If you’re paid weekly, then figuring out how to write a budget for weekly pay that works for you can feel like you’re putting together a jigsaw puzzle. It can be difficult to assemble a puzzle without knowing the entire picture – the same is true for budgeting when you get paid weekly!

Although the idea of getting paid weekly might sound ideal, it actually makes budgeting a bit more complicated. Receiving money in smaller increments can make it difficult to pay off bills on time and ensure you’re saving enough money for the following week.

If you’re paid weekly, then you aren’t alone! Over 30% of Americans are getting paid every week! And you can bet that some of them have learned how to make weekly budgeting work for them.

Today I’m breaking down the exact steps for how to budget when you get paid weekly. My hope is that these steps help make budgeting weekly doable for you.

Step 1: Know your paydays.

Grab a monthly calendar and write down every single day that you receive payment. Even better, write down how much money you’ll make each payday as well. This will help you visually see which paycheck needs to cover each bill.

Assign each paycheck a separate color. Then, highlight that paycheck with its assigned color. The act of color coordinating your budget will help you actually see how you’ll be able to break up your paychecks to cover your expenses. This is a great strategy, especially for visual learners.

Step 2: Add your bills to the same calendar.

Once you’ve added your paydays to your monthly calendar, add your bills as well. You’ll need to know which bills to pay in which weeks so that you aren’t behind on any of your payments.

If your bills change from month to month, then be very careful, so you don’t miss the due date! In fact, set up your bills on auto-draft to ensure that you don’t have any late fees. If you’ve ever had to pay late fees, then you know how annoying it is!

Step 3: List out all other expenses.

Grab another piece of paper and list out your normal expenses for each week. This should include variable expenses such as groceries, gas, and spending money. Break down these expenses by how much you spend each week. You might spend $600 for groceries each month, which would come out to $150 each week.

Having trouble thinking of everything to include in your budget? Go back through your past two bank statements and comb through all your spending. Categorize your expenses under categories such as food, gas, beauty, etc. By looking through your previous spending, you’ll be more likely to include all categories in your budget.

You may be shocked at some of the numbers. If you see areas where you’ve been spending more than you expected, take this opportunity to try and cut down those added expenses. Groceries and eating out tend to be a big one for most people, and eating in more can reduce that monthly number.

Step 4: “Assign” your paychecks to cover your bills and expenses.

Once you’ve included all your bills on your budget calendar, then it’s time to assign your paychecks to cover certain bills and expenses. To do this, you’ll want to highlight the bills that you’ll be paying with certain paychecks. If you plan to pay your electricity bill with your green paycheck, then highlight your electricity bill green.

Make sure to assign some of your paychecks to help partially cover bills in future weeks. A few of your larger expenses, such as your mortgage, might need several paychecks to cover.

One way you can save this money easily is to move the money you need to set aside into a separate checking or savings account. You can even label this account “Bills” because you know it will need to help cover any bills you have in the coming month!

If you have automatic payments set up, try to include some buffer money (money that’s in the account at all times) in your bills account so that you always have money ready for payments.

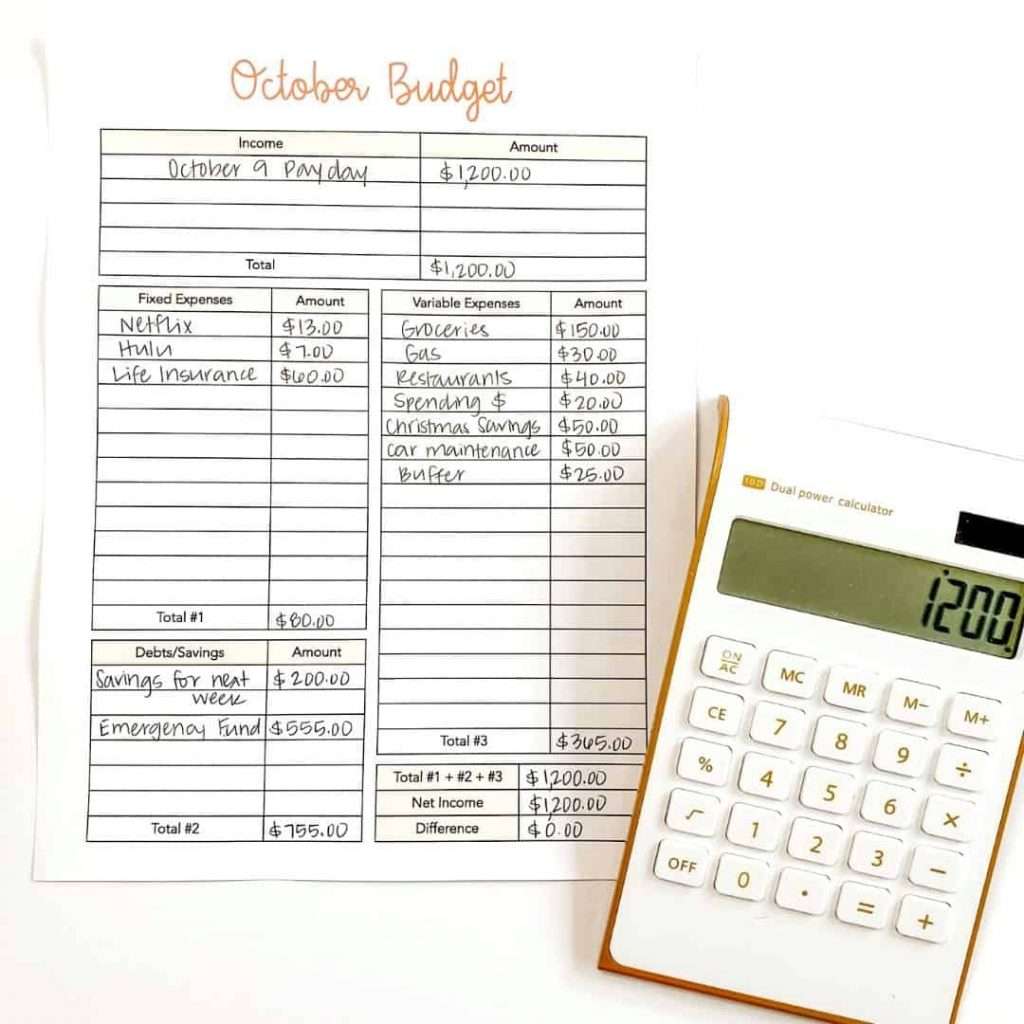

Below is an example of what your budget calendar might look like:

Step 5: Write your weekly budget.

The last step is to actually write your weekly budget. Because you’re paid each week, it only makes sense to make a new budget every week. Thankfully, this shouldn’t take you long at all. The more you work on writing a budget, the quicker it will take you!

Print off four copies of a budget page – I personally use the ones from my Budget Life Planner. You can write the dates at the top of each page. Use this page to keep track of your budget every single week. You can even staple all four of them together and hang them on your fridge! That way, it’s always in view for fresh reminders of what your spending should be.

The goal is to write a budget each week that you can stick to!

What happens when you have too many bills due at a time?

What do you do if your electricity, mortgage, cell phone, and internet bill are all due in the same week? If this is the case for you, then it’s time to call each company and ask them to move your due date.

Take time to explain that it will be easier for you financially to shift the due date by a week or two. Most places will happily do it for you, especially if they think this will help you pay their bill on time! When you’re able to spread out your bills over the month, you won’t be as overwhelmed when it comes to making your bill payments.

What if you don’t have enough money to cover all your bills?

If you’re at the point where you’ve made your weekly budget, and you still have too many bills or expenses, then you have two choices. Here’s the truth: you can’t hide from basic math. You need your income to be greater than your expenses, period. Otherwise, you’ll slowly start to go into debt or suck money from your savings.

Option 1: Find ways to cut out items or money in your budget.

If you can’t cover all your expenses, then one option you have is to cut items and spending out of your budget. An easy way to spend less each month is to go through each of your bills and ask yourself the following questions:

- Can I cancel this bill or subscription?

- Can I call and negotiate this bill for a better rate?

- Should I shop around for a better rate?

By asking yourself these three questions, you’ll find ways to cut back on your monthly bills. Need more ideas and help? Check out 25 Things To Cut From Your Budget Today and 5 Ways To Stop Living Paycheck To Paycheck.

Option 2: Increase your income.

If you don’t have any extra expenses to cut out of your budget (or if you just don’t want to cut anything out of your budget), then it’s time to increase your income! Check out 15 Ways To Make An Extra $500 Each Month for ideas on how to increase your income!

Quick Tips To Make A Weekly Budget Easier.

Budgeting when you’re getting paid weekly doesn’t have to be difficult. Below are a few tips to make budgeting even easier:

- Remember that some of the money you have left for the week should roll over for the upcoming weeks. It’s okay to have money left over in your budget – this is a good thing! When you have money left over, you’ll be more prepared for those upcoming bills and expenses in the future.

- Create a separate checking account dedicated to paying bills. This way, you can move money into your separate account to help cover any future bills. Creating a separate checking account makes bill paying so much easier!

- Set up a weekly budget meeting with yourself or your family. This meeting can be a short 20-minute meeting where you pay any bills, write your upcoming budget, or track your spending. Make these budget meetings a priority by adding them to your weekly calendar!

- Remember that you need time to adjust to budgeting. I’m a firm believer that budgeting takes at least 3-4 months to get accustomed to. You’re going to miss an expense every now and then, and that’s okay. Give yourself some grace because you’re in this for the long haul.

The Bottom Line On Weekly Budgets

Budgeting when you get paid each week might seem more complicated, but it might be easier than you think! By following these 5 steps on how to budget weekly pay, you’ll be able to write a stellar budget that works for you and your family!