“In this world nothing is certain but death and taxes” said Benjamin Franklin

(Founding father of USA and face on America’s One hundred dollar bill/note).

Advance tax, as the name implies, is the tax that one pays in advance. Advance tax is the income tax that is payable if your tax liability exceeds Rs 10,000 and should be paid in the same year in which income is received. It is also called as “Pay as you Earn” scheme since you pay the tax in the same year in which you earn income.

If you are a Salaried employee and have income other than income from salary then you should check Advance Tax.

If you are Freelancer, Professionals, businesses, YouTuber, Blogger then you have to know and pay Advance Tax

- If you estimate that you will owe more than Rs.10,000 on March 31 in taxes (after deducting TDS) then you should pay advance tax.

- You pay this tax in four installments and the due dates with Percentage of Advance Tax to be paid are 15 June(15%), 15 September(45%), 15 December(75%) and 15 March(100%).

- If the Income Tax is not payable as per the above schedule, Interest is liable to be paid for late payment of tax as follows

- Interest under section 234B @ 1% per month

- Interest under section 234C @ 1% per month is payable if 90% of the tax is not paid before the end of the financial year

- Advance Tax can be paid by filing a Tax Payment Challan,ITNS 280.Challan

- Tax applicable: For individual Select 0021 : INCOME-TAX (OTHER THAN COMPANIES)

- Type of Payment: Type of payment depends on why you are paying income tax. Enter 100 for Advance Tax.

- You must claim Advance Tax while filing Income Tax Return ITR

Who has to pay Advance Tax?

The provisions of the Income Tax Act make it obligatory for every individual, self-employed professional, businessman, and corporate to pay Advance Tax, on any income on which TDS(Tax Deducted at Source) is not paid. Both individuals, as well as corporates, must pay this tax.

Advance Tax for Salaried Employee

If an individual’s only income is his salary, then the employer will deduct tax from his income(TDS) and submit it. In such a case there is no cause for worry over advance tax payment. The tax deducted will be made available to the employee by the employer in Form 16.

But when a Salaried employee has income other than income from salary then he has to worry about Advance Tax. Ex income from other sources such as interest gained (on saving bank account), capital gains, lottery wins, from house property or from business, then advance tax becomes relevant.

If one estimates that one will owe more than Rs.10,000 on March 31 in taxes (after deducting TDS) then you should pay advance tax.

Freelancers, Professionals, businesses, YouTuber

Presumptive income for Professionals: Independent professionals such as doctors, lawyers, architects, etc. come under the presumptive scheme under section 44ADA. They have to pay the whole of their advance tax liability in one installment on or before 15 March. They can also pay the entire tax due by 31 March.

Presumptive income for Businesses: The taxpayers who have opted for a presumptive taxation scheme under section 44AD have to pay the whole amount of their advance tax in one installment on or before 15 March. They also have an option to pay all of their tax dues by 31 March.

Who doesn’t have to pay Advance Tax?

Advance Tax is NOT applicable when

- A senior citizen (the resident individual who is 60 yrs or more) who do not have any income from business & profession, does not have to pay advance tax. This change was introduced from AY 2013-14. More details at Senior Citizen : Income and Tax

- If one adopts presumptive taxation then one has to declare income at the prescribed rate and no other deductions are allowed. One has to pay the entire advance tax by 15 March. This is applicable for

How to find if you have to pay advance tax

As we know there are 5 types of Income, Income from Salary, Income from House Property(Any residential or commercial property that you own will be taxed), Income from Capital Gains (When you sell Mutual Funds, Stocks, Bond, Gold, Land or Property, Income from Profits and Gains of Business or Profession & Income from Other Sources. Details in our article Understand Income Tax

For advance tax check

- Income from House Property: If you have rental income.

- Income from Capital Gains: Have you sold Mutual Funds, Stocks, Bond, Gold, Land, or Property. Tax classified as Long Term Capital Gain Tax(LTCG) and Short Term Capital Gain(STCG) is based on the asset you sold, the time period you owned the asset. Details in our article Capital Gain Calculator on Sale on Property, Mutual Funds, Gold, Stocks

- Income from Profits and Gains of Business or Profession: The income chargeable to tax is the difference between the credits received on running the business and expenses incurred.

- Income from Other sources: Check the following income. Details in our article Income From Other Sources

- the interest of Saving Bank Account,

- Interest from Fixed Deposit, Recurring Deposit, Senior Citizen Saving Scheme(SCSS) etc

- Interest from Income Tax Refund

- Family Pension

- Dividend Income: Dividend received on or after 1 April 2020 is taxable in the hands of the investor/shareholder. Details in our article Dividend and Tax

What if we do not pay Advance Tax?

If you have to pay advance tax and If you fail to pay your Advance Tax or, if you pay less than the stipulated tax, you would be penalised and would have to pay extra under Sections 234A, 234B, 234C. So there is no escaping Tax. As the Income Tax office says “Pay Tax Karo Relax“

The interest is calculated at 1% simple interest per month on the defaulted amount for three months. The interest penalty would continue up to the next deadline. If even after the last deadline of 15 March, the tax is not paid, then the 1% would be on the defaulted amount for a month, until the tax is fully paid.

Why Pay Advance Tax?

Advance tax is one of the major tools used by the Govt. to collect tax from the assesses all over India. This prepaid form of tax is designed in such a way that an assessee is made to pay tax to the Govt. in a ‘Pay as You Earn Scheme’. This mainly aims at reducing the last-moment hassles to an assessee for payment of tax liability which may be because of either shortage of time or funds.

The aim of the Indian government behind setting up the advance tax system was to speed up the tax collection. This system also allowed the government to earn interest on the amount collected as tax, thus increasing funds to the government coffers.

How is advance Tax Calculated?

Advance tax is computed on income that an individual might earn during the year, in that sense, it is estimated income. The tax is calculated using the rates applicable for the financial year.

Suppose after paying your first installment of tax on the estimated income, your actual income increased due to some shares/mutual funds you sold, You will need to revise your income and accordingly pay the differential in the next installment.

Although Advance Tax is liable to be paid on all incomes including Capital Gains, it is difficult to estimate the Capital Gains which may arise in an year. Therefore, in such cases, it is provided that if any such income arises after the due date of any installment, then, the entire amount of tax payable on such capital gain (after claiming exemption under section 54) shall be paid in remaining installments of Capital Gains which are due. If the entire amount of tax payable is so paid, then no interest on late payment will be levied

Listed below are the steps to calculate advance tax:

- Determine the Income: Determine the income you receive other than your salary. It’s important to include any ongoing agreements that might pay out later.

- Minus the Expenses: Deduct your expenses from the income. You can deduct expenses related to your work (freelancing) such as rent of the work place, travel expense, internet and phone costs.

- Total the Income: Add up other income that you might receive in the form of rent, interest income, etc. Deduct the TDS deducted from your salaried income.

- Total Advance Tax: If the tax due exceeds Rs.10,000 then you’ll have to pay advance tax.

Advance tax Rates and Dates

From FY 2016-17 For both individual and corporate taxpayers

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% of advance tax |

| On or before 15th September | 45% of advance tax |

| On or before 15th December | 75% of advance tax |

| On or before 15th March | 100% of advance tax |

Below are the dates and percentages before FY 2016-17.

| Due Date | Installment % of Advance Tax |

| 15th September | Up-to 30% |

| 15th December | Up-to 60% |

| 15th March | Up-to 100% |

For example, suppose your total tax liability(after deducting TDS) for this year is Rs 1,00,000

So by 15th June you will need to pay 15% which comes to Rs 15,000

So by 15th September you will need to pay 45% which comes to Rs 45,00

By 15th December you will have to cover 75%, so you will need to pay another Rs 75,000.

By 15th March, 100% of advance tax comes to Rs 100,000, you will need to pay another Rs 25,000.

Penalty on not paying/paying less Advance Tax: Sections 234A, 234B and 234C

If you owe more than Rs.10,000(after deducting TDS) while filing your returns, you will be penalized with Interest under sections 234A , 234 B & 234 C

Under Section 234C, there are three components. For the first instalment, the shortfall penalty is calculated for 3 months @1% p.m. Similarly, in the second instalment, the shortfall penalty is also calculated for 3 months @1% p.m and the final instalment is calculated at a flat rate if 1% for 1 month only.

Under section 234B, penalty arises when the total amount of advance tax paid along with the amount of TDS is less than 90% of the total tax liability. In such a case, interest is calculated at 1% per month of the amount of shortfall for the time period from April to the month in which the return is filed.

Under section 234A, the liability arises only when the return is filed after the due date which for AY 2020-21 is 30 Nov.

Finotax has great Advance tax calculators. Check it out here. Let’s look at these sections in detail.

Interest under section 234 C

234 C will be applicable if you don’t pay your advance taxes in regular installments. As per the Income Tax Act, you’re supposed to pay 15% of advance tax by 15 Jun, 30% of your advance tax by 15th Sep, 60% by 15th December and 100% by 15th March. Let’s see it through some examples.

Mr. Khushal is running a garments shop. Tax Liability of Mr. Khushal is Rs 45,500. He has paid advance tax as given below:

Rs. 8,000 on 15th June, Rs. 11,000 on 15th September, Rs. 12,000 on 15th December, Rs. 14,500 on 15th March. Is he liable to pay interest under section 234C, if yes, then how much?

Any tax paid till 31st March will be treated as advance tax. Considering the above dates, the advance tax liability of Mr. Khushal at different installments will be as follows:

1) In first installment: Not less than 15% of tax payable should be paid by 15th June. The tax liability is Rs. 45,500 and 15% of 45,500 amounts to Rs. 6,825. Hence, he should pay Rs. 6,825 by 15thJune. He has paid Rs. 8,000, hence, there is no short payment in case of first installment.

2) In second installment: Not less than 45% of tax payable should be paid by 15thSeptember. Tax liability is Rs. 45,500 and 45% of 45,500 amounts to Rs. 20,475. Hence, he should pay Rs. 20,475 by 15th September. He has paid Rs. 8,000 on 15th June and Rs. 11,000 on 15th September (i.e. total of Rs. 19,000 is paid till 15thSeptember). There is short payment of Rs. 1,475 (i.e. Rs. 20,475 – Rs 19,000).

Though there is short payment of Rs. 1,475 but Mr. Khushal will not be liable to pay interest under section 234C because he has paid minimum of 36% of advance tax payable by 15th September. He has paid Rs. 19,000 till 15th September and 36% of 45,500 amounts to Rs. 16,380. Hence, no interest shall be levied in case of deferment of second installment.

3) In third installment: Not less than 75% of tax payable should be paid by 15th December. Tax liability is Rs. 45,500 and 75% of 45,500 amounts to Rs. 34,125. Hence, he should pay Rs. 34,125 by 15th December. He has paid Rs. 8,000 on 15th June, Rs. 11,000 on 15th September and Rs. 12,000 on 15th December (i.e. total of Rs. 31,000 is paid till 15thDecember). There is a short payment of Rs. 3,125 (i.e. Rs. 34,125 – Rs 31,000). Hence, he will be liable to pay interest under section 234C on account of short fall of Rs. 3,125 (*).

There is a short fall of Rs. 3,125 in case of third installment. Due to short fall in case of third installment, interest under section 234C will be levied. Interest will be levied at 1% per month or part of the month on the short paid amount of Rs. 3,100 (i.e. Rs. 3,125 rounded off to Rs. 3,100 as per Rule 119A). Interest will be levied for a period of 3 months. In other words, interest will be levied on Rs. 3,100 at 1% per month for 3 months. Interest under section 234C will come to Rs. 93.

4) In last installment: 100% of tax payable should be paid by 15th March. The total tax liability of Rs. 45,500 is paid by Mr. Khushal by 15th March (i.e. 8,000 on 15th June, Rs. 11,000 on15th September, Rs. 12,000 on 15th December and Rs 14,500 on 15th March). Hence, there is no short payment in case of last installment. Thus, Mr. Khushal will not be liable to pay interest under section 234C in case of last instalment.

Interest under section 234 B

234 B will be applicable when the total advance tax paid is less than 90 % Tax Payable. This will be charged at 1% per month till you pay your remaining taxes. Let’s work it out through an Example:

Mr. Suraj is a businessman. His tax liability as determined under section 143(1) is Rs. 28,400. He has not paid any advance tax but there is a TDS credit of Rs. 10,000 in his account. He has paid the balance tax on 31st July i.e. at the time of filing the return of income. Will he be liable to pay interest under section 234B, if yes, then how much

In this case, the tax liability (after allowing credit of TDS) of Mr. Suraj comes to Rs. 18,400 (i.e. Rs. 28,400 – Rs. 10,000) which exceeds Rs. 10,000 and hence, he will be liable to pay advance tax. He has not paid any advance tax and hence, he will be liable to pay interest under section 234B. Interest under section 234B will be levied at 1% per month or part of the month. In this case, Mr. Suraj has paid the outstanding tax on 31st July and hence, interest under section 234B will be levied for the period from 1st April to 31st July i.e. for 4 months. Interest will be levied on unpaid tax liability of Rs. 18,400. Interest at 1% per month on Rs. 18,400 for 4 months will come to Rs. 736.

If you pay our taxes in between April – July period then interest @1% will be applied only on the balance tax payable .

Online Advance Tax Calculators(Free)

Video on Advance Tax

This 8:32 video explains Advance Tax.

This video talks about how to Calculate Advance Tax

How to pay advance Tax?

You can pay advance tax in India through two methods: online or offline. Here’s a breakdown of both:

Online Payment:

- Visit the Income Tax Department’s e-payment website: [income tax e payment ON Income Tax Department portal.incometax.gov.in]

- Enter your PAN and mobile number and proceed after verification with OTP.

- Select the Assessment Year (2024-25 for current scenario) and choose “Advance Tax (100)” under Type of Payment.

- Fill in the challan details like State Code, circle code (refer website for details).

- Choose the payment method (net banking or debit card) and your bank.

- Preview the challan for accuracy and click “Pay Now” to complete the payment.

Offline Payment:

- Download Challan 280 form from the Income Tax Department website.

- Fill the challan with details like your PAN, assessment year, tax type (100 for Advance Tax).

- Mention the installment number (depends on the due date).

- Submit the completed challan at any bank authorized to collect tax payments.

Additional Tips:

- Use an advance tax calculator to estimate your tax liability for accurate payment.

- Keep a copy of the challan (online payment receipt or Challan 280 copy) for record-keeping during ITR filing.

- The last date for the current installment (March 2024) is March 15th, so ensure you pay before the deadline to avoid interest penalties.

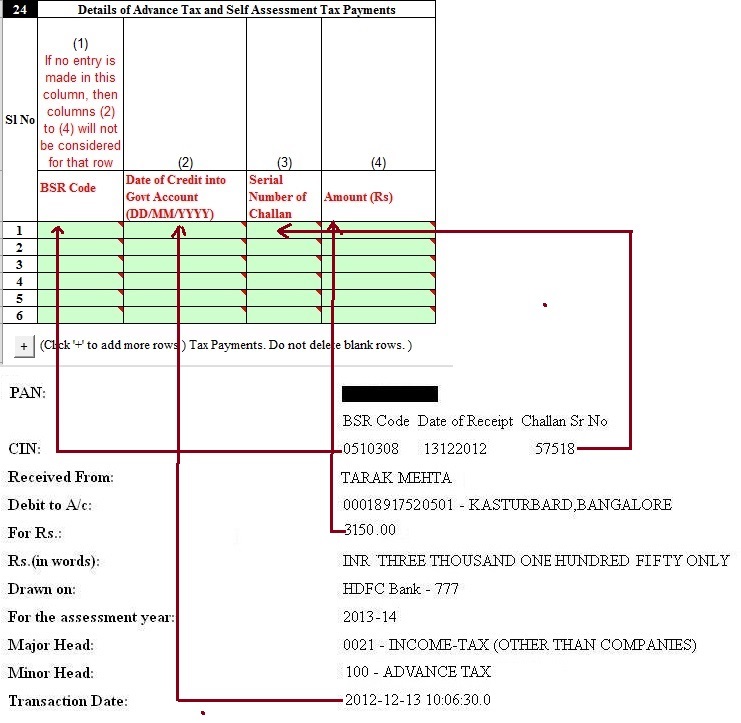

Advance Tax can be paid by filing a Tax Payment Challan,ITNS 280.Challan, at designated branches of banks empanelled with the Income Tax Department. Branches of ICICI, HDFC and SBI accept Advance Tax Payment Challans. Alternatively, individuals could pay Advance Tax online through the Income Tax Dept / NSDL website. e-Payment facilitates payment of direct taxes online by taxpayers. To avail of this facility the taxpayer is required to have a net-banking account with any of the Authorized Banks.

Video on How to Pay Advance Tax

https://www.youtube.com/watch?v=uyS00Ofc6og

Verify Advance Tax in Form 26AS

Part C of Form 26AS has details of Tax Paid (other than TDS or TCS). If you have paid Advance Tax or Self Assessment Tax it will appear in this section. Please verify that advance tax or self assessment tax details are showing up in Form 26AS, If they don’t match with your details please contact the Bank.

Show Advance Tax in ITR

After paying income tax through Challan 280 what next? Is your responsibility over. No. You need to show the tax paid in your ITR, If you have paid Advance/ Self Assessment tax through Challan 280 fill in the details in Tax paid and make sure that your tax liability is 0 before submitting the return as explained for ITR1 in our article Fill Excel ITR1 Form : Income, TDS, Advance Tax and shown in image below.

Related Posts:

It is said “Income tax returns are the most imaginative fiction being written today.”

Do you pay Advance Tax?