What do the Great Depression, the Great Financial Crisis, the Stagflationary 1970s, and the upcoming 10-years have in common?

If you are a strategist at Goldman Sachs, then a lot. At least if you do forecasts for market returns over the next decade (lol), you may see incredible similarities.

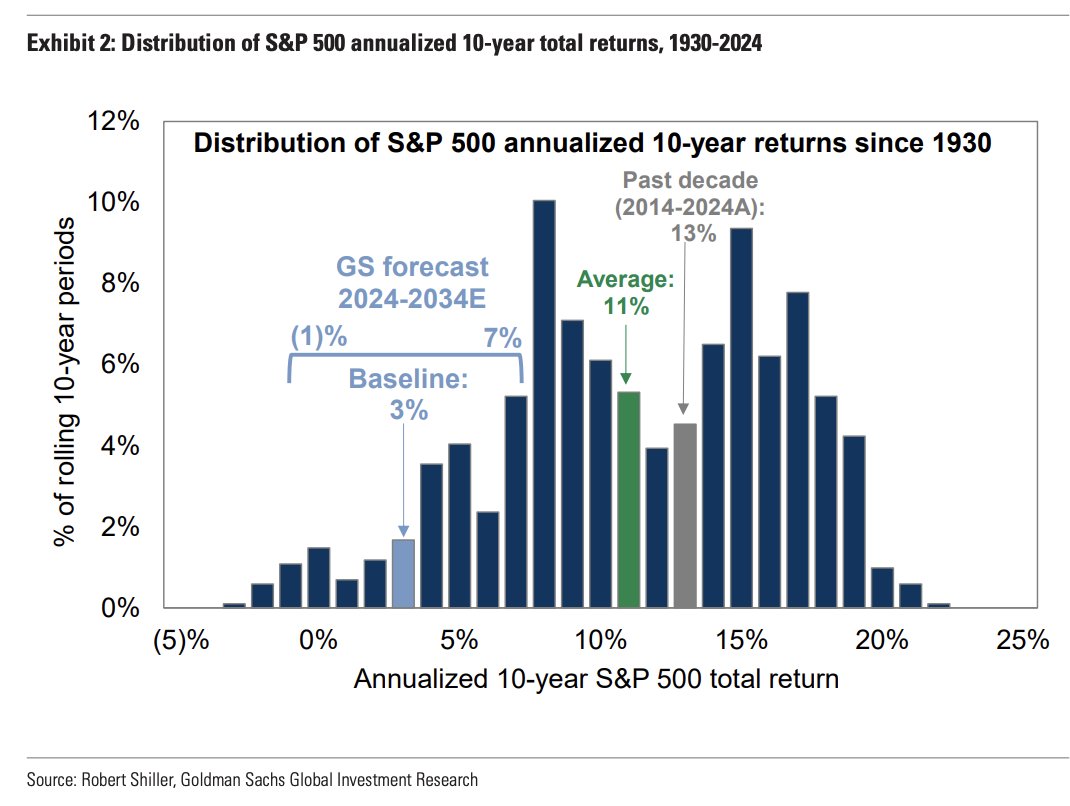

ICYMI: David Kostin and his team of strategists see a 72% chance the S&P 500 underperforms Treasuries, and a 33% possibility equities return less than inflation. They expect ~3% a year (or worse) annually. “Investors should be prepared for equity returns during the next decade that are towards the lower end of their typical performance distribution relative to bonds and inflation.”

Probability Distribution of the next decade in S&P 500 returns (according to GS)

Source: Goldman Sachs Investment Research

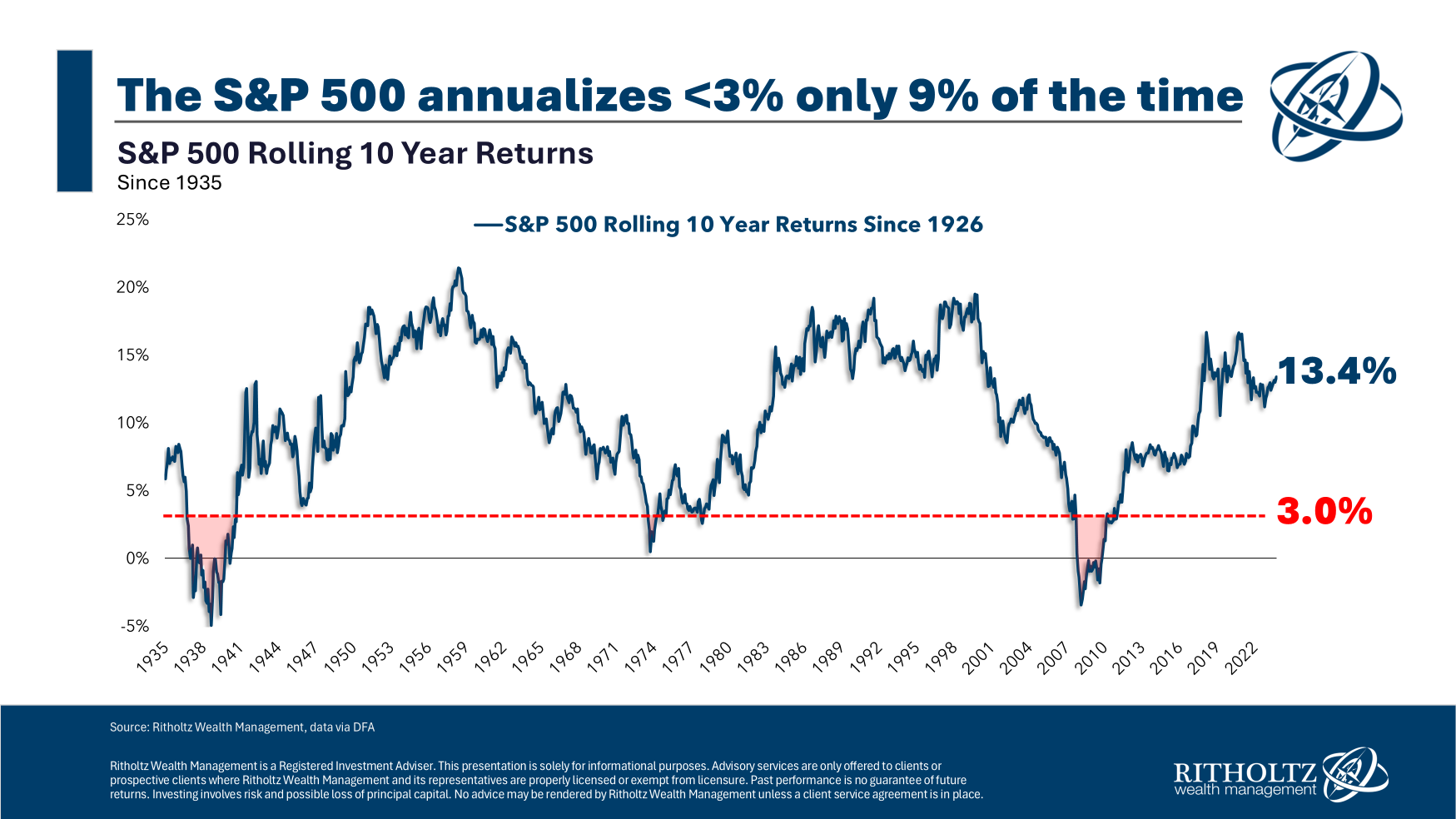

My colleague Ben Carlson buried the lede when he did an examination of all rolling 10-year periods going back to 1925. He found less than 9% of those 10 year periods had returns of 3% or less. All of these decade-long periods took place during the aforementioned eras of the GFC, the 1970s, or the Depression.

In other words, if you were forecasting 10-year returns of 3% annually, you are also forecasting an economic shitstorm of rare and historic proportions. At least, that has been the circumstance of all other decade-long periods where market returns were 3% annually or 1% in real terms.

Forecasting one form of economic disaster or another over the next 10 years is not much of a reach; you will be hard-pressed to think of any decade where some economic calamity or another didn’t befall the global economy. But that’s a very different discussion than 3% annually for 10 years.

This came up yesterday yesterday at Jason Zweig’s book party for the release of the third edition of Ben Graham’s, The Intelligent Investor. The room was filled with fans of Graham and Zweig, hosted by Josh Wolfe of Lux Capital. (its the 75th anniversary of the book’s initial release.) There were a handful of indexers in the room, but it was mostly private credit and venture capital people that I was chatting with

During the Q&A, someone brought up the Goldman forecast. I was incredulous (and amused) that Venture Capitalists were skeptical of the explosive potential for new technologies to create greater economic activity, important, valuable innovations, and of course, further market gains.

I have no idea what the next decade will bring in terms of S&P500 returns, but neither does anyone else. I do believe that the economic gains we are going to see in technology justify higher market prices. I just don’t know how much higher; my sneaking suspicion is one percent real returns over the next 10 years is way too conservative.

***

Of course, you can find other forecasts that are friendlier to your portfolio, For example, JP Morgan sees U.S. stocks returning 7.8% annually over the next 20 years. That’s more in line with historical averages.

But cherry-picking friendlier forecasts still relies on forecasts.

Instead, ask yourself this simple question: In all of your experiences, how many people have made correct, outlier forecasts when looking out 10 years? I am not referring to extrapolating historical returns forward — “Assume 8% total return per year on average” — but rather, here is why markets should return X% versus the consensus of Y% for the next ten consecutive 12-month periods. If we look at enough 10-year forecasts, someone randomly gets it right. But I cannot recall anyone at a major Wall Street Bank actually making money forecasting markets a decade out.

We are all better off if we admit that guessing returns over the next 10 or 20 years is a fool’s errand. It’s certainly no way to manage your portfolio…

Previously:

Forecasting & Prediction Discussions

Sources:

3% Stock Market Returns For the Next Decade?

by Ben Carlson

A Wealth of Common Sense, October 22, 2024