Indigo Paints Ltd – Vibrant Shades of Outperformance

Indigo Paints Ltd., established in 2000 and based in Pune, is one of India’s fastest-growing decorative paint companies. Initially focused on economical cement paints, it has since expanded into a broad range of decorative paints and construction chemicals, including waterproofing via a 51% stake in Apple Chemie India Pvt Ltd. Indigo Paints operates five manufacturing facilities across Jodhpur, Kochi, and Pudukkottai, with over 18,000 active dealers, 53 depots, 9,842 tinting machines, and a presence in 28 states as of FY24.

Products and Services

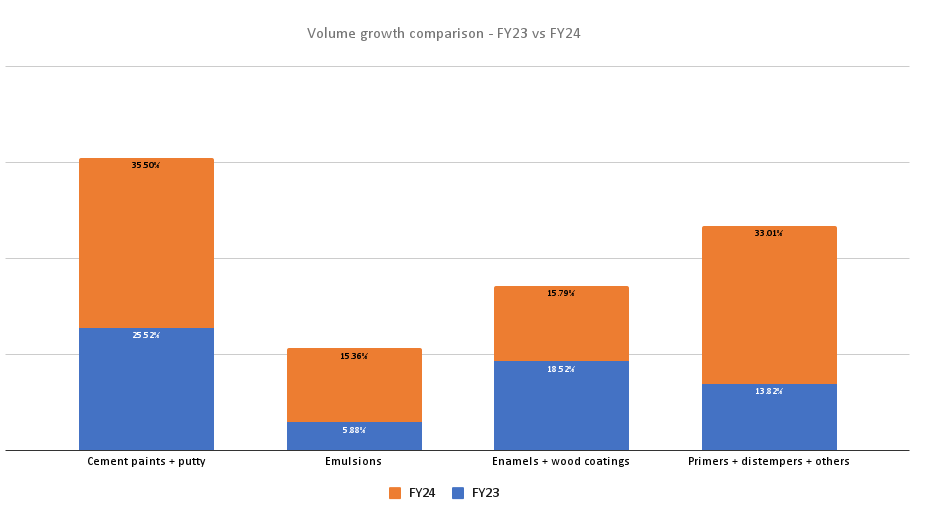

Indigo Paints offers a wide range of products, including emulsions, enamels, wood coatings, primers, distempers, cement paints, putties, and specialized solutions like Aquashield, Crack Heal Paste, Damp Seal, Damp Stop, Poly Repair, and Superseal.

Subsidiaries: As of FY24, Indigo Paints Ltd. has one subsidiary and no associates or joint ventures.

Growth Strategies

- Product Diversification through Acquisition: Acquired a 51% stake in Apple Chemie, a fast-growing player in construction chemicals and waterproofing, yielding 24% growth in FY24 and 47% in Q1FY25 YoY.

- Major Project Collaborations: Apple Chemie supplied materials for significant national projects, including the Mumbai Trans Harbour, Atal Setu, and Versova-Bandra Sea Link.

- Market Expansion: Beyond its original Maharashtra focus, Apple Chemie has now established marketing teams across Karnataka, Bihar, Telangana, Tamil Nadu, Odisha, West Bengal, Madhya Pradesh, and Delhi NCR.

- NABL Accreditation: First construction chemicals company in India to achieve NABL accreditation for its laboratory.

- Capacity Expansion: New plants in Jodhpur are under construction, with capacities of 12,000 KLPA/MTPA for solvent-based products, 90,000 KLPA/MTPA for water-based, and 138,000 KLPA/MTPA for powder-based products. A 50,000 KLPA/MTPA water-based facility in Pudukkottai began operations in September 2023.

- Network and Dealer Enhancement: Actively increasing the dealer base and tinting machine installations, which have boosted dealer sales by 3-4 times through higher throughput.

Operational Performance

Q1FY25

- Revenue Growth: Revenue rose to ₹311 crore, marking an 8% year-over-year increase.

- Profit Decline: Lower realizations, increased manpower, and depreciation costs from the new plant (operational since September 2023) led to a decrease in profits.

- Operating Profit: Fell by 3%, totaling ₹47 crore.

- Net Profit: Declined by 15% to ₹27 crore.

- Sales Force Expansion: Sales team grew by ~40% in Q2FY24, aiming to boost market reach.

- Market Impact: The subdued demand in Kerala, a key revenue source, affected overall performance for the quarter.

FY24

- Revenue: ₹1,306 crore, up 22% YoY.

- Operating Profit: ₹238 crore, a 31% YoY increase.

- Net Profit: ₹149 crore, marking a 28% YoY growth.

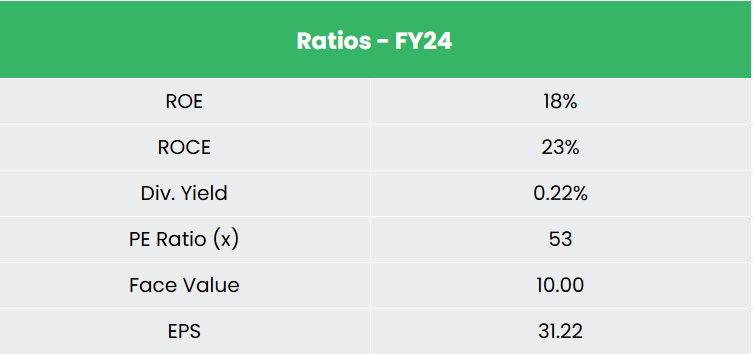

Financial Performance (FY21-24)

- 3-Year CAGR: Revenue grew at 20%, and net profit at 28% (FY21-24).

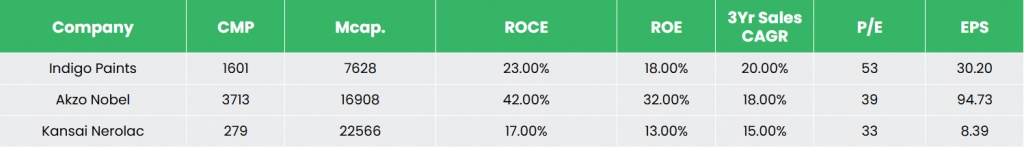

- Return Ratios: Average ROE at 17% and ROCE at 21% over FY 21-24.

- Capital Structure: Strong with a low debt-to-equity ratio of 0.02.

Industry outlook

- Paints and Coatings Market: Driven by population growth and urbanization, India’s paints and coatings market (decorative and industrial) was valued at USD 13,405.4 million in FY24, projected to reach USD 31,706.3 million by FY33 with a CAGR of 8.75%.

- Waterproofing Solutions Market: Expected to grow from USD 1.18 billion in 2024 to USD 1.81 billion by 2030, at a CAGR of 7.44%.

- Construction Chemicals Market: Projected reach USD 5.02 billion by 2030, growing at a CAGR of 7.24%.

Growth Drivers

- Urban Development Initiatives: Programs like the Smart Cities Mission and Housing for All drive construction activities, creating demand in the paint and coating industry.

- Construction Sector Growth: Expanding commercial and residential construction, supported by favorable government policies, boosts demand for construction chemicals and waterproofing solutions.

- Automotive Sector Demand: Growth in automotive sales and after-sale services across segments is increasing the need for specialized paints and coatings.

Competitive Advantage

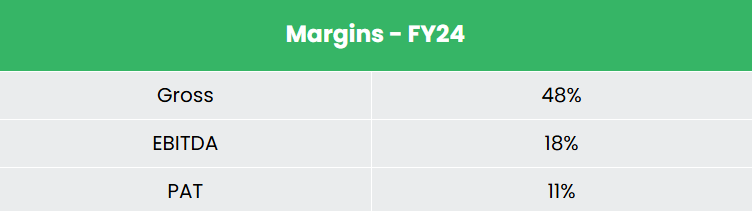

Indigo Paints is generating consistent sales growth with stable returns on invested capital and boasts higher profit margins (18%) compared to competitors like Akzo Nobel India Ltd and Kansai Nerolac Paints Ltd, highlighting its strong potential for earnings expansion.

Outlook

- Category Leadership: Established as a leader in many product categories, facilitating easy entry into Tier 3 and 4 markets, giving them pricing power and expanded margins.

- New Product Launches: Actively launching new products and augmenting capacities to strengthen brand presence across India.

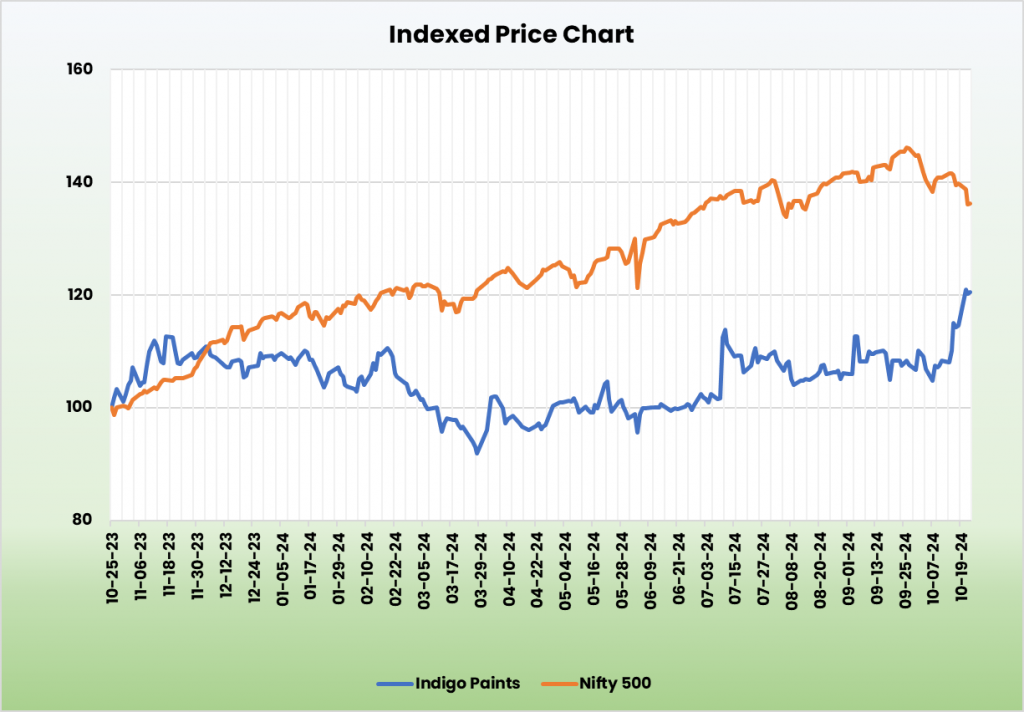

- Outpacing Industry Growth: Consistently outperformed industry growth over the past five quarters.

- Expansion into B2B: Recent entry into construction chemicals and putty segments diversifies the customer base and marks a transition into the B2B market alongside traditional B2C.

- Network and Throughput Improvement: Focus on expanding the dealer network, improving throughput per active dealer, and increasing tinting machine production shows promising growth potential.

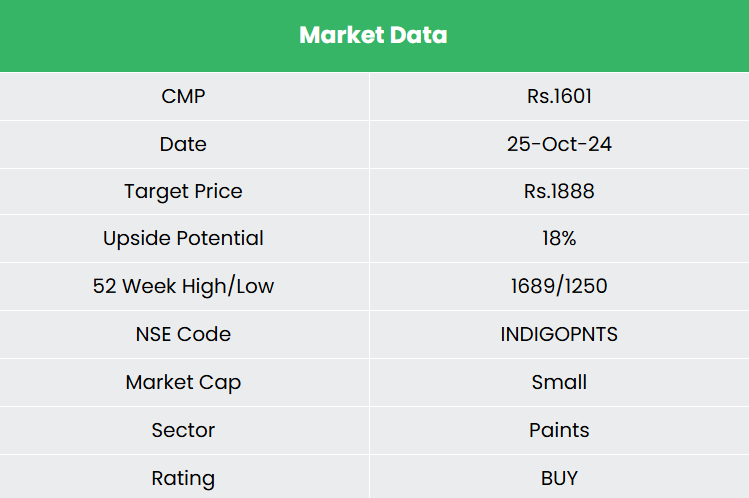

Valuation

Indigo Paints’ strategy of expanding into Tier 3 and 4 cities while gradually growing in Tier 1 and 2 markets, alongside capturing market share from organized competitors and enhancing its waterproofing product offerings, supports its strong performance. The company’s entry into project sales and construction chemicals, combined with increased production capacity, further drives growth. We recommend a BUY rating with a target price (TP) of ₹1,888, based on a valuation of 55x FY26E EPS.

Risks

- Competitive Intensity: Heightened competition from existing players and the entry of new competitors may impact profit margins.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials like titanium dioxide and monomers, influenced by crude oil price volatility, can adversely affect margins.

Note: Please note that this is not a recommendation and is intended only for educational purposes. So, kindly consult your financial advisor before investing.

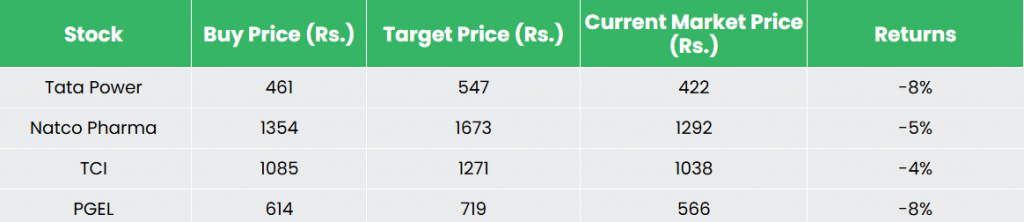

Recap of our previous recommendations (As on 25 October 2024)

Transport Corporation of India Ltd

Other articles you may like

Post Views:

85