Stop focusing on customer service. No, that’s not a typo. The reason I say this is because amazing customer service doesn’t necessarily help your bottom line. This is not to say you shouldn’t provide great service, but rather that it has become more of a commodity and is no longer a competitive differentiator. An amazing customer experience . . . well, that’s a whole other story.

To thrive in today’s competitive environment, you should be devoting substantial resources to elevating the client experience at your firm. Read on to learn about top customer experience strategies that research suggests could drive positive results for your financial advisory business.

Customer Service Vs. Customer Experience

Customer service (CS) is generally reactive to a specific situation, such as a question or service issue with which a customer needs assistance. These inquiries are transactional in nature and are generally handled by a single person. It is also relatively easy to measure how effectively the service is being delivered and to make adjustments as needed.

Customer experience (CX) is a more strategic, holistic approach that builds upon customer service in a way that affects how customers perceive all interactions with an organization. CX encompasses every aspect of a company’s offerings, from its quality of customer care to its reputation, overall marketing, product and service features, and reliability. In contrast to CS, CX is much more subjective and based on general perceptions, which makes it difficult to measure.

Consider this distinction in terms of your business. Perhaps you already provide excellent service, but what about the experience clients have with your firm? Below, I’ll dive into the elements that make up top-notch CX, as well as answer the question: How can financial advisors build the right CX strategy? The process is all about results and how elevating the client experience can lift your firm above the competition.

Building an Emotional Advantage

The quality of a customer’s experience results from a combination of effectiveness, ease, and emotions. Focusing on client emotions is the best place to start. Why? Because, according to a 2017 article published in Frontiers in Psychology, emotions have a substantial influence on memory. What your clients remember about their experience with you is largely based on how you make them feel.

Also, as the Temkin Group found in its 2018 study, “What Happens After a Good or Bad Experience,” your clients will be much more forgiving of any singular difficult situation if they have positive emotions regarding you and your practice.

So, as you start to think about the experience you deliver, ask yourself:

-

Are you delivering value to your clients?

-

Is it easy for your clients to understand and benefit from that value?

-

Do your clients feel good about their experience in working with you and the others in your practice?

Intrinsically, you want your clients to feel positive emotions about your practice. But do you realize that improving your clients’ experience can drastically improve your bottom line? In its industry study, “The US Investment Firm Customer Experience Index, 2019,” Forrester concluded that making your clients feel appreciated, confident, and valued, as well as eliminating situations in which they feel annoyed, disappointed, or frustrated, will have the greatest effect on their loyalty.

By fostering positive emotions, you can build trusting client relationships rooted in three types of loyalty: retention, enrichment, and advocacy. So, if you want clients who stay with you, invest more assets with you, and refer new business to you, developing a robust CX strategy is worth the investment. Ready to get started?

Designing the Right CX Strategy

So, how can financial advisors build the right CX strategy? According to Forrester, in our industry, you should focus on these six areas:

Think about how you can help your clients feel more positive emotions about each area. For example, are there ways you can reduce your clients’ anxieties when speaking about their investments and financial goals? How can you provide friendlier, warmer, or more genuine customer service? What could you do to make your communications more transparent and effective?

Focus on the areas you have the most control over and where change will have the greatest impact on your CX. To get started, follow the five-step process below, which can be applied to existing clients as well as to prospects.

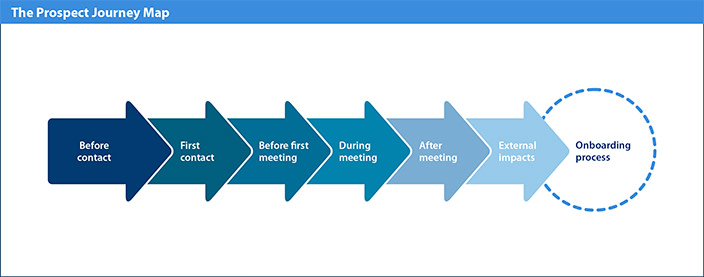

1) Map the journey. Put together a high-level map of the journey prospects would travel through to become clients of your firm.

2) Consider what your prospects may be doing or thinking at each stage. What questions might they have? What emotions might they be feeling?

3) Make changes based on the biggest opportunities and the greatest pain points. What are your prospects’ pain points, and how could you reduce or eliminate them? Where are there opportunities to create positive emotions along the way?

For example, you might focus your efforts on your first interaction with your prospects, where you have an opportunity to make a lasting impact. What are they thinking and feeling? What more could you do to make them feel comfortable and valued? If you’re not sure, try asking some of your newer clients how they felt during that first call. What would have made them feel more comfortable?

Once you determine where you want to begin, make a plan for how you’ll implement the changes, and get to work.

4) Ask for feedback. Because it will be difficult to measure your progress, be sure to loop back in to see how your prospects—now clients!— felt about what you did as they were deciding whether to hire you. Ask if there were other things you could have done to help. Keep track of this feedback and continue to iterate what you’re doing.

5) Identify the next opportunity! Once you’ve improved the first area you chose to work on, look at the others. Identify where you can make a meaningful change and go for it. Before you know it, your clients will be raving!

A Positive Experience for All

There’s a wonderful collateral benefit to putting resources toward elevating the client experience at your firm. Multiple studies have shown that improving your CX can lead to less stress on your employees—who, in turn, will be more engaged and productive and will stay with your firm longer. This, says Forrester, creates a virtuous cycle, as having loyal and satisfied employees creates a more positive experience for your clients.