.bh__table_cell { padding: 5px; background-color: #dddddd; }

.bh__table_cell p { color: #222222; font-family: ‘Helvetica’,Arial,sans-serif !important; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#dddddd; }

.bh__table_header p { color: #222222; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !important; overflow-wrap: break-word; }

Presented by

The industrial real estate market in the US is experiencing a period of remarkable growth. Clarion Partners’ latest research report examines the strong performance of the sector, which is driven by e-commerce companies, strategic inventory stockpiling and the development of specialized subtypes such as industrial outdoor storage (IOS). Discover top insights on why US industrial real estate continues to outperform.

Today's Animal Spirits is brought to you by Innovator ETFs and the CME Group:

See here for more information on Innovator ETFs suite of risk-managed ETFs and here for more information on CME Group's valuable educational materials and trading tools

The Compound Podcasts:

On today’s show, we discuss:

-

Yardeni Says Fed Cut Raises Odds of 'Outright Melt-Up' in Stocks

-

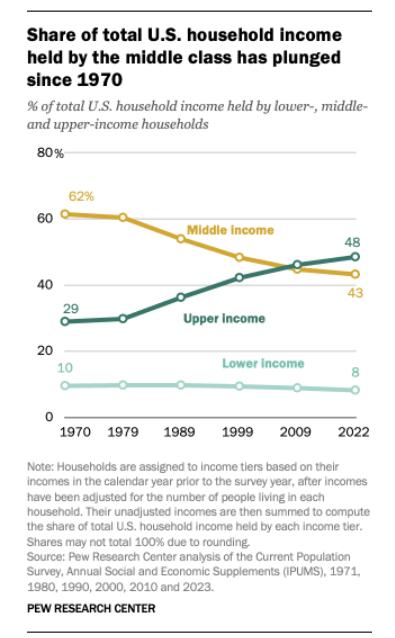

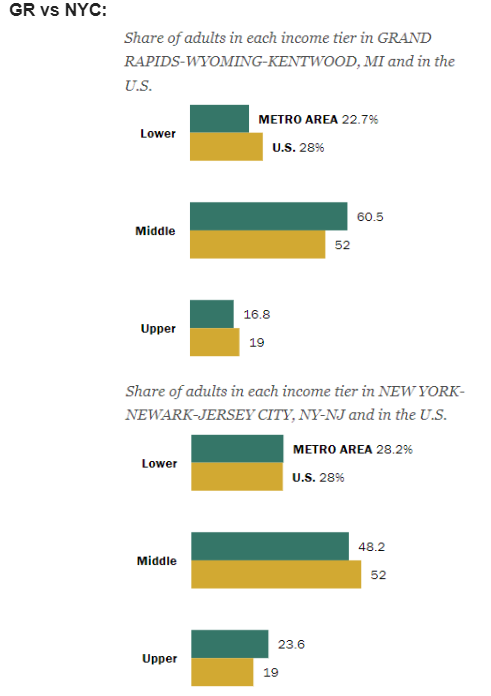

Are you in the American middle class? Find out with our income calculator

-

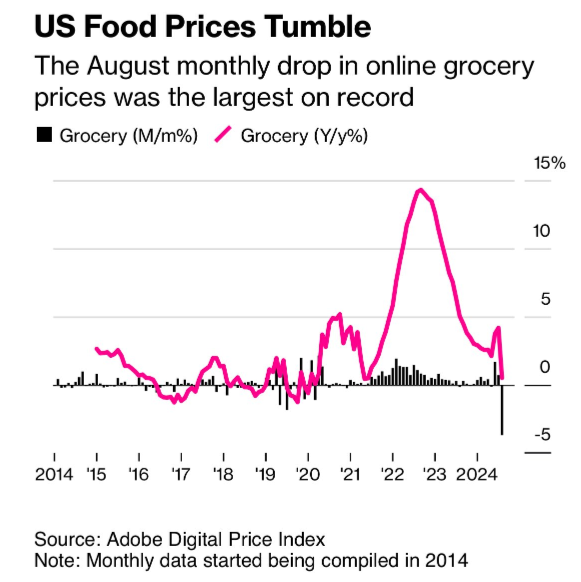

US Online Grocery Prices Plunge the Most on Record in August

-

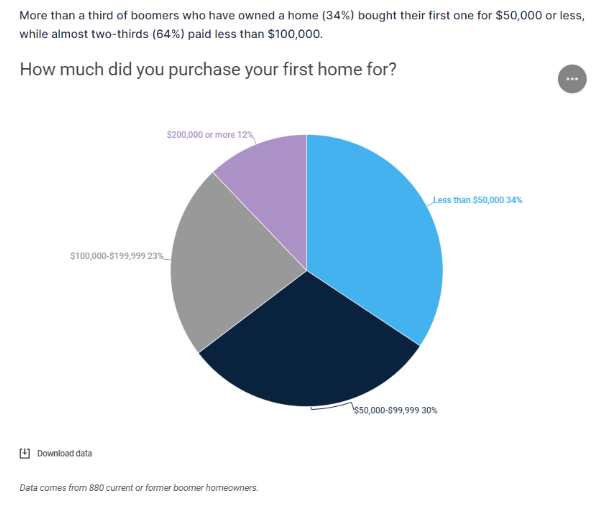

Baby Boomer Housing Market 2024: More Than Half of Older Owners Never Plan to Sell

-

Reversing the Real-Estate Doom Loop Is Possible. Just Look at Detroit.

-

With Bluesky, the social media echo chamber is back in vogue

Charts:

Tweets:

Today is set to be the biggest gap higher for the S&P 500 ETF $SPY (+1.6%) after a scheduled Fed Day since 10/30/08 (+2.9%) after Bernanke cut by 50 bps in the midst of the Financial Crisis.

— Bespoke (@bespokeinvest)

12:45 PM • Sep 19, 2024

Kids born on this date are now old enough to drive.

@MikeZaccardi $LEH $MER $AIG

— Carl Quintanilla (@carlquintanilla)

12:59 PM • Sep 15, 2024

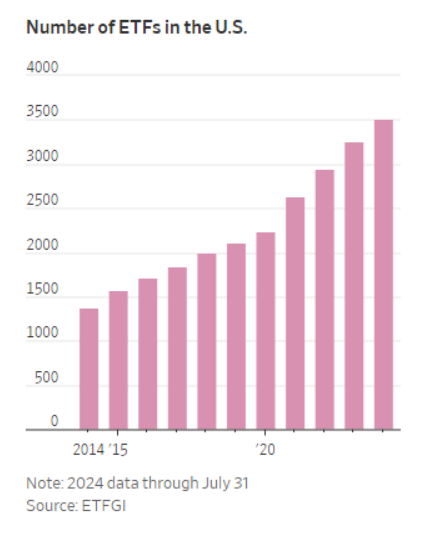

IMHO investors would rather access illiquid assets like private eq/credit in ETFs and deal with discounts and premiums (even steep ones) than in an interval/closed end/mutual fund.. one eg $HYD which traded at 29% discount in 2020, since then it’s remained very popular, even… x.com/i/web/status/1…

— Eric Balchunas (@EricBalchunas)

1:55 PM • Sep 18, 2024

1/ Some things are different, some things are different.

The job market for people in their early 20s is behaving like a pretty standard recessionary cycle (albeit early in that cycle).

Employment is falling. Unemployment is rising.

— Guy Berger (@EconBerger)

3:05 PM • Sep 12, 2024

Gen Z just overtook Baby Boomers

U.S. full-time workforce, by generation

Millennials: 49.5m

Gen X: 42.8mBaby boomers: 17.3m

Gen Z: 17.1m— Lance Lambert (@NewsLambert)

12:46 AM • Sep 23, 2024

Powell says lower rates will bring sellers and buyers back to the housing market.

In fact, more locked-in homeowners and renters are itching to move soon.

If we get 100+ bps of cuts by next March, spring 2025 could see a big spike in both listings and sales.

— Eric Finnigan (@EricFinnigan)

7:35 PM • Sep 18, 2024

from JPM: “Median balances in June 2024 were 15% higher than they had been in June 2019 for low-income households, and 5% higher for high-income households

{{Note this is percent change (relative to 2019) in median monthly ***real*** cash balances, by income quartile}}

— talmon joseph smith (@talmonsmith)

8:49 PM • Sep 19, 2024

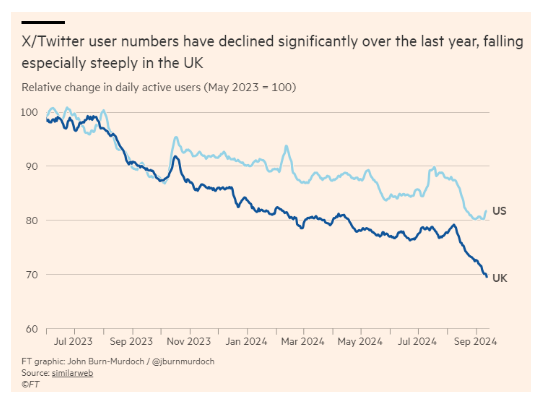

BREAKING: X is about to remove the current block button, meaning that if an account is public, their posts will be visible to the blocked users as well!

— Nima Owji (@nima_owji)

6:03 PM • Sep 23, 2024

Recommendations:

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Past performance is no guarantee of future results. There can be no assurance that any Schafer Cullen strategy or investment will achieve its objectives or avoid substantial losses.

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.