History shows that investing in well-managed, diversified equity funds has led to good return outcomes over the long run.

Yet, very few investors actually stick to these funds for the long term.

Why?

Let’s find out…

There is no escaping underperformance! (even for the best funds)

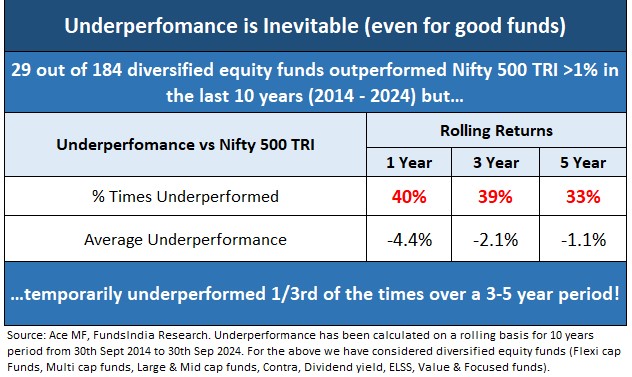

We analyzed the performance of actively managed diversified equity funds with a 10-year history that have outperformed the broader market (Nifty 500 TRI) by more than 1%.

From 184 available funds, we identified 29 that meet these criteria.

On average, these funds have outperformed by 116% in total, with the highest being 400% and the lowest 40%.

While these funds perform well over the long term, how do they hold up in the short term?

For these funds, we looked at their performance over rolling 1-year, 3-year, and 5-year periods. The table below summarizes our findings.

Here comes the surprise…

- Over a 1-year period, these funds (which outperformed over 10 years) have underperformed about 40% of the time, with an average underperformance of 4.4%.

- Even over a 3 to 5-year period, which is often perceived as ‘long term’, these funds underperformed 1/3rd of the time, with an average underperformance of 1% to 2%.

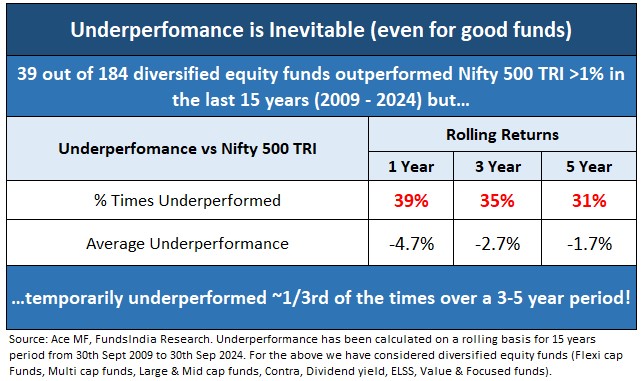

Let’s extend this analysis further and take a look at diversified equity funds with a 15-year history.

From 184 available funds, we identified 39 funds that have outperformed the Nifty 500 TRI by more than 1% per year for the last 15 years.

On average, these funds have outperformed Nifty 500 TRI by 290% over the last 15 years, with the highest being 866% and the lowest 102%.

However,

- Over a 1-year period, these funds (which outperformed over 15 years) have underperformed about 39% of the time, with an average underperformance of 4.7%.

- Even over a 3 to 5-year period, which is often perceived as ‘long term’, these funds underperformed ~1/3rd of the time, with an average underperformance of 1.5% to 3%.

Then how do these funds still end up doing well over the long run?

In most cases, for well managed diversified equity funds, underperformance is almost a given. However, the underperformance phase is temporary and is usually followed by a phase of sharp outperformance that adequately overcompensates for the underperformance. This is how good equity funds end up outperforming over the long term.

Insight 1: ‘Accept’ and ‘Expect’ all good, actively managed, diversified equity funds to go through temporary periods of short-term underperformance.

Weird Challenge for Long Term Equity Fund Investors

This creates a weird challenge for long-term equity fund investors.

Going by the above logic, you should stay invested in a fund, accepting that temporary underperformance is common and that it may still do well in the long run.

But, simply assuming all underperforming funds will bounce back can lead to complacency, and you may end up holding weaker funds that continue to underperform over time.

So, how do you differentiate between a good fund experiencing a temporary underperformance vs a weaker one facing a more serious, long-term underperformance?

Differentiating good and bad underperformance

Here is a simple checklist that you can use to differentiate between a good fund going through temporary underperformance and a bad fund going through sustained underperformance.

- Is there historical evidence that the fund consistently outperforms over long periods of time? (check rolling returns over 5Y, 7Y & 10Y)

- Has the fund managed risk well? (check for extent of temporary declines vs benchmark, portfolio concentration, presence of low quality stocks etc)

- Does the fund manager have a long-term track record?

- What is the investment philosophy and has it remained consistent across market cycles?

- Is the fund portfolio available at reasonable valuations?

- Does the fund face size constraints with respect to the strategy?

- What is the current portfolio positioning?

- Is the fund sticking to its original style and strategy despite underperformance?

- Does the fund communicate transparently and regularly?

If any fund fares well in all the above parameters and is going through near-term underperformance, then this fund might be a good mean reversion candidate with a strong potential for higher returns in the coming years.

We have successfully applied this framework to identify funds such as IDFC Sterling Value Fund (Feb-2020), HDFC Flexi Cap Fund (Aug-2021), Franklin Prima Fund (Aug-2022), UTI Flexi cap fund (Apr-2024) etc before their turnaround. If interested, you can read about how we applied the framework here and here.

Insight 2: Don’t exit funds ONLY based on short-term underperformance – differentiate ‘good’ vs ‘bad’ underperformance

Reducing the mental discomfort of sticking with underperforming investments

If all the funds in your portfolio follow the same investment style/approach, there might be times when all of them underperform at once, causing the whole portfolio to do poorly. This can be tough to deal with psychologically.

From a behavioral standpoint, diversifying your portfolio with different investment styles/approaches can help you stick with temporarily underperforming funds. When you have other funds with different investment styles that are doing well, the overall returns of your portfolio can still be acceptable, making it easier to tolerate the underperformance of some funds.

At FundsIndia we use a portfolio construction strategy called the 5 Finger Framework where the investments are made equally into funds that follow five different investment styles – Quality, Value, Blend, Mid/Small and Momentum.

Insight 3: Diversify across different investment approaches

What should you do?

- While good equity funds do well over the long run, the real challenge is to to stick to such funds through their inevitable but temporary underperformance phase which can sometimes extend for several years

- How to handle equity fund underperformance?

- ‘Accept’ and ‘Expect’ all your actively managed equity funds to underperform at some point in time in the future

- Don’t exit funds only based on short-term underperformance – differentiate ‘good’ vs ‘bad’ underperformance

- Diversify across Different Investment Styles/Approaches

Other articles you may like

Post Views:

107