Today’s Animal Spirits is brought to you by YCharts

See here to register for a webinar with Josh Brown and CEO of YCharts Sean Brown to discuss the hottest trends as we head into 2025!

See here for our annual Animal Spirits Audience Survey

Listen here:

On today’s show, we discuss:

Recommendations:

Charts:

Tweets:

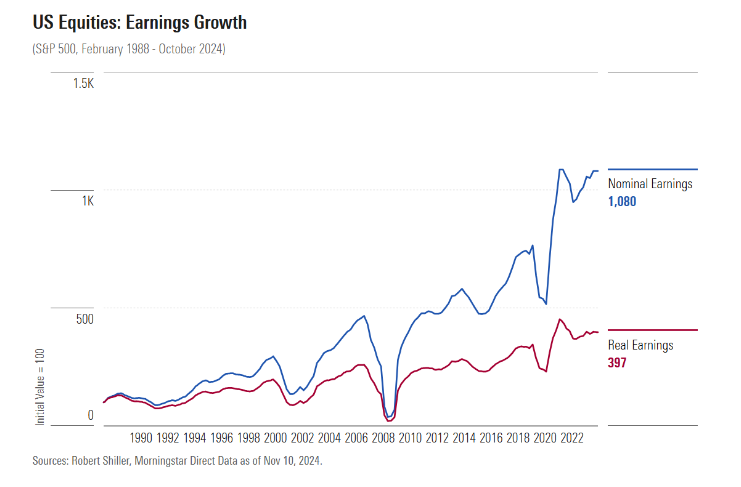

Massive bubble with this much growth? Stop it. pic.twitter.com/ObtEdx8QHi

— Barry Schwartz (@BarrySchwartzBW) November 17, 2024

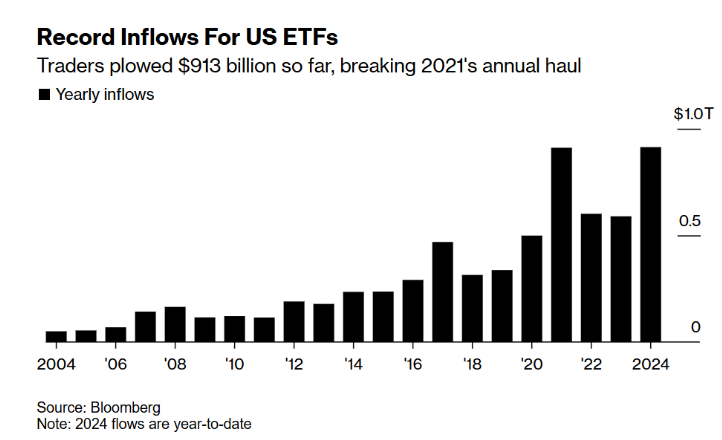

$NVDL (2x Nvidia ETF) is now bigger than $ARKK h/t @Todd_Sohn pic.twitter.com/b8jwLBQfRn

— Eric Balchunas (@EricBalchunas) November 11, 2024

Nvidia’s total value, $3.65 trillion, is within a trillion dollars of the total value of Japan’s Nikkei 225 Index, which itself is valued at $4.65tn. This is no small feat, as Japan is the second-largest stock market in the MSCI All Country World Index (ACWI). pic.twitter.com/pcyYXEutTP

— Jeff Weniger (@JeffWeniger) November 11, 2024

BofA: Median checking and savings deposit balances have declined over the past year for all income cohorts, but still remain above inflation-adjusted 2019 levels pic.twitter.com/jj8sDkXBKs

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 12, 2024

Bitcoin ETFs have crossed $90b in assets, after yesterday’s $6b jump ($1b in flows $5b in mkt appreciation).. they now 72% of the way to passing gold ETFs in assets. pic.twitter.com/7I3TMC8CfZ

— Eric Balchunas (@EricBalchunas) November 12, 2024

JUGGERNAUT: $IBIT has hit the $40b asset mark (a mere two wks after hitting $30b) in a record 211 days, annihilating prev record of 1,253 days held by $IEMG. It’s now in Top 1% of all ETFs by assets and at 10mo old it is bigger than all 2,800 ETFs launched in the past TEN years. pic.twitter.com/WTATlpShUq

— Eric Balchunas (@EricBalchunas) November 13, 2024

THE BENDS: Ethereum ETFs have made a quick and sudden rise from the deep dark depths of cumulative outflows following the Election, finally into fresh air and net inflows. What a chart.. @JSeyff pic.twitter.com/CpzhkHTykG

— Eric Balchunas (@EricBalchunas) November 18, 2024

$IBIT vs $QQQ … huge move higher in the last month.

Bitcoin no longer moving like the Qs pic.twitter.com/9R4LDVV33Z

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) November 15, 2024

#BITCOIN ETF OPTIONS TRADING WILL START TUESDAY

Options trading will begin on Tuesday on the $42 billion iShares Bitcoin Trust $IBIT, the largest of the Bitcoin exchange-traded funds, a Nasdaq spokesperson confirmed to Barron’s late Monday. The move offers a new way to trade,…

— *Walter Bloomberg (@DeItaone) November 19, 2024

Bitcoin is the currency of freedom , a hedge against inflation for middle class Americans,a remedy against the dollar’s downgrade from the world’s reserve currency, and the offramp from a ruinous national debt. Bitcoin will have no stronger advocate than Howard Lutnik.

— Robert F. Kennedy Jr (@RobertKennedyJr) November 16, 2024

Vuori raises $825 Mn at $5.5 Bn valuation. Earlier round was at $4 Bn in 2021. pic.twitter.com/CsjkEpTMUc

— Mostly Borrowed Ideas (@borrowed_ideas) November 9, 2024

This commenter wrote a sarcastic summary of my video without watching it. Just one problem — there’s nothing wrong with buying luxury goods or raising your expenses or buying an expensive car!

Too many people in the personal finance community genuinely believe that spending… pic.twitter.com/nxl2SwvNO2

— Ramit Sethi (@ramit) November 17, 2024

Floyd Mayweather was in the top four most-watched fights this century — until this past weekend’s showdown on Netflix. 🥊 pic.twitter.com/ed5YYvdpLG

— Boardroom (@boardroom) November 18, 2024

Best case scenario, either X or Bluesky just up and dies

Worst case, they’re both good for breaking news and I have to monitor both

Most likely case, I have to stay on X and it’s a bit worse because the smart people who don’t have to be here choose to migrate

— Joe Light (@joelight) November 18, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.