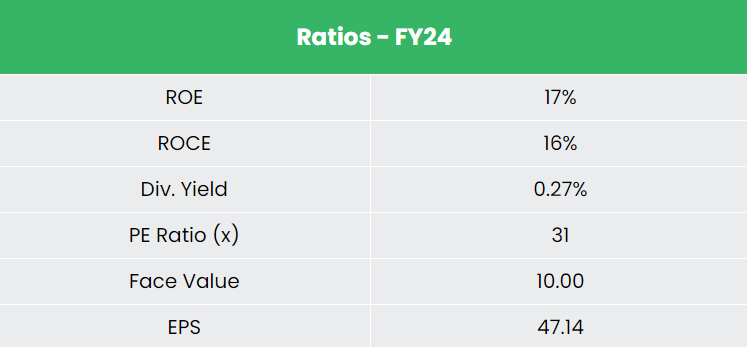

Financial Performance (FY21-24)

- 3-year revenue and PAT CAGR: 33% and 25% (FY21-FY24).

- 3-year average ROE: 30%, ROCE: 26%.

- Healthy capital structure with a debt-to-equity ratio of 0.77.

Industry outlook

- India’s chemical industry covers over 80,000 products, including bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilizers.

- The industry is the 6th largest globally and 3rd largest in Asia.

- Despite challenges like inflation and supply chain disruptions, the sector has shown resilience.

- Projected growth: $300 billion by 2025 and $1 trillion by 2040.

- India ranks 11th in chemical exports and 6th in imports (excluding pharmaceuticals).

Growth Drivers

- Government allocated ₹192.21 crore (US$ 23.13 million) to the Department of Chemicals and Petrochemicals under the Interim Union Budget 2024-25.

- A 2034 vision has been established to boost domestic production, reduce imports, and attract investments in the chemicals and petrochemicals sector.

- 100% FDI is permitted under the automatic route, with some exceptions for hazardous chemicals.

Competitive Advantage

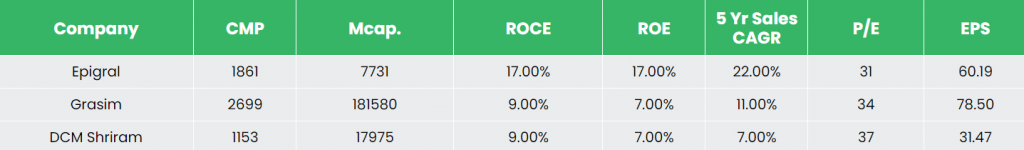

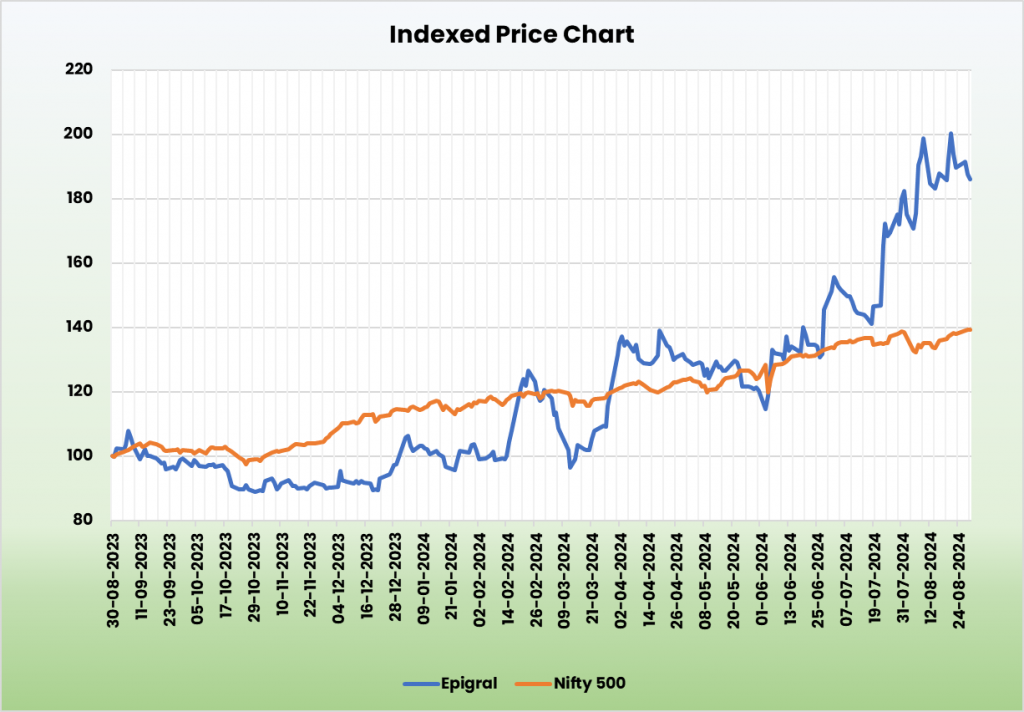

Epigral exhibits superior sales growth and healthier returns on investments compared to competitors like Grasim Industries Ltd and DCM Shriram Ltd.

This performance highlights Epigral’s prudent capital allocation and expanding market penetration.

Outlook

- Epigral’s shift from basic chemicals to specialized products, a first in India strategy, is set to position the company as a key leader in the market.

- By transitioning to niche Derivatives and Specialty chemicals, Epigral is expected to be less affected by market fluctuations.

- With strong earnings growth potential and underutilized recently commissioned capacities, the company is well-positioned for significant future growth and value creation.

Valuation

Epigral’s strategy to expand Derivatives and focus on import substitution is expected to drive growth. Introducing “India’s first” products will further enhance its market position. We recommend a BUY rating with a target price (TP) of ₹2,251, based on 27x FY26E EPS.

Risks

- Single Manufacturing Unit: All production and capacity expansions are concentrated at a single location in Dahej, posing risks if any unexpected issues arise at the site.

- Demand Slowdown: A decline in demand in domestic or export markets could negatively impact margins.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

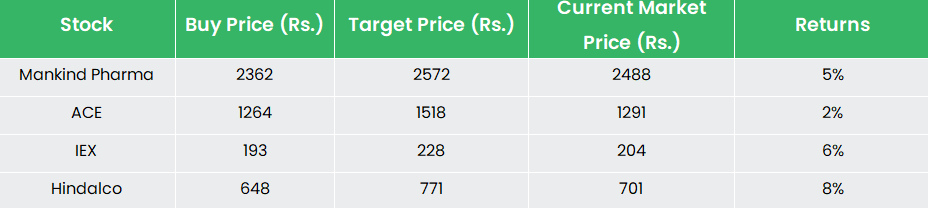

Recap of our previous recommendations (As on 30 August 2024)

Action Construction Equipment Ltd

Other articles you may like

Post Views:

1,159