When you sell an investment, stocks, Mutual Funds(Debt and Equity), real estate, gold you can get Capital Gains or Capital Loss. These are taxable and have to be reported in ITR in the financial year when you made the sale. To assess your tax liability and file your tax returns correctly, you need to know what capital gains you earned during the financial year. For Equity, Debt Mutual Funds you can get it from the Capital Gain Statements by the Registrar and Transfer Agents or Mutual Fund companies. This post is about how to get your Capital Gains statement if you have your email id registered in your Mutual Fund folios.

Capital Gains of Mutual Funds, Tax, ITR

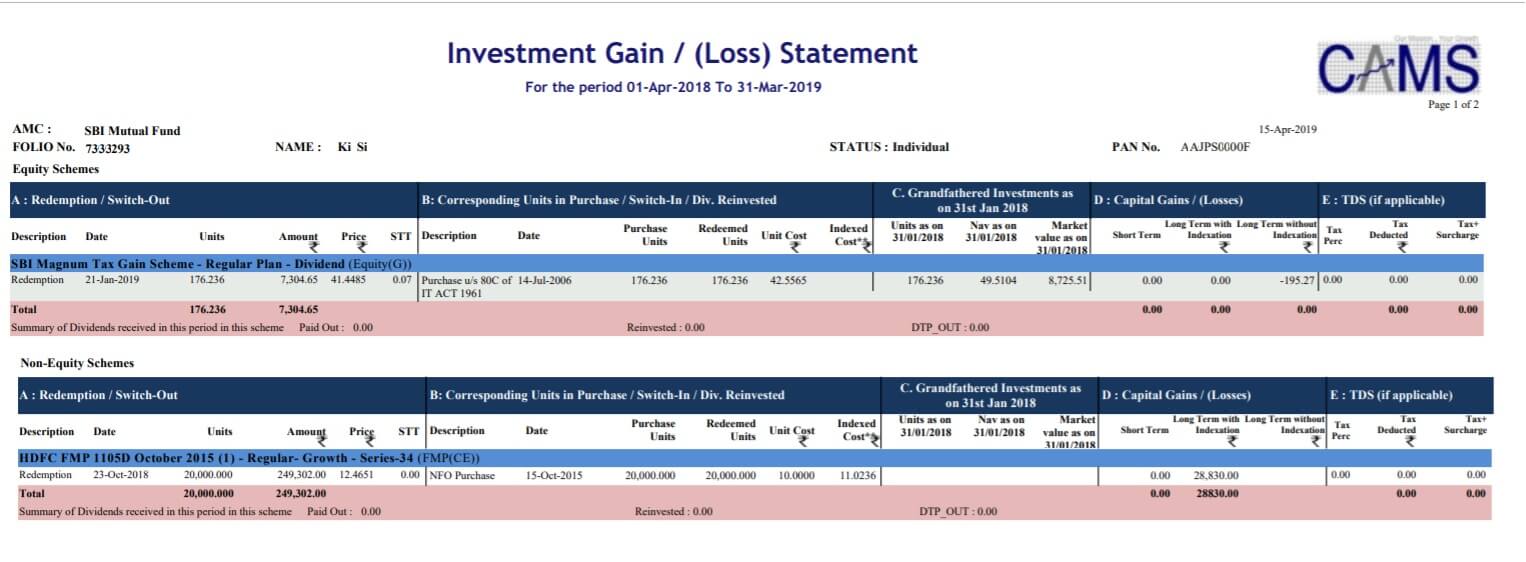

Capital Gain Statement is required for both Regular and Direct Plans. Sample Capital Gain Statement for Equity(which includes grandfathering) and Non Equity/Debt Mutual Funds(which includes Long term capital Gain with Indexation) is shown below. Also is shown an image showing Capital Gain in Debt Mutual Funds in ITR

Capital Gains and Mutual Funds

Both short-term and long-term are defined in different ways for different asset classes (see the image below to understand this better). Not only is short-term different for different assets, but the tax rates also vary too.

- Mutual funds are taxed based on asset categorization and duration of the investment.

- Equity oriented mutual funds have a short-term capital gains tax of 15 per cent for a holding period of up to 12 months. Beyond that, long-term capital gains tax of 10 per cent is applicable for gains (from equity oriented mutual funds and equity shares) over ₹1,00,000.

- Debt mutual funds are taxed as per your income slab for investments held for up to 36 months. After that, long-term capital gains tax of 20 per cent applies, after adjusting for inflation.

- Equity-linked savings schemes are eligible for tax deduction up to ₹1,50,000 per annum

- Dividends are taxable in the hands of investors.

- TDS @10% for resident investor and @20%(plus applicable surcharge and cess) for non-resident investor shall be deducted by the mutual fund on dividend distributed

Following is the tax treatment for Capital Gains on mutual funds:

Note: In the cases of Debt Mutual Funds, Floater Funds, Conservative Hybrid Funds, and Other Funds (where Equity investment is <=35%), which are purchased on or before 31st March 2023, the long-term capital gains will be taxed at 20% with Indexation.

| Type of Mutual Fund | Short-Term Capital Gains | Long-Term Capital Gains |

| Equity Mutual Funds (funds which invest >65% in Equity) |

15% under section 111A | Upto INR 1 lakhs- NIL Above INR 1 lakhs – 10% under section 112A |

| Aggressive Hybrid Funds (where Equity investment is 65% to 80%) |

15% under section 111A | Upto INR 1 lakhs- NIL Above INR 1 lakhs – 10% under section 112A |

| – Debt Mutual Funds – Floater Funds – Other funds (which invest <=35% in Equity) |

Slab rates | Slab rates |

| Conservative Hybrid Funds (where Equity investment is 10%-25% and Debt is 75%-90%) |

Slab rates | Slab rates |

| Balanced Hybrid Funds (Equity is 40% – 60% and Debt is 60% – 40%) |

Slab rates | 20% with Indexation |

| Other Funds (where investment in Equity is >35% but <65%) |

Slab rates | 20% with Indexation |

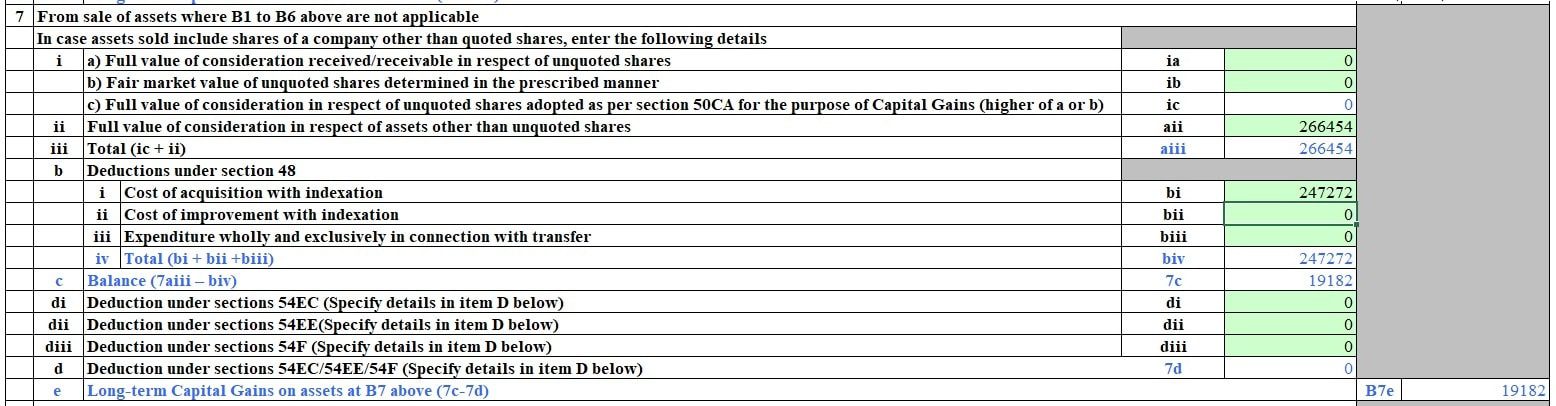

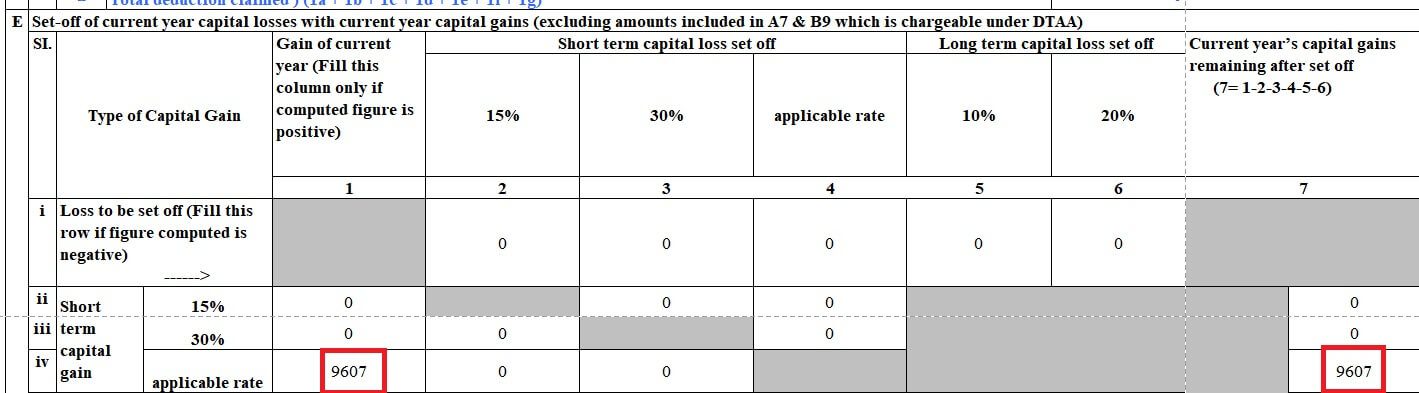

The Capital Gains(Both Long/Short) have to be shown in ITR. The image below shows how Long term Capital Gains of Debt Mutual Funds are reported in ITR. It is from our article how Long term Capital Gains of Debt Mutual Funds: Tax and ITR

Short Term Capital Gains on Debt Mutual Funds If You sell debt mutual funds within 3 years, capital gains on debt funds will be treated as short term. It will be added to your income and taxed as per your applicable tax slab. The image below shows the applicable rate on Short Term Capital Gains on Debt Mutual Funds

in CG Schedule, Section E, Check Short term capital gain for Debt Mutual Funds is as per your income slab

R&T Agents of different Mutual Funds

Registrar and Transfer Agents or RTAs are SEBI approved intermediaries who handle the paperwork or back-office operations of Mutual Funds such as folio statements of units bought and sold by the investor so that Mutual Funds can focus on the investment management and marketing parts.

Most of the Mutual Fund companies have either CAMS or KARVY as their RTA. The exception is Sundaram MF who does it itself i.e. they are their own RTAs.

Our article Mutual Funds: Registrar and Transfer Agent: CAMS, Karvy explains Who are Registrar and Transfer Agents? How do Registrar and Transfer Agent help Mutual fund companies and Mutual Fund investors by taking care of the paperwork? Mutual fund investors do a number of transactions on any given day such as buy, sell or switch units. They could also request for a bank mandate change or an address change.

| CAMS | Karvy | Others |

|

|

Sundaram BNP Paribas Fund Services

|

Our How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off, SIP talks about How to redeem mutual fund units? online or offline? What is the amount one gets on redeeming the mutual fund units Redeeming Mutual Funds Units in SIP or Lump Sum, How will you get your money or redemption proceeds? When will you get the redemption amount?

Get Consolidated Capital Gains Statement

If you have invested in Mutual Funds, then you can use Capital Gains Reports mailback service provided by RTAs like CAMS and KARVY. It does not matter if you have invested in Regular funds or direct Fund, or you have invested directly or through the broker, or you have invested online or offline. All it requires is your email id. You can get it from the individual Mutual Fund company too. The advantage here is that you get Gain Statement for all the Mutual Funds services by that RTA in one place. If you don’t have any investments with Sundaram, you only need to get the Capital Gains report from two places – CAMS and KARVY.

How to get Consolidated Capital Gains Report of Mutual Funds from CAMS

Step 1. Go to CAMS Investor Mailback Services here –

https://www.camsonline.com/InvestorServices/COL_ISMailBackServices.aspx

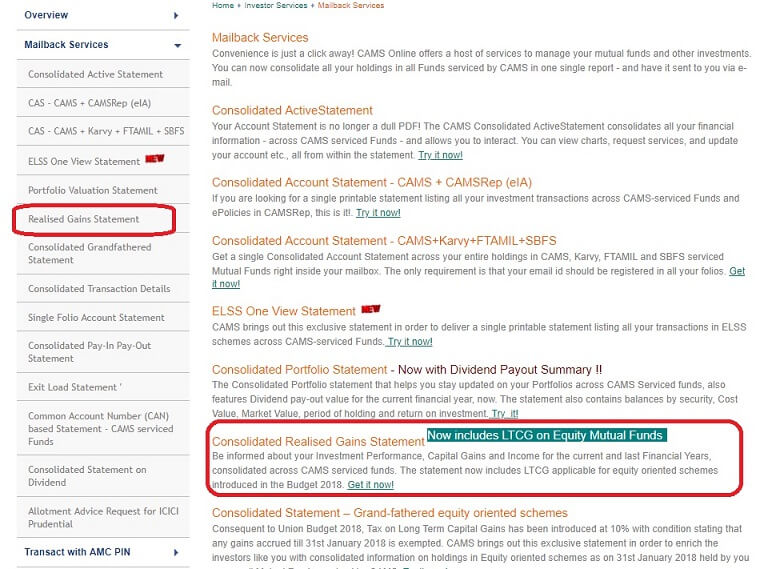

Step 2. Click on Consolidated Realised Gains Statement or Realised Gains Statement marked by red boxes in the image below.

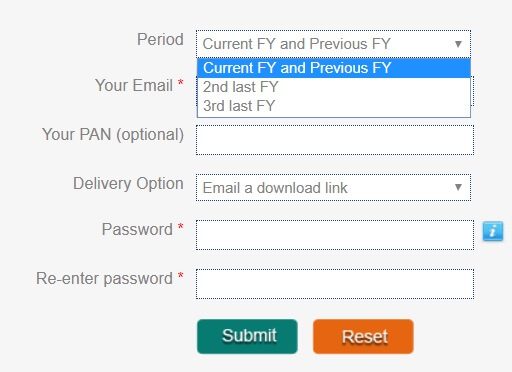

Step 3. You would see the image similar to one shown below. The fields marked with red star Your Email, Password, Reenter Password are mandatory. Fill out the required details, For which Financial Year, Email id, PAN which is optional as shown below.

PAN is optional but if you provide your PAN number then it will also include those investments under your PAN where you may have not registered your email id.

For the period you can choose,

- Current FY and Previous FY(the default option). When you get it there would be two Capital Gains Statement (both with the same password) – one for current FY and one for previous FY.

- You need Current Finacial Year for Advance Tax

- You need Previous Financial Year for Income Tax.

- 2nd Last FY

- 3rd Last FY.

For email enter the email id registered in your investment folios. The report will be sent to this email-id only. Once you enter the email id you will see the options of all Your mutual funds or you can select the Mutual Fund.

- Select ‘All My Funds’. (This option will come once you have entered the email id).

- Delivery option: We prefer Email an encrypted attachment

- Email a download link

- Email an encrypted attachment.

- Password: This is the password for opening the attachment. Set it to something which you can remember. Don’t set it to 12345678.

- Retype the password and hit Submit.

You capital gain Statement will be emailed to you in some time(around 30 minutes) to the registered email id you provided. Mail

- You can search for it with sender name ‘CAMS Mailback Server’.

How to get Consolidated Capital Gains Report of Mutual Funds from KfinTech

Step 2 In Period, select the Financial Year (FY) as Previous Year.

Step 3 Enter your personal Email address and PAN. The report will be sent to this email address.

Step 4 Under the Mutual Fund section select All Funds or Relevant Fund.

Step 5 Under the Statement Format section, select Excel

Step 6 Enter a desired password in Password and Confirm Password fields. The capital gains will be password protected with the password you enter here.

Step 7 Click on Submit. You will receive your capital gain report on your personal email. Download the report.

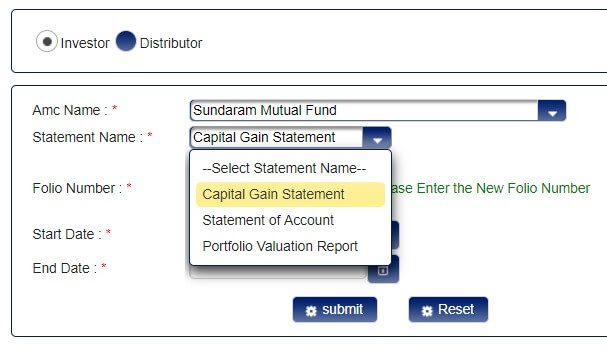

How to get Capital Gains Statement from Sundaram Mutual Fund

The process of getting Capital Gain Statment from Sundaram Mutual Fund House is the same as that for any other Mutual Fund company. It is different from that of CAMS and Karvy as it requires the Folio Number.

When a mutual fund investor purchases a fund, a folio number is assigned by the asset management company to your investment. You are required to quote the folio number to find out the value of your investments or at the time of any transactions. However, there is no restriction on the number of folios. An investor can also have different folio number for different funds within the same fund house.

Visit the Mutual Fund website for example for Sundaram: https://www.sundarambnpparibasfs.in/web/service/estatements/

Fill in the details as shown in the image below.

Related Articles:

- How to sell or redeem Mutual Fund Units: Online, Exit Load, Cut off, SIP

- Short Term Capital Gains of Debt Mutual Funds,Tax, ITR

- Capital Gain Calculator from FY 2017-18 with CII from 2001-2002

- DDT on Dividends of equity mutual funds, LTCG,Growth or Dividend option

- RSU of MNC, perquisite, tax , Capital gains, eTrade

- Basics of Capital Gain

- Mutual Funds: Registrar and Transfer Agent: CAMS, Karvy

Hope this helped you to understand how mutual funds are taxed, how to get the capital gain statement of mutual funds from CAMS, Karvy and Sundaram Mutual Funds.