Have you considered how critical technology is to the success of your financial advisory business?

If you’re a wirehouse advisor thinking of going independent, you’ll need to set up your office infrastructure from the ground up. If you’re an independent advisor considering evolving your business model—to an RIA, for example—you’ll need to decide how your technology may change. And, even if you’re not planning any kind of drastic change, there’s never a bad time to make sure your technology is up to date.

Here, we provide an office technology blueprint for financial advisors, outlining what you need for your ideal setup along with tips on what to look for if you’re seeking a new firm partner.

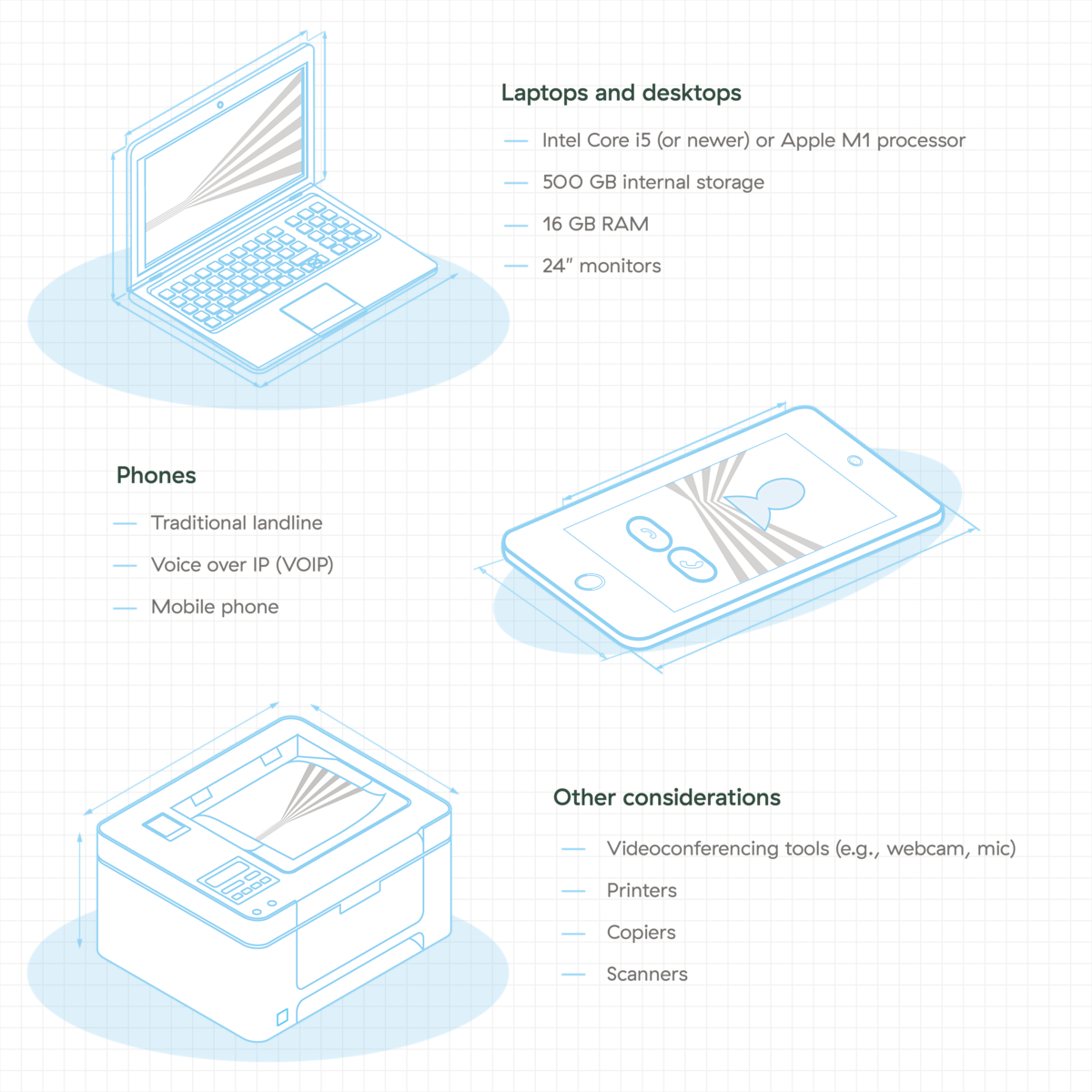

Hardware

Putting the right hardware in place will inform the rest of your technology needs. Be sure to lay out your physical office space first, as your needs may vary depending on whether you’re in-office, remote, or hybrid.

Questions to ask when doing your due diligence:

-

Can you make product recommendations?

-

Will you help me with installation and setup?

-

Do you offer any group discounts?

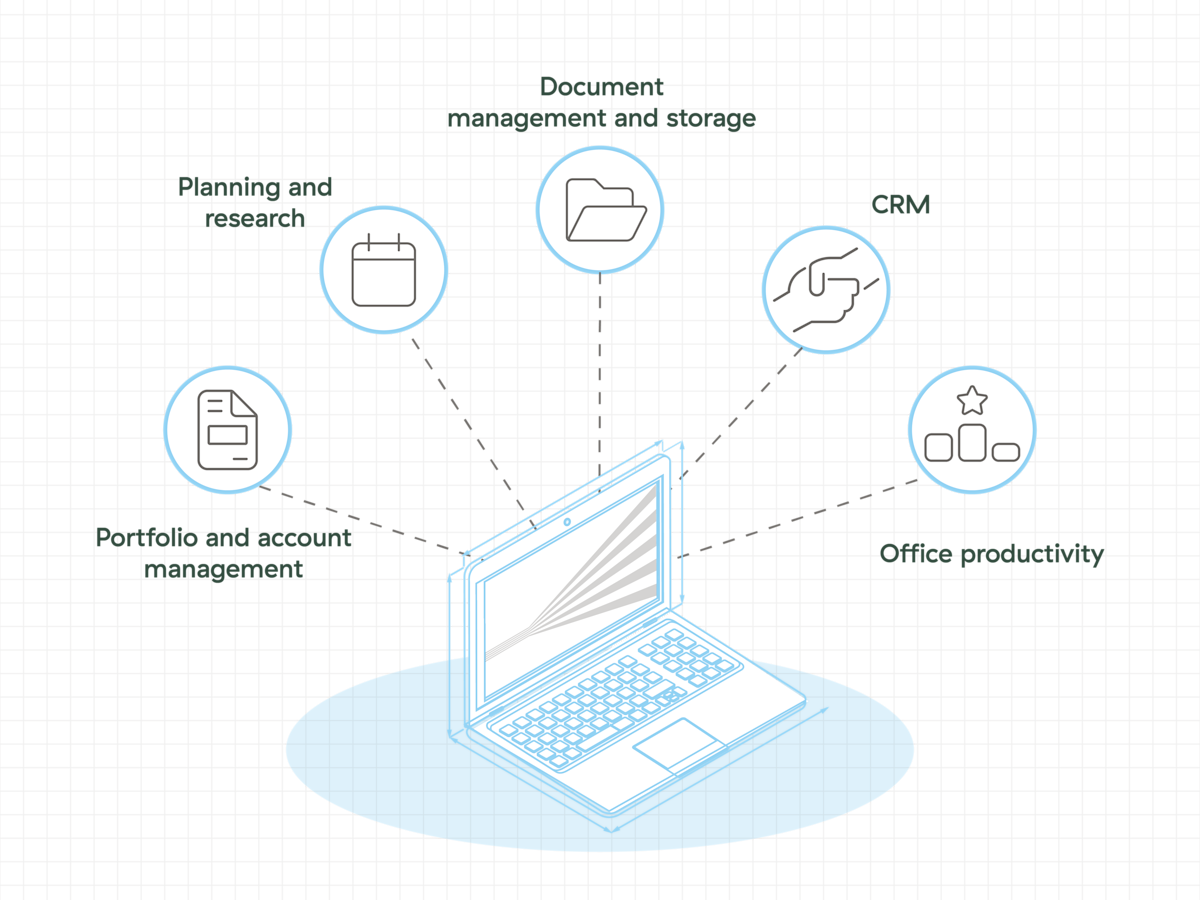

Software

Choosing the right software is vital to how efficiently and effectively you work. If you affiliate with a firm partner, some tools will be provided to you, while others may be available at a discount. If you opt to open your own RIA, you may need to choose the software yourself.

Portfolio and account management. This will allow you to streamline client onboarding (using tools such as eSignature), portfolio construction, as well as trading and performance reporting. According to Kitces, there are at least 50 options available, so choose wisely.

Planning and research. You’ll want to consider software for financial planning (e.g., RightCapital, MoneyGuidePro), investment research (e.g., Morningstar, Argus), and tax, retirement, and estate planning.

Document management and storage. A safe and reliable system will save on physical space, keep you compliant with books and records requirements, and provide quick access to the files you need.

CRM. A robust CRM system can help you deliver personalized content and experiences to your clients and prospects. Be sure its data retention tool includes contact info, activity tracking, and preferences.

Office productivity with cloud technology. Beyond client management are the tools that keep your practice running efficiently. Office365, Teams, and OneDrive allow you to work smarter and more collaboratively (from anywhere, on any device), while accounting software (e.g., QuickBooks) and HR software (e.g., Bamboo HR) will help you easily run the business side of things.

Questions to ask:

-

Do you include any software, such as CRM or document storage, in the technology fee?

-

What additional software do you offer, and what does it cost?

-

Do you offer bundled packages at a discount?

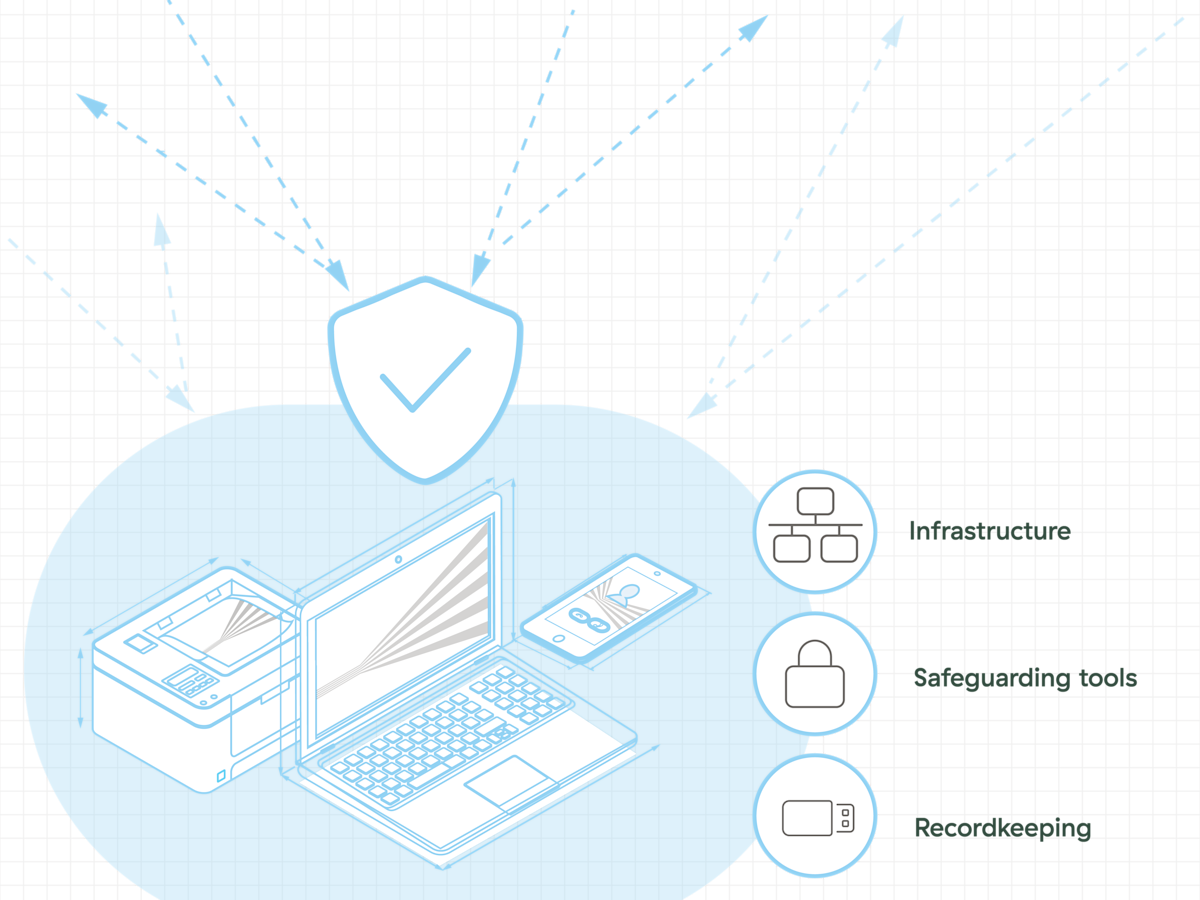

Information Security

The SEC, as well as state and federal regulators, requires financial advisors to protect clients’ personal information and assets from cyberattacks. Tools and software you’ll need to ensure a secure office include the following:

| Infrastructure | Safeguarding Tools | Recordkeeping |

|---|---|---|

|

|

Questions to ask:

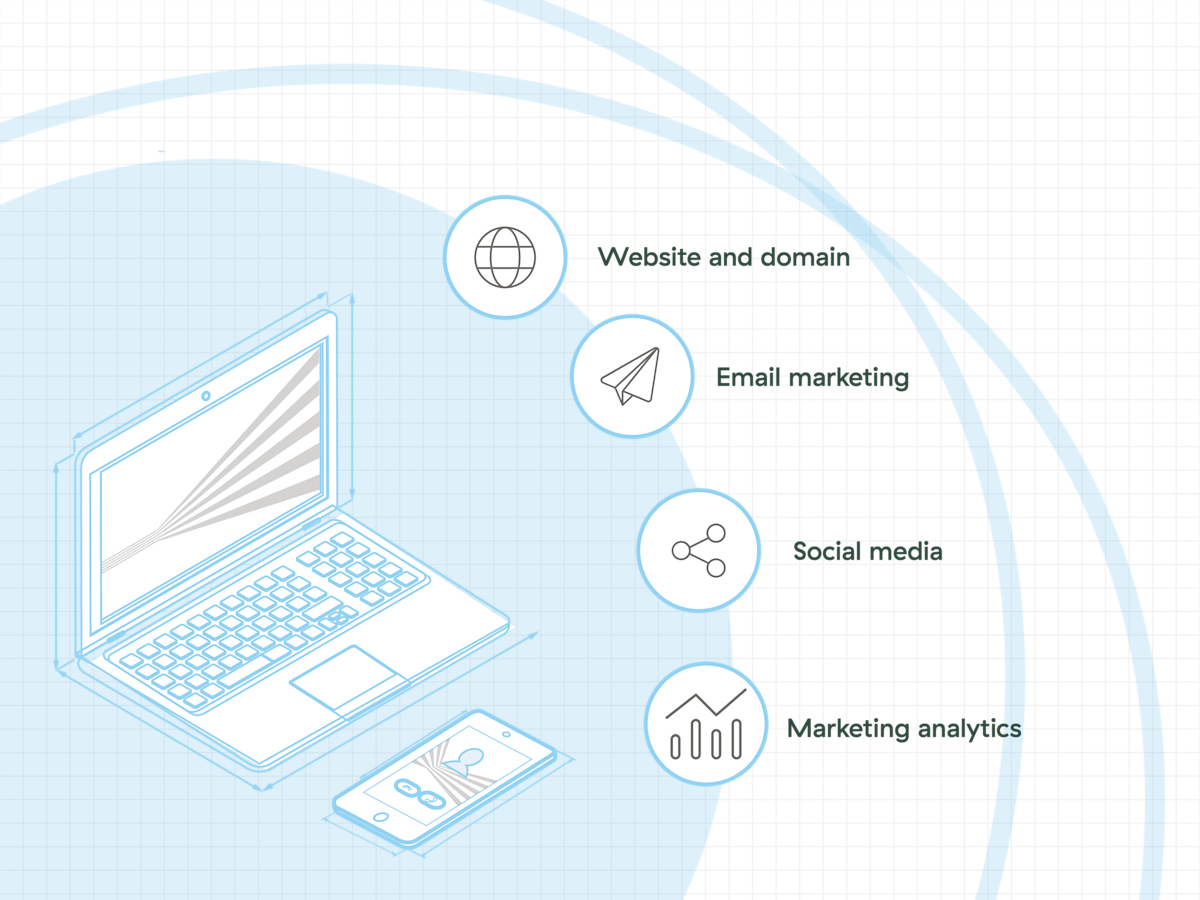

Marketing Technology

Your marketing technology tools will help you engage your current clients and attract new ones. They include:

Website and domain. Your website is a reflection of your brand and provides a first look at who you are and what you offer. It’s important to ensure that it’s professional and carefully designed.

Email marketing. Connect with your clients and prospects more efficiently and intentionally. Consider using their preferences to inform what content you share and how often you communicate.

Social media. LinkedIn, Twitter, Facebook, and Instagram could be relevant channels to help you stay in touch with clients and prospects, share market updates, or promote your brand image.

Marketing analytics. Get more insights into how your prospects and clients respond to your marketing efforts and what impacts business success. Tools like Google Analytics and Google Data Studio provide website analytics and performance data to help you streamline your marketing endeavors.

Questions to ask:

-

Do you have an in-house program to help me develop my brand and website?

-

Does your website platform integrate with compliance reviews and retention requirements?

-

What content do you provide to us for our email and social media marketing efforts?

-

How do you support ongoing marketing learning and development?

Technology Support

A good technology support team can keep your business running smoothly when things go awry. And they can ensure that you’re prepared in advance to help stave off disruptions through:

Questions to ask:

-

Do you have a technology helpdesk that can troubleshoot issues?

-

When are they available, and what kind of support do they offer?

-

Can you provide on-site consulting?

The Right Firm Partner Can Make All the Difference

There are so many things to think about when it comes to the technology you use every day. Having the right tools and support can not only help you efficiently run your business and manage your clients but also keep your and your clients’ sensitive information safe. Check out the powerful technology Commonwealth offers to help advisors do more in less time.

Please consult your member firm’s policies and obtain prior approval for any sales ideas or applications you would like to use with clients.