On November 1, 2024, the former AlphaCentric Strategic Income Fund was rebranded as AlphaCentric Real Income Fund with a new sub-advisor, broader strategy, and new expense ratio to accompany its new name.

CrossingBridge Advisors will manage the investment strategy by employing a team approach. Portfolio managers are T. Kirk Whitney, CFA, who joined the firm as an analyst in 2013, Spencer Rolfe, who first joined in 2017, and David Sherman, CIO. CrossingBridge, with over $3.2 billion in assets as of 8/31/24 was selected to apply a bottom-up, value approach to the strategy.

The fund’s focus on “real income” is new, but the firm’s is not. All CrossingBridge strategies start with the same philosophical statement: “Return of principal is more important than return on principal.” Their hallmark is seeking undervalued income-producing investments having “overlooked factors” that lead to price appreciation. The fund will own a mix of bonds and stocks to provide income and capital appreciation.

The revised investment mandate is to invest in companies directly or indirectly associated with real estate and real property. Real property includes hard-asset businesses, pipeline owners, shipping companies, and so on. The managers anticipate investing in some equity and preferred securities, as well as some debt.

Although this is a new dedicated strategy for CrossingBridge, they have positions – asset-backed securities, mortgage-backed securities, and some real estate companies – in their existing funds that would qualify for the Real Income portfolio. This will be the first mutual fund in which CrossingBridge invests a substantial allocation in equities, so investors should expect significantly greater volatility than CrossingBridge’s traditional offerings.

The other caution is that CrossingBridge is inheriting a portfolio constructed by other managers with other disciplines. It’s normal for funds to see a fair amount of portfolio turnover in their first month or months. Potential investors might want to wait a bit before jumping in.

Three reasons why the fund may be worth your consideration.

Hard assets are attractive assets.

These real property/hard asset investments are fundamentally different from pure financial asset investments. Forests, farmland, pipelines, and warehouses are all long-lasting physical objects that generate predictable income streams over predictable time frames. That means that they have a series of attractions:

- Diversification: These assets can reduce portfolio risk by providing a counterbalance to financial assets. Real estate, for example, has a weak positive relationship with the stock market and a weak negative relationship with bonds.

- Inflation protection: Hard assets tend to maintain or increase in value over time, even as inflation rises. Real asset returns tend to be correlated with inflation, which means that they rise as inflation does.

- Income generation: Many hard assets, such as real estate and commodities, can generate regular income streams.

- Long-term appreciation: Hard assets can appreciate over the long term, providing potential for capital gains. That’s most pronounced if you’re relying on a patient value investor to acquire them at prices below their intrinsic values.

Many advisers consider these to be “alternative investments” that might occupy 5-20% of a portfolio.

The CrossingBridge team are exceptional stewards of your money.

CrossingBridge advises, or sub-advises, six open-ended mutual funds, and one exchange-traded fund. The most recent addition was the Nordic High Income Bond. All are income-oriented, active, and capacity-constrained. In addition, all have top-tier risk-adjusted returns since inception.

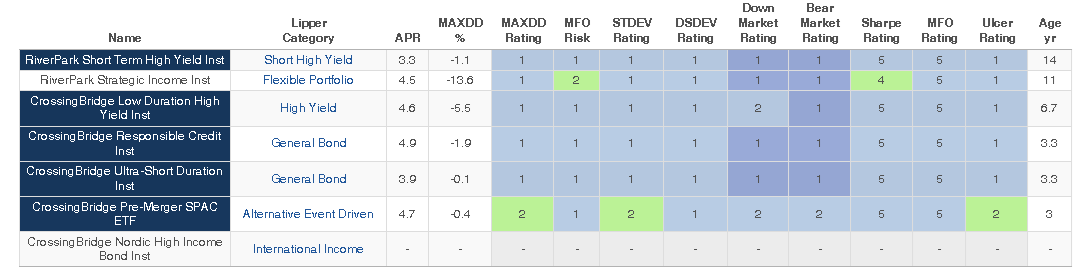

MFO Premium allows us to track funds, including ETFs, on an unusual array of measures of risk-awareness, consistency, and risk-adjusted-performance. For the sake of those not willing to obsess over whether an Ulcer Index of 1.3 is good, we always present color-coded rankings. Blue, in various shades, is always the top tier, followed by green, yellow, orange, and red. Below are all the risk and risk-return rankings for all the funds advised or sub-advised by CrossingBridge since inception.

Total and risk-adjusted performance since inception, all CrossingBridge funds (through 9/30/2024)

Source: MFO Premium fund screener and Lipper global dataset. The category assignments are Lipper’s; their validity is, of course, open to discussion.

Here’s the short version: every fund, by virtually every measure, has been a top-tier performer since launch. That reflects, in our judgment, the virtues of both an intense dislike of losing investors’ money and a willingness to go where larger firms cannot.

Some members of MFO’s discussion community worry that some of the new funds are effectively clones of existing ones. To assess that concern, we ran the three-year correlations between all of the funds that CrossingBridge advises or subadvises.

| RPHIX | RSIIX | CBLDX | CBRDX | CBUDX | SPC | |

| RiverPark Short Term High Yield | 1.00 | |||||

| RiverPark Strategic Income | 0.54 | 1.00 | ||||

| CrossingBridge Low Duration High Yield | 0.70 | 0.81 | 1.00 | |||

| CrossingBridge Responsible Credit | 0.60 | 0.67 | 0.75 | 1.00 | ||

| CrossingBridge Ultra-Short Duration | 0.80 | 0.48 | 0.71 | 0.45 | 1.00 | |

| CrossingBridge Pre-Merger SPAC ETF | 0.14 | 0.36 | 0.33 | 0.13 | 0.28 | 1.00 |

The correlations are consistently low; each new CrossingBridge fund brings something new to the table.

The fund they are inheriting is quite small, about $55 million in assets, and CrossingBridge already has substantial investments in real estate and real property in its other funds, so the adoption poses minimal additional stress on management.

A value-oriented hard asset portfolio offers reasonable income and reasonable growth.

Mr. Sherman was clear that this fund is likely to experience “more volatility than our Strategic Income Fund with higher upside compared to a high-yield bond index. We have a bias toward downside protection so we’re looking at fixed-income plus fixed-income-like equity. That might offer significantly lower volatility than a stock/bond hybrid fund but will also likely have less upside.” The yield of a portfolio like this is “probably 6-7%” and active management of the portfolio has the prospect of adding 150-250 bps when measured over reasonable time frames.

Website: CrossingBridge Advisors and AlphaCentric Real Income Fund. At the point of publication, AlphaCentric had only begun updating the fund’s pages to reflect these changes; for example, the old management team was still listed. Folks seeking to understand CrossingBridge’s approach might start with their website, check the Corporate Finance Institute’s overview of hard or real assets, and then check back with AlphaCentric.