I get a chuckle when I read and hear all the posts and content around expected budget provisions. No one really knows but for the sake of eyeballs everyone has something to say.

Of course, the actual budget announcements turn out to be different.

Sometimes with googlies. The googly this time was around capital gains tax. Yeah, a large part of the market participants wanted it gone but…the capital gains tax rate went up. Read it again… it went up!

Let’s see all the tax changes the Budget 2024 has brought in. Read till the end – that’s where the fun is.

Capital Gains Tax

For listed stocks, the new long term capital gains tax rate is now 12.5%, up from 10% till July 23, 2024. Long Term capital gains tax kicks in after 1 year of holding period.

For unlisted stocks, the holding period to determine long term capital gains is 2 years and the tax rate is the same at 12.5%.

The short term capital gains on the above two is 20%.

For all other non equity assets (including REITs, Gold ETFs, Overseas funds), the long term capital gains tax is now 12.5% too. Short term capital gains tax will be as per slab rate / marginal income tax rate.

Note: The long term capital gains exemption on equity is increased from Rs 1 lakh per year to Rs. 1.25 lakh per year. A hi-five to those who focus on tax harvesting.

A word on Real Estate

The biggest change on the capital gains tax front has been on Real Estate. For properties sold from July 23, 2024 onwards, a flat 12.5% long term capital gains tax is applicable. This is down from 20% earlier. But with a caveat.

The indexation benefit for any asset including real estate is now history. So, no more cost inflation index benefit. One less headache to take care of. (For real estate indexation is allowed only till 2001).

Now, you are probably exhausting yourself thinking, calculating if you will pay less tax or more tax. It is of no use really. The change is effective immediately. You got to pay what you got to pay.

Overall, this capital gains tax system is moving towards simplicity. This is easier to understand and implement.

Revised Income Tax Slabs in the New Regime

The tax slabs have been changed but only in the new tax regime. This is one step further to make the new tax regime more attractive without hassles.

This is how the slabs look for FY 2024-25.

| Taxable Income (per year) | Marginal Tax Rate (FY 24-25) |

| Rs. 0 to 3 lakhs | NIL |

| Rs. 3 to 7 lakhs | 5% |

| Rs 7 to 10 lakhs | 10% |

| Rs 10 to 12 lakhs | 15% |

| Rs. 12 to 15 lakhs | 20% |

| Above Rs. 15 lakhs | 30% |

If you are wondering what the change is, well, the 5% slab is now uptil 7 lakhs (previously 6 lakhs) and similarly 1 lakh has been increased in 10% slab. The upper limit of 15% and all other slabs is still the same.

The old tax regime saves tax only those who have all the deductions for HRA, Home loan, LTA, Health Insurance, charity contributions.

Shifting to the new tax slabs doesn’t mean that you stop saving or investing anything that does not give you tax benefits.

You still need life, health and accident/disability insurance for protection. PPF can still be a good allocation for fixed income.

Tax saving or no tax saving – these are important for your personal financial well-being.

Two other points of note:

- The standard deduction is now up from 50,000 to 75,000.

- The employer contribution to NPS which is tax deductible is now up from 10% to 14%. (If you have corporate NPS, expect an email soon asking for your permission to increase this)

Updated Sense of Humour

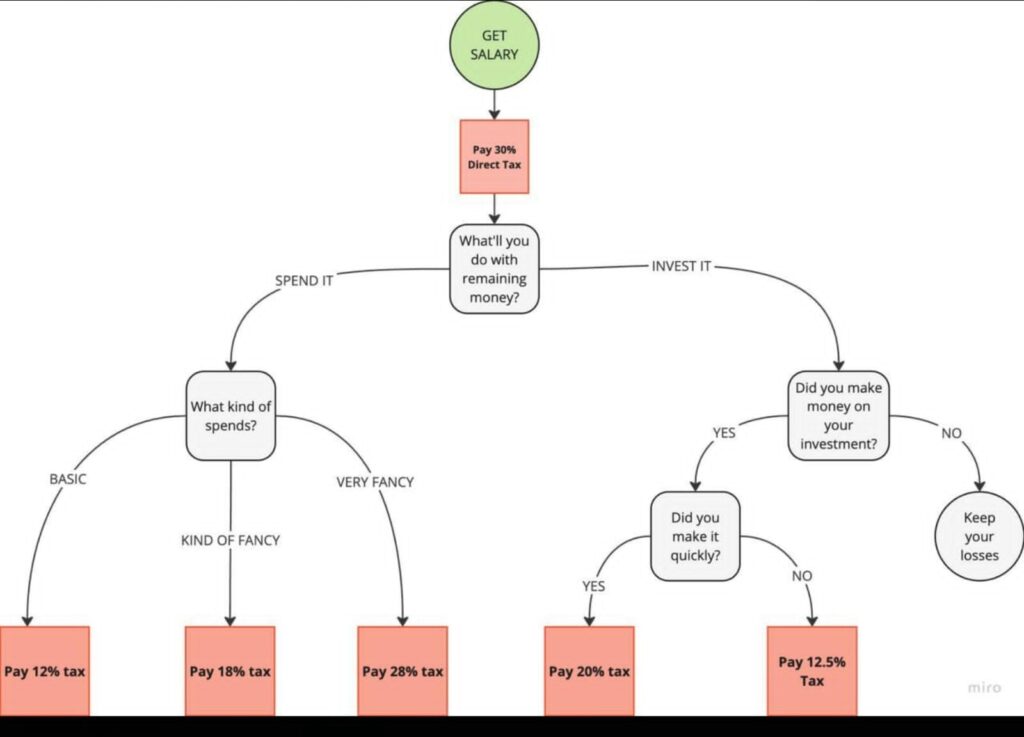

The budget did one nice thing. It push started the sense of humour of one salaried person. This is what it turned into. IT is floating on WhatsApp and due credit to the one who made it.

I don’t want to be wet blanket but the one thing on the right side that needs to be clarified is that the set off provisions of capital losses and gains are still valid.

So, if you have a loss on your long term investment then you can set it off against long term gain and thus avoid paying any taxes to that extent.

But keep the humour flowing!

—

What’s your take on the budget? Do share your comments and let’s get the discussion going.