After nearly two years of a stock market that seemed to move higher each day, investors are now experiencing a bout of volatility that has not been seen in quite some time. So, will the second half of 2022 bring a return to the lackluster market environment that investors grew accustomed to in 2020–2021 (with the exception of the novel coronavirus sell-off)? Or should we expect elevated volatility to become the norm moving forward?

What’s Changed?

Before we answer those questions, let’s assess what’s changed in the market and the economy in such a short time. Entering 2022, risk assets (including global equities) sold off dramatically on the heels of a shocking move higher in inflationary data. Prices for goods and services rose sharply as consumers emerged en masse from Covid-19 lockdowns, eager to resume their pre-pandemic spending and travel habits. Fast-forward to the middle of the year and an above-average inflation trend has been exacerbated by rising energy prices, tight labor markets, and supply chain disruptions—raising the cost of everything from baby formula to used cars. Russia’s invasion of Ukraine has further extended the duration—and implications—of the elevated inflationary backdrop for investors.

Notably, sustained inflationary pressures precipitated the Fed to hike interest rates, which have moved abruptly higher thus far in 2022. Some readers may (correctly) assume that rising rates are more impactful to fixed income investments. While there is certainly some validity to that sentiment, as evidenced by the very real carnage felt in fixed income markets year-to-date, equity investors are not entirely immune to the adverse effects of the Fed’s monetary policies. For equity investors, during periods of rising interest rates coupled with inflation increases, the market will generally discount future cash flows at a higher interest rate. Ultimately, the higher the discount rate applied to earnings, the lower the value of equities.

Where Do We Go from Here?

Equity and fixed income investors have experienced declining prices over the past six months. But the key question moving forward is, where do we go from here? From my perspective, I believe that inflation is likely to remain elevated for the foreseeable future before abating as we get closer to the end of the year. While energy and food prices will likely remain volatile, we are starting to see other components of inflation soften (e.g., housing and labor), which could result in a more benign inflationary outlook as we get close to the fourth quarter of 2022.

The overall view for equity markets is that elevated volatility should be expected during the summer and into the fall as the market digests interest rate policy and assesses the Fed’s ability to generate a soft landing for the economy. That backdrop should be constructive for long-term investors who are looking to allocate capital in equity markets. What sectors, styles, and market caps should be favored is another interesting question, as the disparity in returns has been significant across the board so far in 2022.

Value or Growth?

Growth-oriented sectors have experienced a notable pullback as of late, largely attributed to the combination of rising rates and excessive valuations. An additional factor is the pandemic’s acceleration of demand for growth-oriented companies, which now face the aftermath of a “pull-forward” effect, as evidenced by recent slowing demand. Some pockets of this growth have resulted in negative returns reminiscent of the dot-com crash of the early 2000s.

What’s very different this time around, however, is the lack of consumer and corporate leverage in the system, coupled with the fact that many of these stocks are producing positive earnings and cash flows for investors. Further, we believe that there are many longer-term secular trends in place, such as advancements in medical sciences, a growing global reliance on digitization, and a transition to a more service-based economy—which should translate into a more constructive landscape for growth-oriented investors moving forward.

Despite growth’s recent pullback, the backdrop for value-oriented stocks remains positive, even after notable outperformance in recent months. The current economic environment is constructive for value sectors like financials and industrials, and it is difficult to envision that dynamic materially changing in the near term. Plus, as long as oil prices remain firmly above $100, there is obvious support for the earnings prospects for many stocks in the energy sector.

We believe that U.S. equity valuations are relatively attractive at this point, if earnings do not disappoint in the second half of the year. When putting new capital to work, investors may consider employing a dollar-cost averaging approach in the current environment (a strategy I will personally be looking into over the coming months). While no one has a crystal ball that can predict whether we’ve already seen the lows in markets this year, investors may take a level of comfort in the long-term outlook for U.S. equities at current levels.

Is There a Case for Foreign Equities?

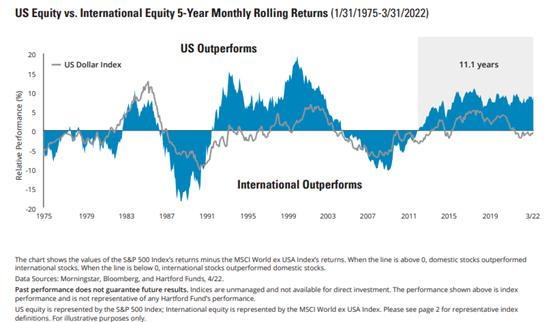

Developed international and emerging markets equities have underperformed U.S. equities for a prolonged period of time, as evidenced by the chart below. In fact, the outperformance cycle for U.S. equities versus international has lasted an average of 7.9 years since 1975, according to data from Morningstar and Bloomberg. Slowing economic growth, supply chain disruptions, a strong U.S. dollar, and heightened geopolitical risks have all served as headwinds for international equities during this period.

While investor sentiment is understandably quite poor in light of the performance disparity with U.S. equities, is the U.S. versus international dynamic setting the stage for more attractive relative returns in international markets moving forward? Sentiment can be a powerful contrarian indicator, so I think it makes sense to have a healthy respect for the fact that markets can rally when investor attitudes are, in fact, pessimistic.

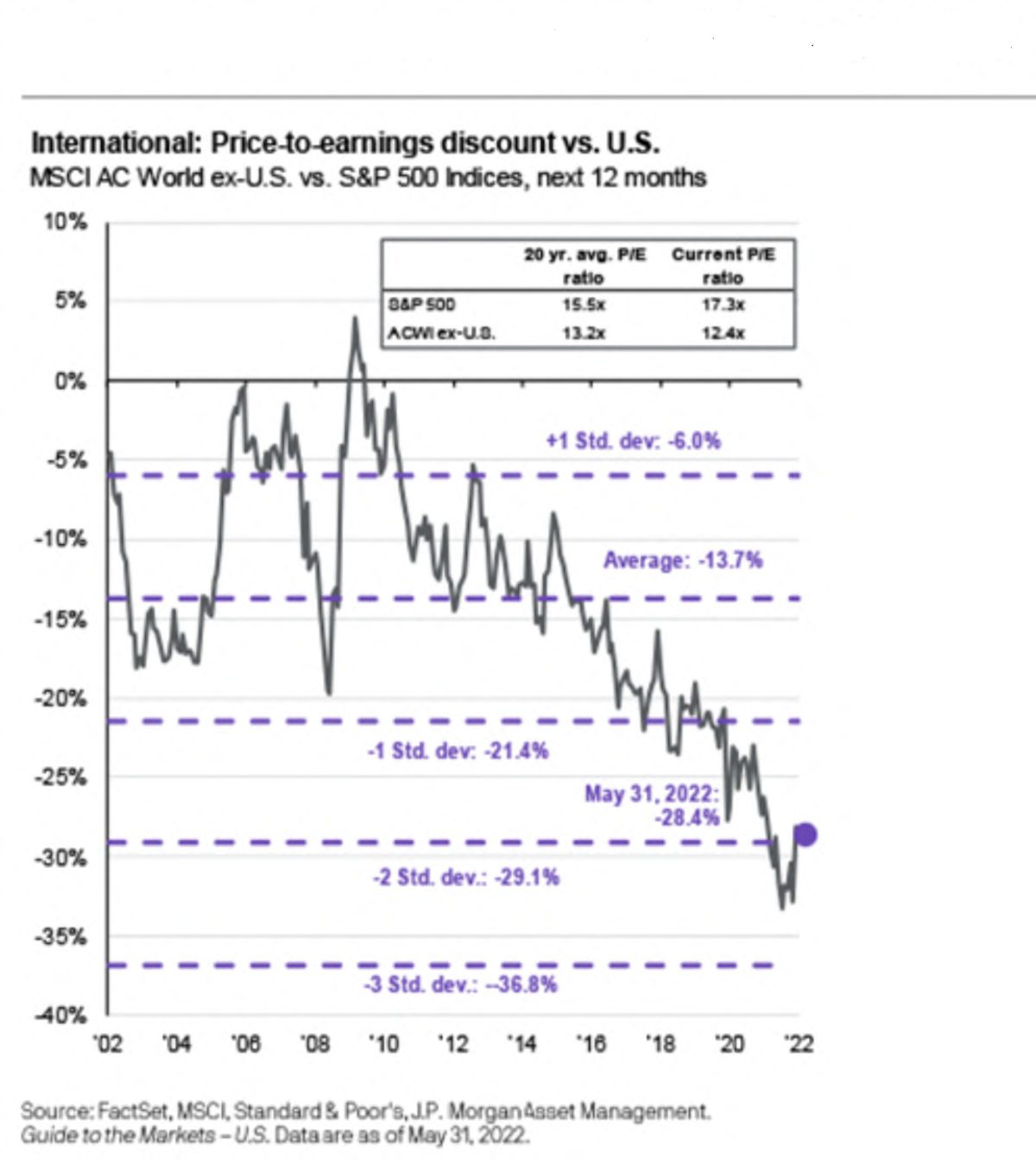

Another factor supporting the forward-looking case for international equities is valuations. The MSCI ACWI ex USA Index was trading at a price-to-earnings (P/E) ratio of 12.4x as of May 31, 2022, which is below the 20-year average of 13.2x. The notable disparity in valuations between the U.S. and developed foreign equities is highlighted in the chart below.

The bear case for foreign equities in the near term, however, is that fundamentals are likely to remain challenging due to heightened geopolitical risks and until we start to see positive developments with the war in Ukraine emerge. In the near term, it is reasonable to expect that foreign equities may struggle to outperform in the current environment.

A Difficult Needle to Thread

With no shortage of near-term challenges for risk assets, and equities in particular, investors are likely to experience spurts of volatility over the next few months. The market will continue to evaluate the Fed’s ability to bring inflation under control without triggering a recession—a difficult needle to thread, though one that is certainly doable. If successful, I believe the stage is set for attractive risk-adjusted returns for equity investors over the next three to five years.

Dollar-cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. Markets will fluctuate, and clients must consider their ability to continue investing during periods of low price levels.

The MSCI ACWI ex USA is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. It does not include the U.S.