Source: The College Investor

- Yes, you can open multiple 529 college savings plans across different states.

- Each state’s 529 plan offers unique benefits, fees, and investment options.

- You’re still subject to your own state’s tax laws in regard to 529 plan contribution and distributions.

529 plans are tax-advantaged education savings accounts designed to encourage saving for future education costs.

While these plans are state-sponsored, investors are not limited to their home state’s plan. Opening multiple 529 accounts in different states allows families to diversify their investment portfolios and take advantage of varying investment options and fee structures.

Different states offer a range of investment choices, fees, and performance histories. By selecting plans from multiple states, parents can tailor their investment strategy to align with their risk tolerance and financial goals.

Related: 529 Plan Guide By State

Maximizing Contributions

Each state’s 529 plan has an aggregate contribution limit per beneficiary, ranging from $235,000 to over $550,000. These limits represent the maximum total contributions allowed to a particular state’s 529 plan for a beneficiary.

If a family were to contribute the maximum allowable amount to every state’s 529 plan, the cumulative potential savings could exceed $23 million per beneficiary. While this scenario is uncommon due to the substantial financial commitment required, it illustrates the flexibility 529 plans offer in accommodating large education savings goals.

This could even potentially be used by families to setup dynasty 529 plans or effective education trusts.

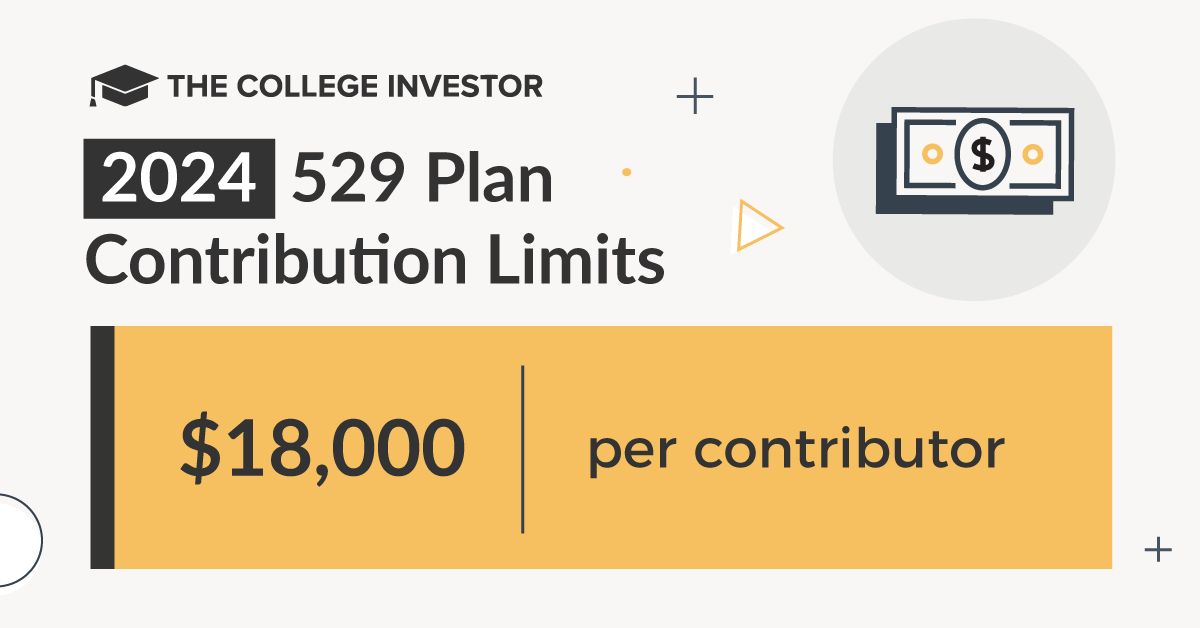

It’s important to note that while there is no federal limit on the number of 529 plans one can open, contributions may be subject to federal gift tax rules. For 2024, contributions up to $18,000 per beneficiary per year ($36,000 for married couples) qualify for the annual gift tax exclusion. Additionally, 529 plans allow for accelerated gifting, enabling lump-sum contributions of up to five times the annual exclusion amount without incurring gift taxes, provided no further gifts are made to the beneficiary in the next five years.

Source: The College Investor

Understanding State Tax Benefits

One significant consideration when opening multiple 529 plans is the state tax benefits associated with contributions.

Over 30 states offer a tax deduction or credit for contributions made to their own state’s 529 plan. If your state provides such incentives, contributing to your home state’s plan may offer immediate tax savings.

However, some states extend tax benefits to contributions made to any state’s 529 plan (known as tax-parity).

Regardless of what state you open the 529 plan in, you will be subject to your state’s tax laws.

For example, as a California resident, if you open an plan in Arizona, you’re still subject to California’s rules. So, while Arizona does have a tax deduction, you don’t get to claim that on your California tax return (though, if for some reason you also had an Arizona return, you could claim it).

Also, the benefits don’t transfer. For example, Arizona allows the 529 plan to be used for K-12 education and converted to a Roth IRA. But California does not. Even if you open an Arizona plan, if you do either of these events as a California resident, you’ll be subject to taxes and a penalty.

Financial Aid Implications

While maximizing contributions can significantly boost education savings, it’s essential to consider the potential impact on financial aid eligibility.

Assets in 529 plans owned by the parent are considered parental assets on the Free Application for Federal Student Aid (FAFSA) and can affect the student aid index. However, if your goal is to get millions into a 529 plan, you’ll likely not need (or qualify) for financial aid anyway.

Don’t Miss These Other Stories: