Especially over a plate of turkey and mashed potatoes.

You can dance around emotionally charged issues like politics, the economy, the stock market and your love life for only so long before your cranky uncle decides to shatter the cordial air with a five-minute rant about the state of the world.

Or your deadbeat cousin asks you what you think about BONK or dogwifhat or whatever the meme coin du jour is.

You don’t want to go there, but you are familially obligated to go there.

Instead of changing the subject, chugging your wine or sprinting from the table, I want you to stun your inquisitive family members with the best, most thoughtful answers possible. Prove to your cranky uncle that you’re the niece or nephew he shouldn’t have underestimated all this time. Earn the respect you deserve at the dinner table.

I can’t help you with life questions. Those are for you and your therapist to figure out.

But I can help you with artful responses to other money-specific topics.

Behold, the OptimistiCallie guide to awkward conversations at the holiday dinner table.

Uncle Tony: What’s this Nvidia thing? Is it gonna crash the stock market?

Where do I start? Nvidia – pronounced en-vi-deeyuh, by the way – is a computer chip maker. But it’s not just ANY computer chip maker. Nvidia dominates the market for chips used in artificial intelligence and machine learning.

Ever heard of ChatGPT? No? Hand me your phone, I’ll show you how – oh my god Uncle Tony, turn your phone flashlight off, you’re blinding me!

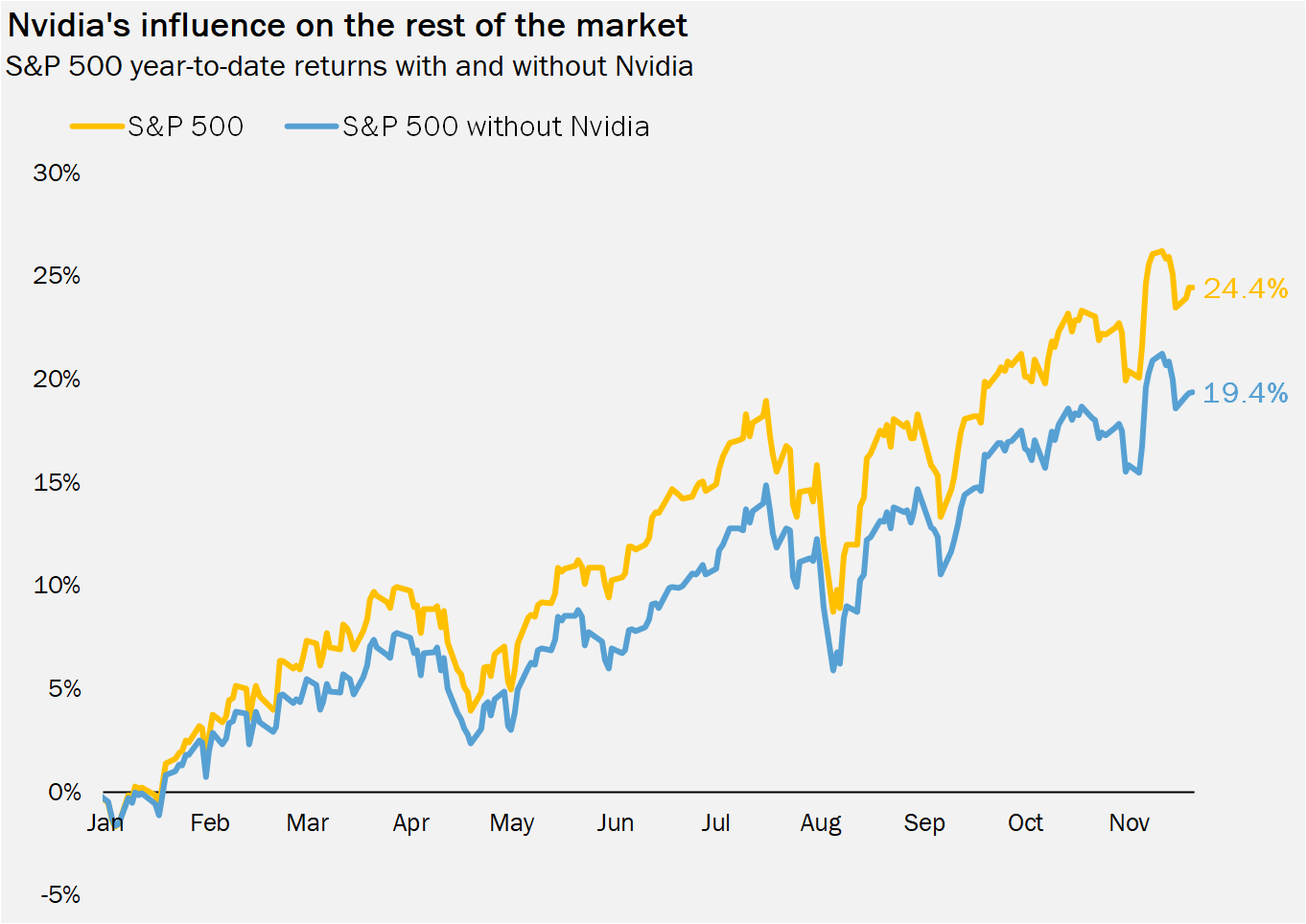

Never mind. Nvidia’s sales are exploding higher because the world is obsessed with AI, and the stock’s meteoric rise has led to a good year on Wall Street. Nvidia has added over $2 trillion in market cap in just 11 months, accounting for about 20% of the gain in the S&P 500 – an index of America’s biggest public companies.

Source: Callie Cox Media LLC, YCharts

When a company grows that much that fast, it can propel the rest of the market higher. The opposite scenario can happen, too. In August – a particularly rough month for tech stocks – Nvidia and the S&P 500 moved in the same direction every day but one.

I’m not sure Nvidia alone can trigger a big, broad market crash, though. The scariest market drops have happened alongside economic crises like the housing market meltdown and the COVID pandemic. The stock market has historically reacted more to bigger trends than individual company struggles.

And by the way, the stock market will crash again some day. The S&P 500 has gone through a 20% drop about once every seven years since 1950. Nvidia or not, plan on something to happen. That’s just the rhythm of life.

I’m a realist, Tony. Now pass the cranberry sauce.

Aunt Linda: Trump won. My stocks are booming. America is gonna crush the rest of the world forever!

AUNT LINDA. I will not talk about politics at the dinner table, especially with only one glass of wine in my system.

But since you’re sharing your opinion, I’ll share mine. It’s only fair.

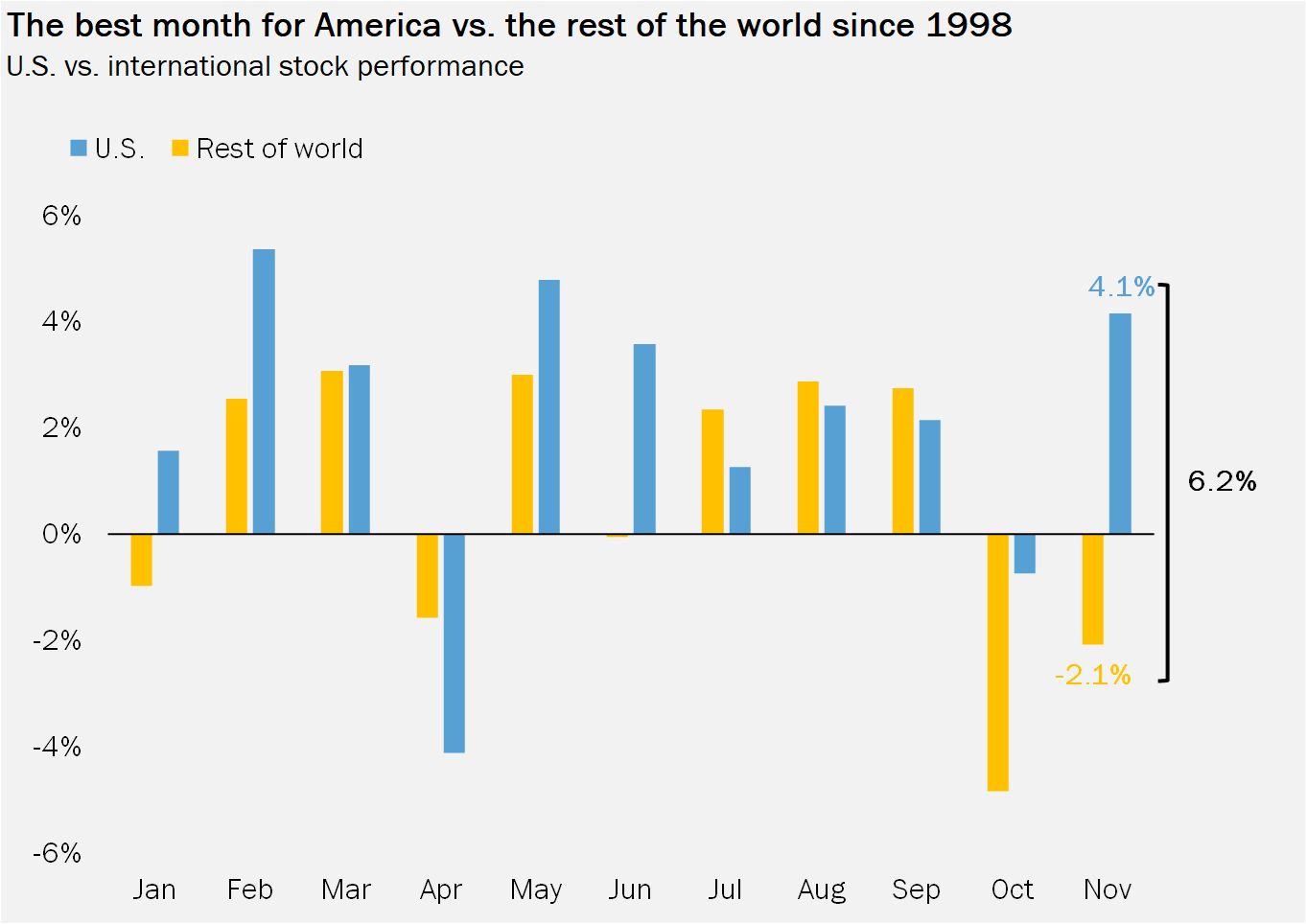

You’re right. America is crushing the rest of the world right now. This month, U.S. stocks are beating international stocks by the most in 26 years – primarily due to the election and the euphoric sentiment surrounding the next administration’s promise of more tax cuts and fewer regulations.

Source: Callie Cox Media, MSCI

Nothing is ever as good or as bad as it first seems, though. People may be cheering the America-first approach, but they haven’t considered what the U.S. might lose by turning its back on the rest of the world.

Take the 500 biggest companies on the stock market. About 40% of their sales come from overseas. That iPhone you’re holding? Apple, the company that made it, has one of the most diverse supply chains in the world – and about a third of its 467 suppliers are in China. Changes in global trade could have costs, and they may eventually hit your stocks – and your pocketbook.

For now, it seems like everybody’s getting swept away by the headlines while forgetting the nuance. Remember 2016? We saw a similar post-election trade. U.S. stocks handily beat the rest of the world in November, but that was the beginning of a year and a half period of international markets trouncing the U.S.

So yeah…no. World domination could be much more fraught than it sounds. Catch me later in the night if you really want get into it.

Your overbearing mom: Honey, when are you gonna buy a house? You’re throwing so much money away on rent – grow up and invest in your future already!

Mom. I’ve told you this before. Renting is not throwing money away. That’s one of the biggest myths of personal finance, so don’t come at me with that. Plus, my lease allows me to pack up at a moment’s notice and move far away from you when I get sick of your surprise visits. Kidding! Sort of.

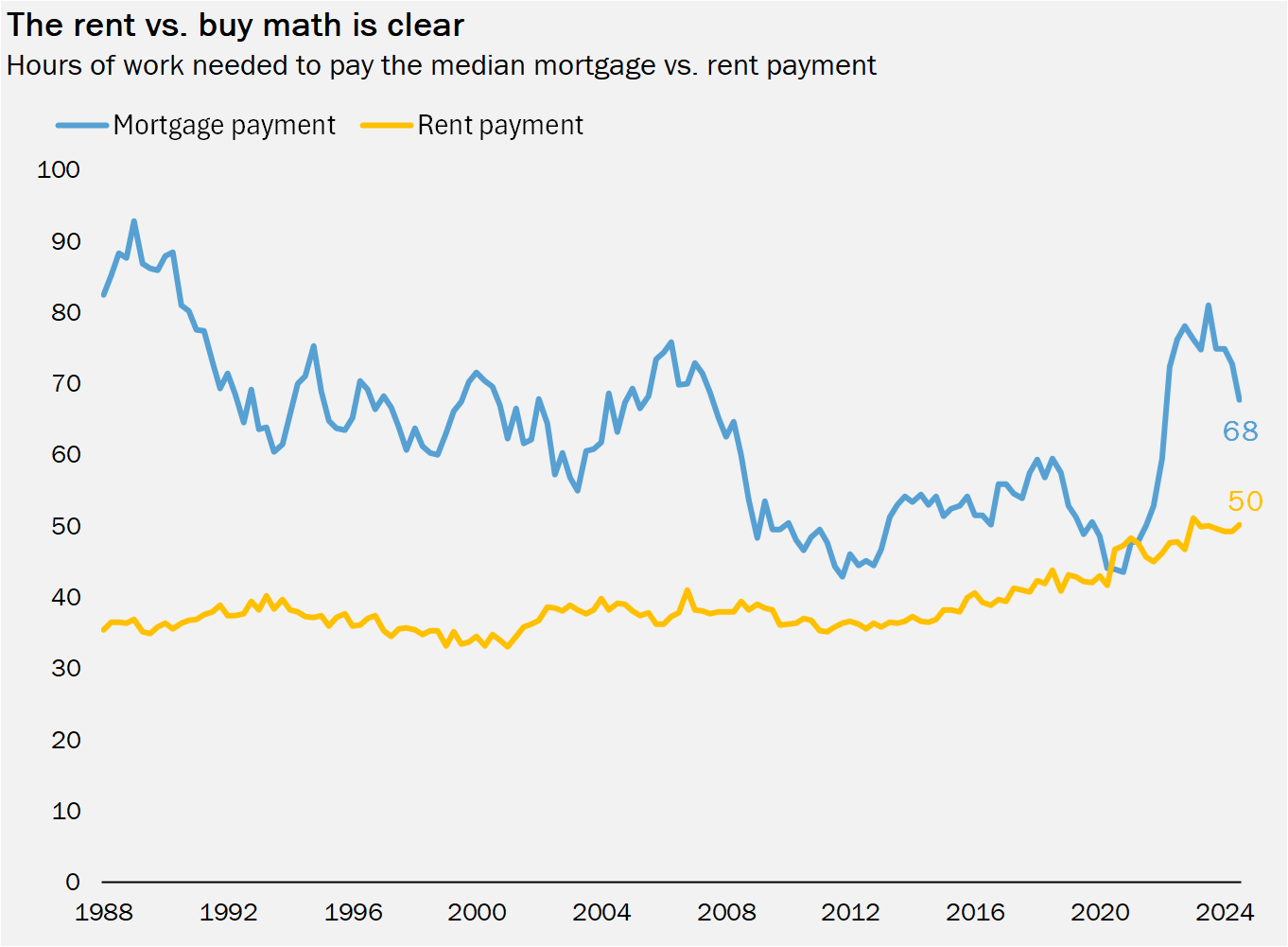

Besides, buying a house is so expensive! If I bought a house at today’s mortgage rate, it would cost me over $2,000 a month. I pay about $1,500 a month for my apartment, which I’ve heard is about the median for U.S. renters.

Did you know it’s rarely been this expensive to buy versus renting? I like to think of it in terms of how many more hours I’d have to work to afford that mortgage payment. $500 is like 20 extra hours of work for something I don’t want care for. All those house projects and routine repairs, gross!

Source: Callie Cox Media LLC, Census Bureau, Freddie Mac, Bureau of Labor Statistics. Mortgage payment calculated as the average monthly payment on a 30-year fixed mortgage at the median home sales price, assuming a 20% down payment. Pay for an hour of work is the average hourly wage for production and nonsupervisory workers tracked by the BLS.

My rent bill is predictable, even if it isn’t necessarily adding to my assets. I build my wealth in other ways, too. I started investing that extra $500 a month in an S&P 500 fund five years ago, and now I’m sitting on $47,000.

Don’t worry about me, Mom. I’m doing just fine.

Cousin Eddy (IYKYK): BONK is going to the moon! I bought it a month ago and I’ve already doubled my money. It’s so easy – you should buy it and get rich with me!

Oh, Eddy. I am so happy for you. Crypto has been on fire recently, and you clearly find a lot of joy in learning about the industry.

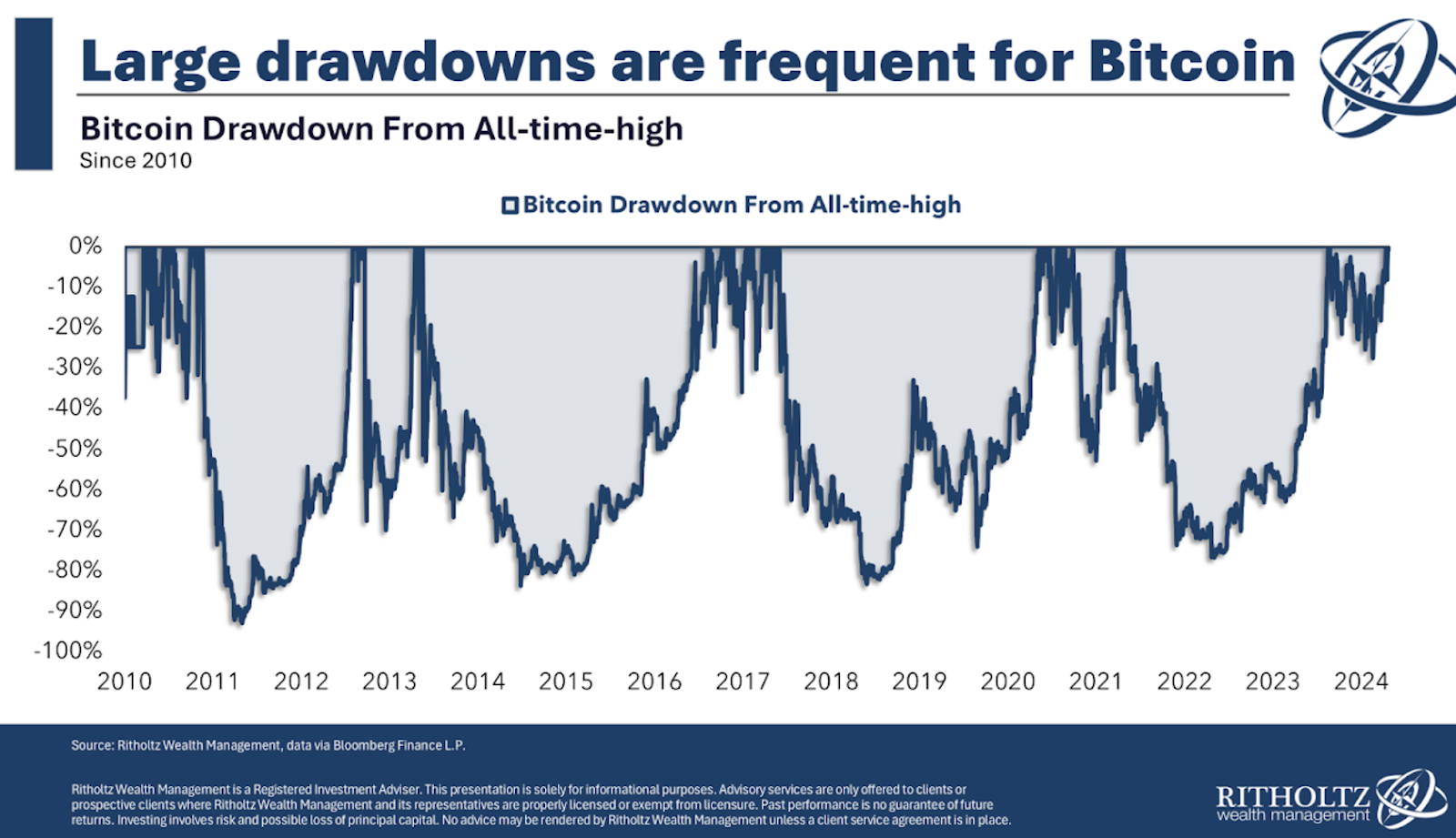

But there’s no easy button in investing. Especially in crypto. The good days feel euphoric, but the bad days feel crushing. Take Bitcoin, the most well-known cryptoasset out there. Bitcoin, of any crypto coin, should be especially stable given how much of Wall Street and everyday investors’ money is sitting in its ecosystem.

Stability is a relative thing, though. Bitcoin has crashed 20% or more 13 times in the past 10 years. That’s a gut-wrenching drop every year on average, buddy.

Just two years ago, it was in the midst of a 70% drop. You think that’s wild? BONK is 0.2% the size of Bitcoin, with fewer holders and probably bigger ups and downs.

Crypto and blockchain are innovating by leaps and bounds, and everybody wants to find the next big thing. But it can be hard to sort through the innovation, the hype and the actual value. Your golden ticket hinges on how this mix changes from day to day.

I don’t know if I want to buy BONK with you. But if I did, I’d set a clear price for when I’d want to sell. Take feelings and momentum out of the equation and make a plan to cash out when enough is enough.

Your jealous, attention-hogging sister: Wait, I thought I was the smart one in the family?!? This is SO unfair.

Not any more, sis! Read OptimistiCallie and maybe you’ll catch up to my awesomeness 😉

Happy Thanksgiving! May your turkey be juicy, your mashed potatoes creamy, and your conversations especially awkward.

Callie

Like what you just read? Share it with a friend, pretty please 😊 Here: Optimistic Callie